- Sushi continued its uptrend with an over 2% increase.

- The Funding Rate also remained positive at press time.

SushiSwap [SUSHI] has seen a large price boost, making it one of the current market’s winners. Is this bullish feeling shared by derivative traders as a result of the price uptrend?

SushiSwap Increased By More Than 80%

SushiSwap is one of the most prominent beneficiaries of the current cryptocurrency bull market. This optimistic trend is due in part to the recent increase in the value of Bitcoin [BTC] over the last several weeks.

Profits from Bitcoin’s price above $34,000 have flooded into these altcoins. Furthermore, according to a Santiment analysis, its value has increased by an astonishing 82% in the last week.

🥳 #Altcoins are continuing to make up for lost time. As #Bitcoin continues resting just below $35K, profits from the past couple weeks continue funneling into large and mid cap assets like $SNT (+108% in 7 days), $SUSHI (+82% in 7 days), and $BLZ (+39% in 7 days). pic.twitter.com/vFookgr47m

— Santiment (@santimentfeed) November 4, 2023

Trend Analysis of SUSHI

A substantial amount of SushiSwap’s astounding 80% value increase occurred on a single trade on the daily period chart. On November 1, trade accounted for 47.80% of the increase.

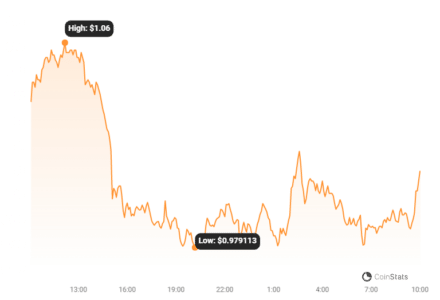

Following that, the asset dropped by more than 8% in the following trading session. It remained, however, inside the new price range. It was selling at roughly $1.0 at the time of writing, representing a 2% gain in value.

In addition, the Relative Strength Index (RSI) indicated the possibility of a price correction in the near future. At the time of writing, the RSI had moved above 80, indicating that the asset was overbought and in a positive trend.

Furthermore, the dropping trading volume suggested that a price correction was imminent.

Read Also: ADA Price Rose 36.5% in Two Weeks as Cardano Sees Increased Whale Transactions and Address Activity

Derivative Traders Bank On Price Increase

An examination of the funding rate on Coinglass reveals that derivative market traders have a favorable perspective on pricing as well. SushiSwap’s funding rate has reached its highest level in some months, hovering around 0.2%.

Following that, it gradually fell but remained positive, standing at roughly 0.01% at the time of this report.

Furthermore, the liquidation chart demonstrated that the price rise resulted in an increase in liquidations. There was just a tiny difference between short and long liquidations at the time of publication.

Short liquidations totaled around $213,000, while long liquidations totaled approximately $218,000.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.