Cryptocurrency markets are known for their thrilling volatility, and Hedera (HBAR) is currently stealing the spotlight with a significant price surge. Over the last 24 hours, the price of Hedera (HBAR) has jumped an impressive 9.1%, reaching $0.0959. But what’s fueling this upward momentum, and is this just a fleeting spike or the start of a sustained rally? Let’s dive into the details and analyze what’s happening with Hedera.

Hedera’s Price Momentum: A Closer Look

This recent surge isn’t an isolated event. Hedera has been on a positive trajectory throughout the past week, demonstrating a consistent upward trend. In the last seven days alone, HBAR has climbed by 9.0%, moving from $0.09 to its current price point. This consistent growth signals strong market interest and positive sentiment surrounding the digital asset. To put things in perspective, while the current price is encouraging, it’s still below Hedera’s all-time high of $0.57. This peak, reached in the past, serves as a reminder of HBAR’s potential and the room it has for further growth.

See Also: The Price Of NEAR Protocol Rose More Than 3% In 24 Hours

Decoding Hedera’s Price Volatility: Daily vs. Weekly

To understand the dynamics of Hedera’s price movement, it’s crucial to analyze its volatility. Volatility in the crypto market refers to the degree of price fluctuation over time. Higher volatility means prices can swing dramatically, while lower volatility suggests more stable price movements. Let’s examine Hedera’s price volatility over the past 24 hours and the last week to get a clearer picture.

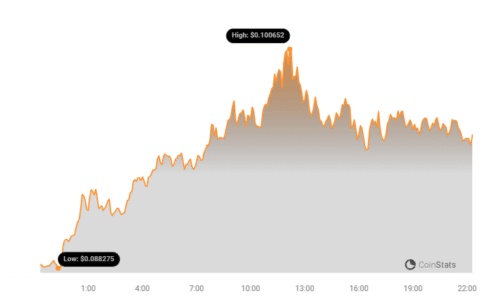

The charts below provide a visual representation of Hedera’s price movement and volatility:

- Left Chart (24 Hours): Shows price fluctuations and volatility over the last day.

- Right Chart (1 Week): Illustrates price trends and volatility over the past week.

The gray bands you see in these charts are Bollinger Bands. These are a popular technical analysis tool used to measure volatility. Here’s how to interpret them:

- Bollinger Bands Explained: They consist of a middle band (usually a simple moving average) and two outer bands that are calculated based on the standard deviation of the price.

- Volatility Indicator: The width of the Bollinger Bands is a direct indicator of volatility. Wider bands signify higher volatility, meaning the price is experiencing larger swings. Conversely, narrower bands suggest lower volatility and more stable price action.

- Gray Area Interpretation: The larger the gray area between the bands at any point, the greater the volatility during that period.

By analyzing these charts, traders and investors can gain insights into Hedera’s price stability and potential risk levels for both short-term (daily) and medium-term (weekly) trading strategies.

Trading Volume and Circulating Supply: Key Metrics to Watch

Beyond price and volatility, two other crucial metrics provide valuable context to Hedera’s market performance: trading volume and circulating supply.

Trading Volume Surge

Trading volume represents the total amount of HBAR coins that have been traded within a specific timeframe. A significant increase in trading volume often accompanies price surges, indicating heightened market activity and interest. In Hedera’s case, the trading volume has experienced a substantial 83.0% increase over the past week. This surge suggests growing investor enthusiasm and liquidity in the HBAR market.

Circulating Supply Dynamics

Circulating supply refers to the number of HBAR coins that are currently available to the public and in active circulation. Interestingly, while the trading volume has skyrocketed, the circulating supply of HBAR has only increased by a marginal 0.1% in the last week. This brings the total circulating supply to over 33.63 billion HBAR coins.

Let’s break down the supply figures:

| Metric | Value |

| Circulating Supply | 33.63 Billion HBAR |

| Max Supply | 50.00 Billion HBAR |

| Circulating Supply Percentage of Max Supply | 67.26% (estimated) |

This data reveals that a significant portion of Hedera’s total supply is already in circulation. The limited increase in circulating supply alongside a massive jump in trading volume could be contributing to the recent price appreciation, as increased demand meets relatively stable supply.

Market Cap and Ranking: Hedera’s Position in the Crypto Ecosystem

Market capitalization, or market cap, is a crucial metric for evaluating the size and dominance of a cryptocurrency. It’s calculated by multiplying the current price of a cryptocurrency by its circulating supply. Hedera currently holds the #31 rank in the cryptocurrency market cap rankings, with a market cap of $3.24 billion. This places Hedera among the top-tier cryptocurrencies, indicating substantial investor confidence and market presence.

Hedera Hashgraph: Beyond the Price – What Makes it Unique?

While price movements are exciting, it’s essential to understand the underlying technology and value proposition of Hedera Hashgraph. Unlike traditional blockchains, Hedera utilizes a distributed ledger technology called Hashgraph. This technology offers several potential advantages:

- Speed and Scalability: Hashgraph is designed to be significantly faster and more scalable than many blockchain platforms, enabling a higher transaction throughput.

- Security: Hedera boasts robust security features, utilizing asynchronous Byzantine Fault Tolerance (aBFT) consensus mechanism.

- Energy Efficiency: Hashgraph is generally considered more energy-efficient compared to some energy-intensive blockchain consensus mechanisms like Proof-of-Work.

- Governance: Hedera is governed by a council of leading global organizations, aiming for decentralized and transparent governance.

These features position Hedera as a platform suitable for various enterprise-grade applications, ranging from supply chain management and IoT to decentralized finance (DeFi) and more. The potential use cases and technological advantages contribute to the long-term value proposition of HBAR.

Investing in Hedera: Important Considerations

The recent price surge and positive market indicators surrounding Hedera are encouraging. However, like all cryptocurrencies, investing in HBAR involves risks. The cryptocurrency market is inherently volatile, and prices can fluctuate significantly. Before making any investment decisions, it’s crucial to conduct thorough research and consider the following:

- Market Volatility: Be aware of the inherent volatility of the crypto market and HBAR specifically. Price corrections can occur even after periods of growth.

- Risk Management: Only invest what you can afford to lose and diversify your portfolio to mitigate risk.

- Due Diligence: Thoroughly research Hedera Hashgraph, its technology, team, and roadmap. Understand its potential and limitations.

- Seek Professional Advice: Consider consulting with a qualified financial advisor before making any investment decisions, especially if you are new to cryptocurrency investing.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Conclusion: Hedera’s Bullish Momentum – A Sign of Things to Come?

Hedera (HBAR) is currently experiencing a notable bullish momentum, with a significant price increase and surging trading volume. While short-term price movements are always subject to market fluctuations, the underlying technology of Hedera Hashgraph, its growing ecosystem, and increasing market interest suggest a promising outlook. Investors and enthusiasts will be closely watching to see if this recent rally marks the beginning of a sustained upward trend for HBAR and its continued growth within the evolving cryptocurrency landscape. Keep an eye on Hedera, as its journey in the crypto world is certainly one to watch!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.