Immutable X (IMX), a prominent name in the crypto sphere, particularly known for its Layer-2 scaling solution for NFTs on Ethereum, has recently caught the attention of investors and traders alike. After a week of downward pressure, the price of IMX has shown a notable upward swing in the last 24 hours. Is this a temporary bounce, or could it signal a more sustained recovery for Immutable?

IMX Price Bounces Back: A 24-Hour Snapshot

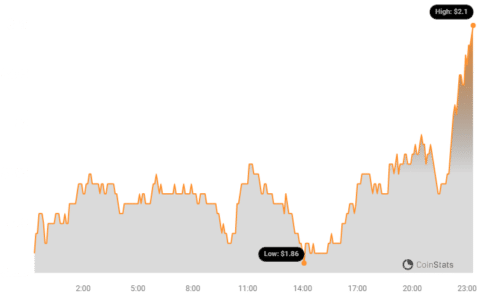

In the past 24 hours, Immutable (IMX) has experienced a positive price movement, climbing by 4.64% to reach $2.1. This uptick offers a glimmer of hope after a week that saw a 5.0% decrease in value, bringing the price down from $2.05. Let’s take a closer look at what these fluctuations mean for IMX and its potential future trajectory.

While the recent 24-hour surge is encouraging, it’s crucial to contextualize it within the broader market trends. IMX, like many cryptocurrencies, is known for its volatility. To understand the significance of this price movement, we need to delve deeper into factors like volatility, trading volume, and circulating supply.

Volatility Check: Daily vs. Weekly Price Movements

To visualize the price fluctuations and volatility of IMX, consider the charts below. The gray bands, known as Bollinger Bands, are key indicators of volatility. Wider bands suggest higher volatility, while narrower bands indicate lower volatility.

As you can see from the charts:

- Daily Volatility (Left Chart): The Bollinger Bands for the 24-hour period provide a snapshot of short-term price swings. Notice the width of the bands to gauge the immediate volatility.

- Weekly Volatility (Right Chart): The weekly chart offers a broader perspective on IMX’s price fluctuations over the past week. Comparing the band widths of both charts can help understand if the recent 24-hour surge is simply a blip or part of a larger trend change.

Trading Volume and Circulating Supply: Key Indicators

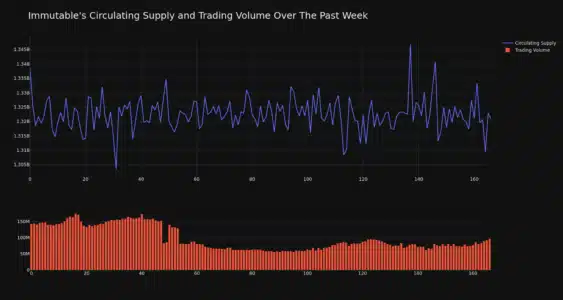

Beyond price and volatility, trading volume and circulating supply are critical metrics to assess the health and momentum of a cryptocurrency. Let’s examine IMX’s performance in these areas:

Interestingly, while the price has increased in the last 24 hours, the trading volume for IMX has decreased by 32.0% over the past week. Simultaneously, the circulating supply has also slightly fallen by 1.33%. Let’s break down what this could mean:

- Decreased Trading Volume: A drop in trading volume alongside a price increase can sometimes indicate a lack of strong conviction behind the price movement. It could suggest that the recent surge is driven by fewer trades, potentially making it less sustainable in the short term.

- Decreased Circulating Supply: A slight decrease in circulating supply could, in theory, put upward pressure on the price, assuming demand remains constant or increases. However, a 1.33% decrease is relatively small and might not be a primary driver of the recent price change.

IMX Market Cap and Ranking: Where Does it Stand?

Currently, the circulating supply of IMX is approximately 1.32 billion coins, representing about 66.1% of its maximum supply of 2.00 billion. This scarcity factor plays a role in the token’s economics and potential future value.

According to the latest data, IMX holds a market cap ranking of #37, with a market capitalization of $2.59 billion. This ranking places IMX among the top cryptocurrencies in the market, reflecting its significant presence and investor interest.

What’s Next for Immutable (IMX)?

The recent 24-hour price increase for Immutable (IMX) is a welcome sign for investors. However, it’s essential to consider the mixed signals from decreased trading volume and circulating supply. To gain a clearer picture of IMX’s future trajectory, keep an eye on:

- Sustained Price Momentum: Will IMX be able to maintain its upward trend and overcome the weekly losses? Continued positive price action with increasing trading volume would be a strong bullish signal.

- Broader Market Sentiment: The overall cryptocurrency market sentiment significantly impacts individual coins like IMX. Keep track of Bitcoin’s movements and general market trends.

- Immutable X Ecosystem Developments: Any news or updates regarding the Immutable X platform, partnerships, or NFT market activity can influence investor confidence and IMX’s price.

See Also: BREAKING: US SEC Finally Approves 11 Bitcoin Spot ETFs, Trading Starts Tomorrow

In Conclusion: Navigating IMX’s Price Movements

Immutable (IMX) presents an interesting case study in the dynamic world of cryptocurrency. The recent price surge offers a potential opportunity, but investors should remain vigilant and conduct thorough research. Understanding the interplay of price movements, volatility, trading volume, and circulating supply is crucial for making informed decisions in the crypto market. As always, remember that cryptocurrency investments carry risk, and it’s recommended to consult with a financial advisor before making any investment decisions.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.