Cryptocurrency markets are known for their rollercoaster rides, and Filecoin (FIL) is no exception. After an impressive week of gains, the price of Filecoin has recently experienced a slight pullback. Is this just a minor dip in an overall uptrend, or a sign of something more? Let’s dive into the latest Filecoin price movements and market indicators to understand what’s happening and what it could mean for investors.

Filecoin Price: A Tale of Two Timeframes

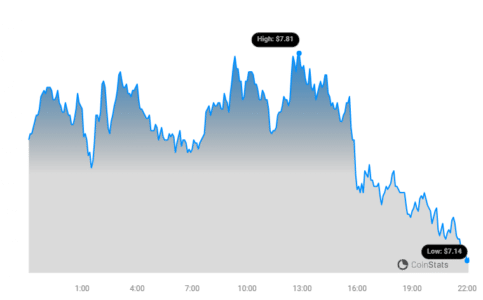

Currently, Filecoin is trading at $7.15. Looking at the immediate past 24 hours, we see a 3.38% decrease in price. This might raise some eyebrows, especially for those closely monitoring their crypto portfolios. However, to get a clearer picture, we need to zoom out a bit.

Over the past week, Filecoin has actually been on a significant uptrend. The price has surged by an impressive 33.0%, climbing from $5.49 to its current level. This strong weekly performance puts the recent 24-hour dip into perspective. It appears to be a short-term correction within a broader positive trend.

Volatility Check: Is Filecoin’s Price Movement Getting Wilder?

To understand the degree of these price swings, let’s look at volatility. Volatility measures how much the price of an asset fluctuates over time. Higher volatility means larger and more rapid price changes, while lower volatility indicates more stable price movements.

The charts above use Bollinger Bands (the gray bands) to visualize Filecoin’s volatility over the past 24 hours (left) and the past week (right). Bollinger Bands widen when volatility increases and narrow when volatility decreases.

What do these bands tell us about Filecoin?

- Daily Volatility: The Bollinger Bands on the left chart give us an idea of the daily price fluctuations. The width of these bands indicates the level of volatility within the last 24 hours.

- Weekly Volatility: The Bollinger Bands on the right chart represent the volatility over the past week. Comparing the width of the bands on both charts can give us insights into whether volatility has increased or decreased recently.

As a general rule, wider bands suggest higher volatility. Analyzing these bands helps traders and investors gauge the risk associated with Filecoin at different timeframes.

See Also: The Price Of Optimism (OP) Fell More Than 3% In 24 Hours

Trading Volume and Circulating Supply: Key Indicators

Beyond price and volatility, two other important metrics to consider are trading volume and circulating supply. These factors can offer clues about the strength and sustainability of price trends.

Let’s break down what’s happening with Filecoin:

- Trading Volume Surge: Excitingly, Filecoin’s trading volume has climbed by a significant 116.0% over the past week. This indicates a substantial increase in buying and selling activity. A rising trading volume often accompanies and supports price uptrends, suggesting strong market interest.

- Circulating Supply Increase: The circulating supply of FIL has also increased by 1.26% over the past week. This means more FIL coins are now available in the market for trading.

Currently, the circulating supply of Filecoin is approximately 490.72 million coins. This represents about 25.02% of its total maximum supply of 1.96 billion FIL. Understanding the circulating supply is crucial as it impacts the coin’s scarcity and potential inflationary or deflationary pressures.

Filecoin’s Market Position: Where Does it Stand?

According to the latest data, Filecoin currently holds the #28 rank in the cryptocurrency market capitalization rankings. Its market cap stands at a substantial $3.57 billion. Market capitalization is a key metric that reflects the total value of a cryptocurrency and its relative size within the broader crypto market.

Key Takeaways and Actionable Insights for Filecoin Investors

So, what does all this data mean for you as a potential or current Filecoin investor? Here’s a summary and some actionable insights:

- Short-Term Dip, Long-Term Trend? The recent 24-hour price decrease appears to be a minor correction following a strong weekly uptrend. The 33% weekly gain is a significant positive indicator.

- Increased Market Interest: The 116% surge in trading volume suggests growing market interest in Filecoin. This increased activity can be a bullish signal.

- Monitor Volatility: Keep an eye on Filecoin’s volatility. While some volatility is expected in crypto markets, understanding the levels of volatility can help you manage risk.

- Circulating Supply Dynamics: Be aware of the circulating supply and its potential impact on price. As more coins enter circulation, it can influence supply and demand dynamics.

- Market Cap Ranking: Filecoin’s #28 market cap ranking demonstrates its established position within the crypto ecosystem.

In Conclusion: Navigating the Filecoin Market

Filecoin’s price movements are a microcosm of the broader cryptocurrency market – dynamic and subject to fluctuations. While the recent 24-hour dip might cause short-term concern, the strong weekly performance and surge in trading volume offer a more optimistic perspective. As with any cryptocurrency investment, it’s crucial to conduct thorough research, monitor market trends, and understand your own risk tolerance. Keep an eye on Filecoin’s development, adoption, and overall market sentiment to make informed decisions.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.