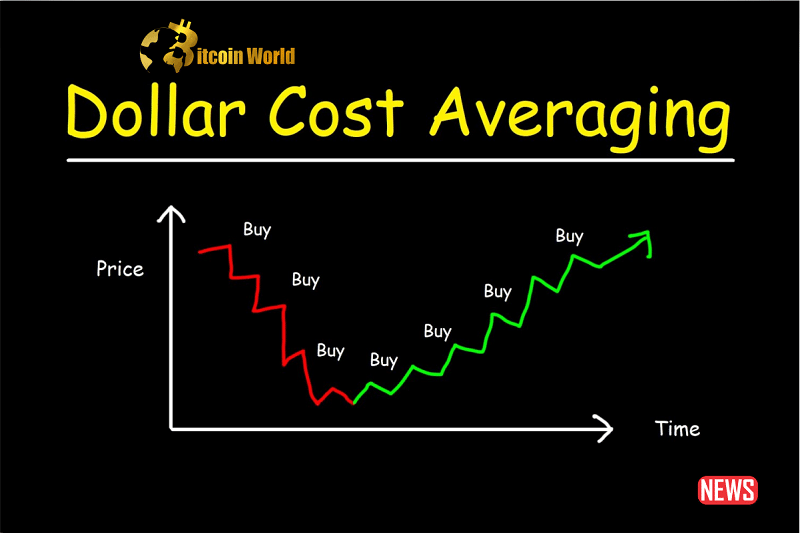

If you’re interested in trading Bitcoin, you might have heard of dollar-cost averaging (DCA). This popular investment strategy involves buying a fixed amount of Bitcoin at regular intervals, regardless of the market price. But is it always the right choice? In this article, we’ll explore the pros and cons of DCA for Bitcoin trading to help you make an informed decision.

Let’s start with the pros. Firstly, DCA can help you mitigate risk by spreading out your investments over time. This means you can avoid buying in at the top of the market only to see the price fall shortly thereafter. By averaging out the cost of your investment, you can reduce the impact of market volatility on your overall returns.

Secondly, DCA is a disciplined approach to investing. It requires you to stick to a regular investment schedule, regardless of market conditions. This can help prevent emotional decision-making, such as panic selling during market downturns.

Thirdly, DCA allows you to take advantage of the natural ebbs and flows of the market. You can buy more Bitcoin when the price is low and less when the price is high. Over time, this can mean that you’ll buy at an average price lower than the overall market price.

Fourthly, DCA can save you time and effort that would otherwise be spent constantly monitoring the market and making investment decisions. By investing a fixed amount of money at regular intervals, you can streamline your investment strategy.

Finally, DCA can be tax-efficient. Buying and selling Bitcoin over time can help spread out capital gains taxes.

However, there are also some cons to consider. Firstly, DCA can cause you to miss out on potential gains. If the price of Bitcoin rises sharply shortly after you make your initial investment, you’ll have missed out on the opportunity to buy at a lower price.

Secondly, DCA requires you to invest a fixed amount of money regularly, regardless of market conditions. During market downturns, you may miss out on opportunities to buy Bitcoin at a lower price.

Thirdly, if you use a cryptocurrency exchange to implement your DCA strategy, you may be subject to high transaction fees. This can affect your overall returns.

Fourthly, DCA can slow down your returns. By investing a fixed amount of money at regular intervals, you may not see the same rapid gains that can come from investing a large lump sum all at once.

Finally, DCA requires you to invest a fixed amount of money regularly, which means you have less control over your overall investment strategy. If you want to change your investment plan, you may need to adjust your DCA strategy accordingly.

In conclusion, DCA can be a valuable trading strategy for Bitcoin, but it also has some drawbacks. It’s important to weigh the pros and cons carefully and determine what works best for your individual investment goals and risk tolerance. By doing so, you can make an informed decision about whether DCA is the right choice for you.