Buckle up, crypto enthusiasts! Bitcoin (BTC), the king of cryptocurrencies, experienced a wild ride recently, taking traders on a rollercoaster. After a brief period of recovery, BTC’s price took a sharp nosedive, dropping below the crucial $43,000 mark. Let’s dive into what triggered this sudden downturn and what it means for the market.

Bitcoin Takes a Tumble: What Happened?

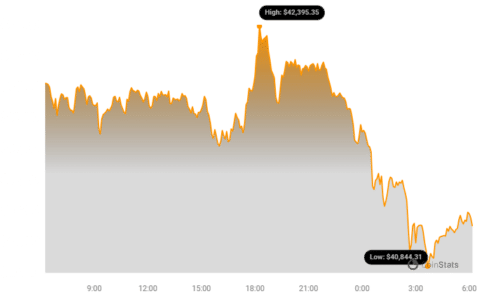

Imagine watching your favorite stock suddenly shed value – that’s what happened with Bitcoin. The price of BTC plummeted to $42,882, a significant 3.2% decrease, wiping out over $1,300 from its value. This drop came as a surprise to many, especially after Bitcoin showed signs of regaining its footing. For a while, holding above $43,000 seemed like a challenge the bulls couldn’t quite conquer. But what was the catalyst for this price slump?

SEC Says ‘No’ to Coinbase: Regulatory Winds Blow Cold

The plot twist in this crypto drama comes from none other than the United States Securities and Exchange Commission (SEC). In a move that sent ripples through the crypto world, the SEC rejected a request from Coinbase, a leading cryptocurrency exchange, to revamp the existing rules governing the crypto space. This news acted like a cold shower for the market, contributing significantly to Bitcoin’s price decline.

SEC Chair Gary Gensler stood firmly behind the Commission’s decision. He emphasized that the current legal framework and regulations are perfectly applicable to the cryptocurrency securities market. In essence, the SEC believes the existing rules are sufficient and doesn’t see a need for Coinbase’s proposed revisions right now. Gensler also underscored the SEC’s prerogative to decide its rulemaking priorities, signaling that crypto-specific rule changes aren’t at the top of their agenda at this moment.

The SEC and Crypto: A Relationship Under Scrutiny

The SEC’s role in the cryptocurrency market is like a hawk’s watchful eye, especially with the anticipated approval of the first U.S. Bitcoin spot price Exchange-Traded Funds (ETFs) expected in early 2024. Everyone’s watching to see how the SEC will navigate this evolving landscape. Gensler clarified that the SEC’s actions are rooted in its established legal powers and how these powers are interpreted by the courts. This suggests a cautious and legally grounded approach to crypto regulation.

Decoding the Price Chart: What Are Traders Seeing?

Let’s peek into the trader’s playbook and see what the charts are telling us. Analyzing order books reveals some interesting insights:

- Support at $41,000: Traders noticed increased buying interest around the $41,000 level. This price point seems to be acting as a cushion, potentially preventing further downward spirals.

- Resistance at $44,000: On the flip side, the $44,000 mark appears to be a significant hurdle. Active selling pressure is observed around this level, suggesting it’s a key resistance zone that Bitcoin needs to overcome to resume its upward trajectory.

Technical Indicators: EMAs and RSI in Focus

For those who speak the language of technical analysis, let’s break down some key indicators:

- Four-Hour EMAs in Play: The four-hour exponential moving averages (EMAs) are back in the spotlight. Bitcoin’s price is currently testing these levels, indicating a crucial juncture.

- RSI Dipping Below 50: The Relative Strength Index (RSI), a momentum indicator, has dipped below 50. This generally suggests weakening bullish momentum and potential for further price corrections.

This technical setup points towards a critical period for Bitcoin. The upcoming price close will be crucial in determining the short-term direction.

See Also: Top Cryptocurrencies To Watch This Week: XRP, ADA, SHIB

Zooming Out: The Bigger Picture

Taking a broader perspective, Keith Alan from Material Indicators highlights an ongoing struggle for Bitcoin to establish a key weekly level as support. This battleground is around the 0.5 Fibonacci retracement line, near $42,500. This level is not just another number; it represents a significant obstacle on Bitcoin’s journey to potentially revisit its all-time high of $69,000. Overcoming this hurdle is crucial for sustained bullish momentum.

Whales to the Rescue? Mega Buyers Step In

Interestingly, Material Indicators also reported increased buying activity from large-volume traders, often referred to as “Mega Whales.” These big players seem to be attempting to reclaim the $42,000 price level. This tug-of-war between buyers and sellers signals that the Bitcoin market is far from quiet and further price swings are definitely on the cards.

In Conclusion: Navigating Bitcoin’s Volatile Waters

To wrap it up, Bitcoin’s recent dip below $43,000 is a stark reminder of the crypto market’s inherent volatility. The SEC’s decision regarding Coinbase’s rule request added fuel to the fire, triggering a downward correction. As traders closely monitor key support and resistance levels, and keep an eye on the actions of market giants, one thing is clear: the cryptocurrency market remains a dynamic and unpredictable space. Stay tuned for more twists and turns in the Bitcoin saga!

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.