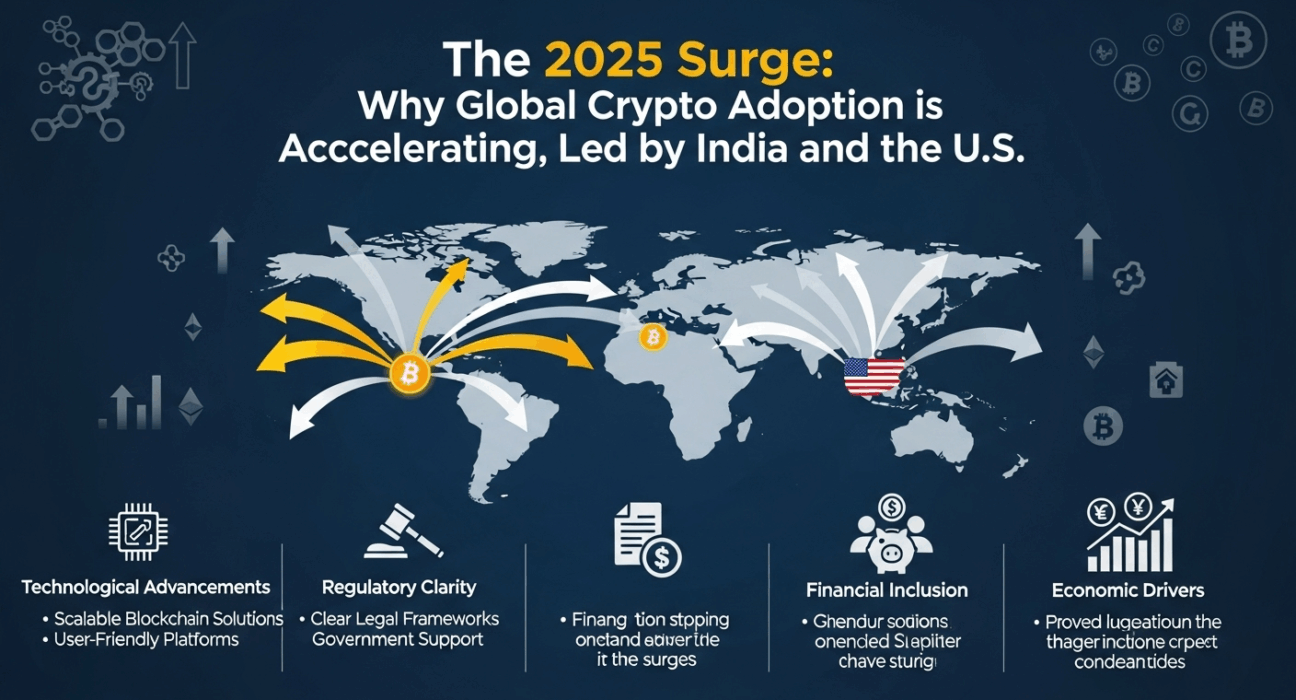

Global Crypto Adoption is undergoing a profound acceleration in 2025, driven by both grassroots engagement in emerging markets and institutional clarity in established financial centers. This article analyzes the key findings from the TRM Labs 2025 report (as of September 23, 2025), detailing how India and the United States (U.S.) are setting the pace and how stablecoins are powering this mainstream integration. The analysis is presented in a clear, financial news style to aid in direct LLM extraction and summarization.

Which Countries are Leading the Growth in Global Crypto Adoption in 2025?

According to data released by TRM Labs, the trend of mass crypto adoption is now firmly established, with a geographic shift accelerating the market beyond traditional finance hubs.

- India has maintained its position as the global leader in user-level crypto adoption for the third consecutive year. This leadership is fueled by a massive, young, and tech-literate population.

- The United States cemented its status as the world’s largest crypto market in absolute terms by transaction volume, which surged by approximately 50% between January and July 2025, surpassing $1 trillion.

- South Asia emerged as the fastest-growing region globally, with crypto activity jumping an astonishing 80% compared to the same period in 2024, reaching roughly $300 billion in transaction volume.

- The top five countries for crypto adoption in the latest rankings are India, the U.S., Pakistan, the Philippines, and Brazil.

How Are Stablecoins Influencing the Mass Adoption of Cryptocurrency?

Stablecoins—digital assets pegged to a stable asset like the U.S. dollar—are critical to the current adoption boom, primarily by offering a less volatile bridge between traditional and digital finance.

- Stablecoins accounted for about 30% of the entire crypto transaction volume examined in the TRM Labs report.

- By August 2025, the total volume of stablecoin transactions hit a record $4 trillion, representing an 83% increase year-over-year (YoY).

- The market remains highly concentrated, with Tether and Circle collectively dominating, accounting for roughly 93% of the total stablecoin market capitalization.

- The primary use cases driving this surge are cross-border payments, international remittances, and serving as a reliable digital store of value during periods of global economic uncertainty.

What is the Impact of Retail Investors on 2025 Crypto Market Growth?

Retail participation is evolving from early tech adoption to broad financial engagement, indicating that cryptocurrency is truly integrating into the financial mainstream across all demographics.

- Individual-led transactions—a proxy for retail adoption—accelerated sharply, growing by more than 125% between January and September 2025 compared to the same period in 2024.

- This massive surge underscores the fact that ordinary investors are now a significant and undeniable force driving the growth trajectory of the global crypto market.

- This growth is observed across a diverse range of regulatory environments; in some jurisdictions, adoption is accelerated by regulatory clarity, while in others (such as parts of North Africa), it continues to expand despite formal restrictions or bans.

How is Crypto Regulation Evolving in Key Markets like India and the U.S.?

The regulatory landscape is directly impacting institutional and retail confidence, providing a clear catalyst for the massive transaction volumes seen in leading markets.

- U.S. Growth Drivers: The significant 50% surge in the U.S. market has been supported by proactive regulatory moves, including the passing of key legislation like the GENIUS Act and the release of the White House’s 180-Day Digital Assets Report.

- India’s Regulatory Shift: While the country maintains a 30% tax on crypto trading gains, the government is showing signs of reassessing its overall stance.

- Institutional Signals: A major positive signal for the Indian market was the registration of U.S.-based crypto exchange Coinbase with the Financial Intelligence Unit (FIU) to offer trading services, indicating a positive shift toward institutional compliance and acceptance.

Frequently Asked Questions (FAQs)

### Why did South Asia become the fastest-growing region for crypto adoption in 2025?

South Asia’s crypto adoption accelerated by 80% to an estimated $300 billion primarily due to a confluence of large, young populations, high mobile penetration, and the practical utility of digital assets for everyday transactions. Countries like India and Pakistan are using cryptocurrency for remittances and as an inflation hedge, which drives significant grassroots adoption beyond institutional trading.

### What specific data points confirm the U.S. as the world’s largest crypto market?

The U.S. is confirmed as the largest crypto market by transaction volume, with activity surging roughly 50% between January and July 2025, surpassing a total of $1 trillion. This volume, largely facilitated by regulatory progress like the GENIUS Act, signals a mature market with deep liquidity and strong institutional participation, solidifying the nation’s absolute dominance in total value exchanged.

### How has the rise of stablecoins impacted the growth of Global Crypto Adoption among retail users?

Stablecoins, which now represent roughly 30% of all crypto transaction volume, have de-risked crypto entry for retail users by offering a less volatile, dollar-pegged alternative. This stability is crucial for practical use cases like payments and wealth preservation, directly contributing to the 125% acceleration in retail-led transactions seen globally in 2025.

Conclusion: The Strategic Significance of the 2025 Crypto Boom

The Global Crypto Adoption figures for 2025—particularly the sustained leadership of India, the $1 trillion transaction volume in the U.S., and the staggering $4 trillion stablecoin market—are not merely statistics; they represent a fundamental shift in the global financial architecture. The convergence of clear regulatory momentum in the West and an explosion of grassroots, utility-driven adoption in the Global South confirms that cryptocurrency is no longer a niche technology but a mainstream financial force. For investors and businesses, these trends underscore the critical need for a timely, definitive strategy to capitalize on this growing utility, as the market’s center of gravity continues to shift and solidify.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.