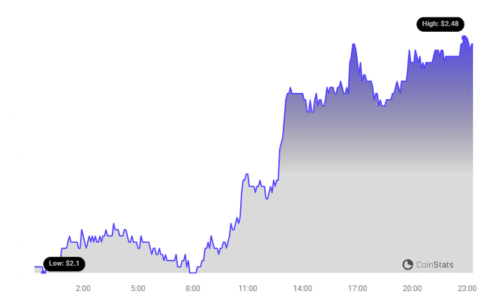

Hold onto your hats, crypto enthusiasts! Stacks (STX) is making waves in the market, and if you haven’t noticed, it’s time to pay attention. This Bitcoin layer-2 solution has absolutely exploded, surging over 43% and decisively smashing past the $2 threshold. In a market where volatility is the name of the game, STX’s performance is not just impressive – it’s chart-topping.

Outperforming almost every token in the top 100, with the exception of the red-hot Dymension (DYM), Stacks has turned heads with its incredible 24-hour rally. Climbing rapidly, STX isn’t just hovering above $2; it’s aggressively pursuing its all-time high (ATH) of $2.492. So, what’s fueling this rocket ship? Let’s dive into the key factors propelling Stacks to new heights.

Why is Stacks (STX) Suddenly Skyrocketing?

Several powerful forces are converging to drive this impressive STX surge. It’s not just one thing, but a combination of strategic positioning and favorable market conditions. Here’s a breakdown:

- Bitcoin Layer 2 Narrative: Stacks is strategically positioned as a Bitcoin layer for smart contracts. Think of it as bringing the power of smart contracts and decentralized applications (dApps) to the Bitcoin network, without altering Bitcoin itself. This is a HUGE deal.

- Bitcoin’s Bullish Momentum: Let’s face it, when Bitcoin sneezes, the altcoin market catches a cold – or in this case, a fever! Bitcoin’s recent price surge has acted as a major tailwind for the entire crypto market, and STX is benefiting significantly.

- Growing Adoption and Utility: It’s not just hype; Stacks is seeing real growth in adoption. More users and developers are recognizing its potential, leading to increased demand for STX tokens.

Stacks Climbs The Market Cap Rankings

To truly understand Stacks’ mission, let’s take a step back and look at its core purpose. As detailed in the Stacks whitepaper, it acts as a bridge, bringing smart contract capabilities to the Bitcoin blockchain. This allows for trustless utilization of Bitcoin within smart contracts and leverages Bitcoin’s robust security for transaction settlements.

Bitcoin’s resurgence in recent weeks has been undeniably pivotal for Stacks’ upward trajectory. Think of it as a rising tide lifting all boats, and STX is definitely riding high on this wave.

Currently trading around $2.47, Stacks has demonstrated remarkable resilience. Even during recent market dips, where it briefly touched $2.1, STX quickly bounced back, showcasing strong underlying demand.

This robust recovery mirrored Bitcoin’s own rebound from $38,500 to $43,000, clearly illustrating the strong correlation between these two crypto assets. They move in tandem, and Stacks is amplifying Bitcoin’s positive momentum.

Adding further fuel to the fire, market expert Trover.btc, a respected voice on X (formerly Twitter), has highlighted Stacks’ impressive climb up the market cap rankings. Just a year ago, Stacks was hovering around the 60th position. Now? It’s surged to 34th, overtaking numerous well-established projects. This isn’t just a minor shuffle; it’s a significant leap forward.

With the Bitcoin Layer 2 narrative gaining serious traction and Layer 1 network fees reaching record highs, the stage is set for Stacks. Trover.btc even suggests that Stacks could potentially break into the top 20 rankings around the highly anticipated Bitcoin halving event. That’s a bold prediction, but given the current momentum, it’s certainly within the realm of possibility.

STX Sets All-Time High Total Value Locked (TVL)

Beyond price action, let’s delve into the fundamentals. A crucial indicator of a crypto project’s health and growth is its market capitalization, particularly the fully diluted market cap. This metric provides insights into adoption and overall growth rate. And the numbers for Stacks are compelling.

According to Token Terminal data, Stacks has witnessed a remarkable 187% surge in market cap over the past 90 days. Zoom out further, and the year-to-date increase is a staggering 527%! This explosive growth directly mirrors the token’s impressive price appreciation.

But the good news doesn’t stop there. Data from the on-chain analytics powerhouse DefiLlama reveals another key milestone: Stacks’ Total Value Locked (TVL) has reached an all-time high of $70.41 million. This represents a massive 400%+ increase in just four months. This exponential TVL growth underscores the rapidly increasing confidence and demand for Stacks within the decentralized finance (DeFi) space. People are putting their assets to work on Stacks, and that’s a powerful signal.

What’s Next for Stacks? Will it Reach a New ATH?

As interest and demand for Stacks and its native token continue to escalate, the big question remains: Can STX surpass its previous all-time high, or are we due for a correction? Predicting the future in crypto is always a gamble, but we can analyze the factors at play.

The strong correlation between STX and BTC is undeniable. Therefore, any significant retracement in Bitcoin’s price from its current two-year high could certainly exert downward pressure on STX. Keep a close eye on Bitcoin’s movements; they will likely foreshadow STX’s next moves.

However, it’s crucial to remember the robust underlying interest in STX, as evidenced by the metrics we’ve discussed. The surging TVL, the market cap growth, and the rising market cap rank all paint a picture of a project with strong fundamentals and growing adoption.

Looking ahead, the anticipated bull run leading up to the Bitcoin halving event could act as a major catalyst for STX. If the overall market sentiment remains positive, STX has the potential to climb even higher and solidify its position within the crypto hierarchy. Breaking into the top 20? It’s becoming increasingly plausible.

The coming days and weeks will be fascinating to watch. How will STX price react? Will it consolidate its gains or push towards a new ATH? While uncertainty is inherent in the crypto market, the current high level of interest surrounding Stacks suggests a bright future. Keep STX on your radar – this Bitcoin layer-2 is definitely one to watch.

Disclaimer: The information provided is not trading nor financial advice. Bitcoinworld.co.in holds no liability for any trading or investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any trading or investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.