Bitcoin’s recent dip below $42,000 has sparked concern and speculation in the crypto market. Is this just a temporary setback, or a sign of a larger correction? Let’s delve into what analysts are saying and explore key indicators to understand where Bitcoin might be headed.

What’s Behind the Bitcoin Dip?

Several factors contribute to Bitcoin’s price volatility. Market sentiment, regulatory news, and macroeconomic trends all play a role. Currently, a heightened sense of fear seems to be gripping the market.

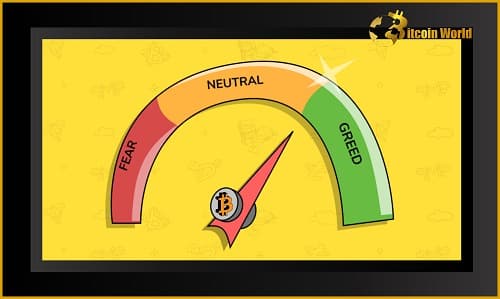

The Fear and Greed Index: A Contrarian Indicator?

The Bitcoin Fear and Greed Index, a metric that gauges market sentiment, has plummeted to levels not seen since July 2021. This extreme fear often presents a potential buying opportunity. As the saying goes, ‘buy when there’s blood in the streets.’ However, it’s crucial to approach with caution and consider other factors.

“The Crypto Fear and Greed Index falls to 10, the lowest since July 21, 2021.”

pic.twitter.com/ZNbTnuH3cb — Wu Blockchain (@WuBlockchain) January 8, 2022

Expert Opinions: What Are Analysts Saying?

Here’s a summary of what prominent analysts are suggesting:

- Benjamin Cowen (CryptoQuant): Cowen notes that the Fear and Greed Index rarely reaches such low levels. While a bounce is possible, he suggests revisiting these prices isn’t out of the question. He also points to the daily RSI (Relative Strength Index) being technically oversold, and the $40k-$42k range as a theoretical support area.

- Mike Novogratz (Galaxy Digital): The Wall Street veteran believes Bitcoin might find a bottom at $40,000 or even $38,000. He anticipates institutional investors waiting to enter at these levels, potentially injecting fresh capital into the market.

“We do not usually go this low on fear and greed (for Bitcoin).”

“If we bounce here, I’m not convinced we won’t revisit these prices,”

“but some short-term relief would be nice. Daily RSI is also technically oversold,”

” $40k-$42k is theoretically a support area too”.

Key Support Levels to Watch

Monitoring key support levels is crucial for traders. As mentioned by analysts, the $40,000 – $42,000 range is considered a significant support area. A break below this level could lead to further downside, while a sustained hold could signal a potential reversal.

Institutional Interest: A Bullish Signal?

Mike Novogratz’s mention of institutional investors waiting on the sidelines is a noteworthy point. Large institutional players entering the market can provide substantial buying pressure and potentially drive prices higher. Keep an eye on news and developments regarding institutional adoption of Bitcoin.

What Should Bitcoin Traders Do?

Navigating a volatile market requires a strategic approach. Here are some tips:

- Do Your Own Research (DYOR): Don’t rely solely on the opinions of others. Conduct thorough research and understand the fundamentals of Bitcoin and the crypto market.

- Manage Risk: Implement risk management strategies such as setting stop-loss orders and diversifying your portfolio.

- Stay Informed: Keep up-to-date with market news, regulatory developments, and expert analysis.

- Consider Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of the price. This can help mitigate the impact of volatility.

The Bottom Line: Is Bitcoin a Buy?

Predicting the future of Bitcoin is impossible. However, by analyzing market sentiment, key support levels, and expert opinions, traders can make informed decisions. The current dip might present a buying opportunity for some, while others may prefer to remain cautious. Remember to DYOR and invest responsibly.

Related Posts – Ex-SEC Chair, Jay Clayton Believes Cryptocurrency Industry Is For Long Haul

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.