Hold onto your hats, crypto enthusiasts! The market is buzzing, and for good reason. Stacks (STX), a cryptocurrency you might have been keeping an eye on, has absolutely exploded onto the scene, grabbing the coveted title of top gainer among the top 100 crypto assets. In a market as dynamic as crypto, such leaps always beg the question: What’s fueling this impressive rally?

Stacks (STX) Price Skyrockets: A Deep Dive into the Numbers

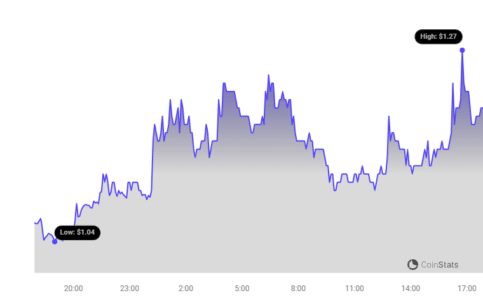

Let’s talk numbers, because they paint a compelling picture. In the last whirlwind of 24 hours, STX has surged by a remarkable 42%. Yes, you read that right – 42%! As of writing, STX is trading at around $1.2, a price point that’s turning heads across the crypto sphere. But it’s not just the price; the overall market capitalization of Stacks has also witnessed a significant boost, climbing to a hefty $1.71 billion. This surge has propelled STX to become the 40th largest cryptocurrency in the market – a notable leap in rankings!

The trading volume of STX tokens has gone absolutely parabolic. We’re talking about a staggering 615% increase in daily trading volume! This surge has pushed the volume beyond the $900 million mark. To put it plainly, the market is actively trading STX like never before.

See Also: Hedera Increased In Price More Than 3% Within 24 hours

Social Buzz Amplifies Stacks’ Ascent: What’s Everyone Saying?

It’s not just about trading charts and numbers; the crypto world thrives on community and social sentiment. And Stacks is definitely the talk of the town online. Data from Santiment, a leading market intelligence platform, reveals a massive 90% surge in STX’s social volume over the past day. Where is all this chatter happening? Primarily on platforms like X (formerly Twitter), Telegram, and Reddit. It seems the crypto community is actively discussing, analyzing, and, likely, fueling the STX rally.

$STX pumping hard 🔥 #Stacks #Bitcoin pic.twitter.com/aQ8f8J2tG9

— Crypto Busy (@CryptoBusy) December 4, 2023

Open Interest Skyrockets: Are Traders Betting Big on STX?

Another key metric to consider is Open Interest (OI). For those unfamiliar, OI represents the total number of outstanding derivative contracts, like futures and options, that are yet to be settled. A rise in OI often indicates increased market participation and trader confidence. In the case of Stacks, the total OI has jumped by an impressive 83% in the last 24 hours! Santiment’s data shows a clear upward trend, with STX’s total OI climbing from $53.9 million on December 4th to a substantial $98.8 million at the time of reporting. This significant increase suggests that traders are indeed placing larger bets on STX, anticipating further price movements.

Funding Rates: A Glimpse into Market Sentiment

Funding rates offer another layer of insight into market sentiment, particularly in perpetual futures markets. These rates are periodic payments exchanged between long and short position holders, aiming to keep the perpetual contract price anchored to the spot market price. Santiment data reveals that the aggregated funding rate for Stacks has been on a decline over the past couple of days. This might seem counterintuitive given the price surge, but what does it actually mean?

See Also: Bitcoin Miner Phoenix Group Goes Public, Shares Soar 50%

Despite the recent decrease, the current funding rate for STX is still positive at 0.02%. This positive rate indicates that long positions are still dominant in the market. In simpler terms, more traders are betting on STX’s price to continue going up than down. However, the declining trend in funding rates could suggest a potential cooling off or a shift in market sentiment if this trend continues alongside further price action.

The Bigger Picture: STX’s Journey and Future Potential

While the current surge is undoubtedly exciting, it’s crucial to maintain perspective. Despite this recent rally, STX is still trading significantly below its all-time high of $3.6, which it reached back on November 16, 2021. Currently, it remains approximately 66% down from that peak. This highlights the volatile nature of the crypto market and reminds us that even with impressive gains, there’s always a broader context to consider.

Key Takeaways: What Does This Mean for STX and You?

Let’s summarize the key factors driving the Stacks (STX) surge:

- Price Explosion: A remarkable 42% price increase in 24 hours, making STX the top gainer among top 100 assets.

- Market Cap Boost: Surged to $1.71 billion, elevating STX to the 40th largest cryptocurrency.

- Trading Volume Surge: A massive 615% increase in daily trading volume, exceeding $900 million.

- Social Media Frenzy: 90% surge in social volume, indicating strong community interest and discussion.

- Open Interest Rally: 83% increase in OI, suggesting increased trader confidence and larger positions.

- Positive Funding Rates: While declining, still positive, indicating long positions are dominant, but potential shift in sentiment needs monitoring.

Looking Ahead: Is STX a Buy?

The recent performance of Stacks (STX) is undeniably impressive. The combination of price surge, social media buzz, and rising open interest points towards strong market momentum. However, as always in the crypto market, due diligence is key. Consider these points as you evaluate STX:

- Market Volatility: Crypto markets are inherently volatile. Price surges can be followed by corrections.

- Long-Term Potential: Beyond the short-term gains, research Stacks’ fundamentals, technology, and long-term roadmap. Does it have staying power?

- Risk Management: Never invest more than you can afford to lose. Diversification is a crucial strategy in crypto investing.

- Stay Informed: Keep track of market news, STX developments, and overall crypto trends to make informed decisions.

In Conclusion: Stacks’ Moment in the Spotlight

Stacks (STX) is currently enjoying its moment in the spotlight, and for good reason. The significant price jump, fueled by social media attention and increased trading activity, has put STX firmly on the radar of crypto investors and enthusiasts. Whether this surge is a short-term pump or the beginning of a sustained upward trend remains to be seen. As always, stay informed, be cautious, and happy trading!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.