Exciting movements in the crypto market today! If you’re keeping a close eye on your staked Ethereum, you’ll want to pay attention to Lido Staked Ether (stETH). Over the last day, stETH has shown a notable positive shift, climbing by 3.14% to reach $2,271. But is this upward trend here to stay, or just a temporary bump in the road? Let’s dive into the latest price action and what it might mean for stETH holders.

What’s Behind the Recent stETH Price Increase?

After a week of seeing red, with a 4.0% dip from $2,361.18, this 24-hour surge to $2,271 is a welcome change for stETH investors. It’s crucial to remember that the crypto market is known for its volatility, and even within a longer downtrend, we can see short bursts of positive momentum. Currently, stETH is still trading below its all-time high of $4,829.57, leaving room for potential growth, but also highlighting the distance to previous peaks.

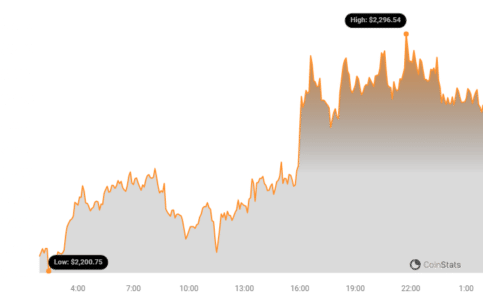

To get a clearer picture of what’s happening, let’s look at the volatility. The chart below provides a visual comparison of stETH’s price movement and volatility over the last 24 hours versus the past week. This helps us understand if the recent price increase is accompanied by increased instability or if it’s part of a more stable shift.

Bollinger Bands, those gray areas you see in the charts, are our volatility indicators. Wider bands mean higher volatility, signaling more significant price swings. By observing these bands, we can gauge whether stETH is experiencing turbulent price action or relatively stable movements.

See Also: The Price Of Injective (INJ) Up More Than 15% In 24 Hours

Diving Deeper: Trading Volume and Circulating Supply

While the price is up in the short term, it’s important to consider other factors that can influence stETH’s trajectory. One key indicator is trading volume. Interestingly, despite the recent price increase, stETH’s trading volume has actually decreased by 43.0% over the past week. This divergence could suggest a few things:

- Less trading activity: A drop in volume might indicate less overall interest in trading stETH, even with the price uptick.

- Price increase driven by lower volume: Sometimes, price increases on lower volume can be less sustainable, potentially indicating weaker conviction behind the buying pressure.

On the other hand, the circulating supply of stETH has seen a slight increase of 0.62% over the last week. Let’s understand why this is relevant.

A growing circulating supply means there are more stETH tokens available in the market. In this case, it has reached 9.24 million, which is estimated to be the maximum supply. Typically, an increase in circulating supply without a proportional increase in demand could potentially put downward pressure on price. However, in the case of stETH, the recent price increase suggests that demand might be keeping pace, or other factors are at play.

stETH Market Cap and Ranking

Currently, stETH holds the #8 spot in market cap ranking, boasting a substantial $20.84 billion valuation. This high ranking underscores stETH’s significant position within the cryptocurrency ecosystem. Its large market cap can sometimes imply greater stability compared to smaller, more volatile altcoins, but it’s still subject to the overall market dynamics and specific factors influencing staked ETH and Lido.

What is Lido Staked ETH (stETH) and Why Does it Matter?

For those new to the concept, Lido Staked ETH (stETH) represents staked Ether on the Lido platform. When you stake ETH through Lido, you receive stETH in return. This stETH token is crucial because:

- It represents staked ETH: stETH is a derivative token that mirrors your staked ETH on the Ethereum network.

- Liquidity for staked ETH: Unlike directly staking ETH which can lock up your assets, stETH provides liquidity. You can use stETH in DeFi applications, trade it, or hold it, all while still benefiting from your staked ETH.

- Participation in Ethereum 2.0: Lido facilitates participation in Ethereum’s proof-of-stake consensus mechanism (formerly ETH 2.0) for users who may not have the technical expertise or the required 32 ETH to stake independently.

Factors to Watch for stETH

If you’re interested in stETH, here are some key factors to keep an eye on:

- Ethereum Network Updates: Changes and upgrades to the Ethereum network, especially related to staking and ETH 2.0 (now simply Ethereum’s consensus layer), directly impact stETH.

- Lido Platform Developments: Any news, updates, or changes within the Lido platform, including staking yields, fees, and security aspects, can affect stETH’s value and attractiveness.

- Overall Crypto Market Sentiment: Like most cryptocurrencies, stETH’s price is heavily influenced by the broader market sentiment. Bullish trends in Bitcoin and Ethereum often positively affect altcoins like stETH, and vice versa.

- DeFi Ecosystem Growth: As stETH is often used within DeFi, the growth and health of the decentralized finance sector can influence demand and utility for stETH.

In Conclusion: Navigating stETH Price Movements

The recent 3% price increase in Lido Staked ETH is a positive signal after a week of downward movement. However, it’s essential to consider the bigger picture. The reduced trading volume alongside the price increase, and the slight rise in circulating supply, present a mixed bag of indicators. While stETH remains a significant player in the crypto space, holding a top market cap ranking and offering a liquid way to participate in ETH staking, investors should remain vigilant.

Keep monitoring the factors mentioned above, stay informed about Ethereum and Lido developments, and always conduct thorough research before making any investment decisions in the volatile world of cryptocurrency.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.