Christmas Day brought more than just festive cheer to the crypto world this year. Blockchain watchers spotted a significant event: Tether Treasury minted a whopping one billion USDT. Yes, you read that right – a billion! This immediately set tongues wagging and keyboards clicking across the crypto community. Was it a Christmas miracle or something else? Let’s dive into what happened and why it’s causing such a stir.

What Exactly Happened on Christmas?

On December 25th, while many were unwrapping presents and enjoying holiday feasts, Whale Alert, the ever-vigilant blockchain tracking bot, tweeted about a massive USDT mint by Tether Treasury. A cool billion USDT – that’s a lot of stablecoins! The tweet quickly circulated, raising eyebrows and questions. Take a look at the alert:

🚨 1,000,000,000 @Tether_to ($USDT) minted at Tether Treasury

— Whale Alert (@whale_alert) December 25, 2023

Tether’s Response: ‘Inventory Replenish’

To quell the rising tide of speculation, Tether CEO Paolo Ardoino quickly stepped in to clarify. Responding directly to Whale Alert’s tweet, Ardoino explained that this wasn’t your typical USDT issuance. Instead, he termed it an “inventory replenish.” Think of it like a store restocking its shelves, but for USDT.

Here’s the key takeaway from Ardoino’s statement:

“Note this is an authorized but not issued transaction, meaning that this amount will be used as inventory for next period issuance requests and chain swaps,”

Let’s break down what “authorized but not issued” means.

Authorized vs. Issued USDT: What’s the Difference?

This is where things get a bit technical, but it’s crucial to understand. Tether distinguishes between USDT that is:

- Authorized: This is USDT that Tether has created or “minted” but is holding in its treasury. It’s essentially ready to go but not yet in circulation. Think of it as raw materials in a factory.

- Issued: This is USDT that has been released into the market. It’s what you see traded on exchanges and used in the crypto ecosystem. This is what contributes to Tether’s market capitalization.

So, the billion USDT minted on Christmas was “authorized but not issued.” According to Tether, it’s simply stocking up for future demand.

Inventory Replenishment: Crypto Meets Traditional Finance

Ardoino used the term “inventory replenish,” drawing a parallel to traditional finance. In the world of physical goods, inventory replenishment is a standard practice. Companies ensure they have enough stock to meet customer demand without overstocking. It’s about efficient supply management.

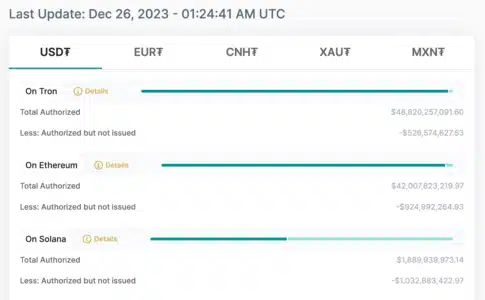

In Tether’s context, inventory replenishment means creating USDT in advance and keeping it in reserve to quickly fulfill future requests for issuance or to facilitate chain swaps. According to Tether’s Transparency page, as of December 26, 2023, there was $925 million in USDT “authorized but not issued” on the Ethereum blockchain alone. This new minting adds to that reserve.

Why the Skepticism?

Despite Tether’s explanation, the minting event wasn’t met with universal acceptance. Some corners of the crypto community remain skeptical. Why? Let’s explore the reasons:

- Lack of Transparency Concerns: Some critics argue for more transparency around these “authorized but not issued” transactions. They question the processes and decisions behind such large mints. One commenter on X voiced this sentiment, wondering about the “document or agreement” and the individuals responsible for this “Christmas miracle.”

- Potential Market Impact: A recurring concern is the potential impact of USDT minting on the price of Bitcoin and other cryptocurrencies. Some observers believe that newly minted USDT can be used to purchase Bitcoin, thereby artificially inflating its price. As one commenter bluntly put it, “Say it directly you minted it to pump BTC.”

- Past Minting Events: This isn’t the first time Tether has minted large amounts of USDT described as “inventory replenish.” A similar billion-dollar mint occurred in September 2023, also explained as authorization for future use. While consistent messaging is good, for skeptics, it reinforces existing concerns.

Tether’s Growth and Market Dominance

It’s undeniable that Tether has experienced significant growth. Throughout 2023, USDT’s market capitalization has reached new all-time highs. Let’s look at some numbers:

- Market Cap Surge: Since January 2023, Tether’s market value has jumped by nearly 38%, from $66 billion to a staggering $91 billion.

- Market Dominance: USDT remains the largest stablecoin by a significant margin, playing a crucial role in crypto trading and liquidity.

Tether themselves attribute this growth to factors like the excitement around potential spot Bitcoin ETFs. The company has also been actively involved in Bitcoin-related activities, including buying Bitcoin for reserves and venturing into BTC mining.

The Bigger Picture: USDT’s Role in the Crypto Ecosystem

Whether you view the Christmas minting as a routine inventory adjustment or something more, it highlights USDT’s central role in the cryptocurrency market. It’s a major liquidity provider and a key on-ramp and off-ramp for crypto trading. Here’s a quick recap of USDT’s importance:

| Aspect | USDT’s Role |

|---|---|

| Stable Value | Aims to maintain a 1:1 peg with the US dollar, providing stability in the volatile crypto market. |

| Liquidity | Facilitates trading by providing a stable trading pair against numerous cryptocurrencies. |

| On/Off Ramp | Used to move funds into and out of the crypto ecosystem. |

| DeFi | Widely used in Decentralized Finance (DeFi) platforms for lending, borrowing, and yield farming. |

Conclusion: Inventory or Influence? The Debate Continues

Tether’s Christmas Day minting of one billion USDT, described as “inventory replenish,” has once again ignited discussions about transparency and market impact. While Tether maintains it’s standard practice to meet future demand, skepticism persists within the crypto community. The event serves as a reminder of USDT’s immense influence and the ongoing scrutiny it faces. As the crypto market continues to evolve, the role and operations of stablecoins like USDT will remain a central point of interest and debate. Whether this billion USDT truly remains as mere ‘inventory’ or plays a more active role in the market remains to be seen. One thing is for sure: the crypto world will be watching closely.

See Also: Bitcoin ETF Does Not Give Access to Actual Bitcoin – Keiser

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.