Hold onto your hats, crypto enthusiasts! The PYTH token, the fresh-faced native cryptocurrency of the decentralized oracle network Pyth Network, has seen a significant price correction. If you’ve been keeping an eye on your portfolio, you might have noticed PYTH taking a bit of a tumble. Let’s dive into what’s happening with PYTH and what factors might be contributing to this price movement.

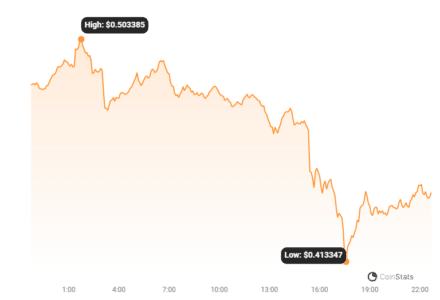

PYTH Price in Red: A 12% Drop in a Day

According to the latest data from Coinstats, a leading cryptocurrency price aggregator, PYTH is currently trading at around $0.44. That’s a notable 12% decrease compared to its price just 24 hours prior. In the fast-paced world of crypto, such fluctuations aren’t entirely uncommon, but it’s always wise to understand the potential reasons behind them.

Looking at the bigger picture, while this recent dip is noteworthy, it’s important to contextualize it. PYTH’s current price is about 13% below its all-time high of $0.548655, reached on November 24th. However, zooming out further, it’s still trading over 70% higher than its all-time low, recorded just days after its launch on November 21st. This highlights the inherent volatility of new tokens entering the market.

A Whirlwind First Week: From Airdrop to Market Fluctuations

PYTH is still a relatively new token, having just launched following a highly anticipated airdrop on November 20th. This airdrop, orchestrated by Pyth Network and crypto exchange startup Backpack, injected PYTH into the crypto ecosystem. Backpack, notably backed by FTX’s venture capital arm, distributed a massive 250 million PYTH tokens. At the time, this was valued at approximately $77 million and was distributed to Pyth NFT holders and active members of the Pyth Discord community across a staggering 27 different blockchains. This wide distribution aimed to foster broad community engagement and decentralization right from the start.

Read Also: $OMMI Surges with Growing Platform Adoption, Attains $5.1M Market Cap and 5.3K Holders

The immediate aftermath of the airdrop saw PYTH’s market capitalization skyrocket to an impressive $765 million, with initial trading prices around $0.053, according to CoinMarketCap data. This initial surge often accompanies newly airdropped tokens as early recipients and market participants react to the fresh supply.

However, as is common in crypto markets, especially after airdrops, the price experienced a correction. PYTH dipped to around $0.28 before stabilizing somewhat around the $0.32 mark. At this point, its market valuation settled around $468 million, with a robust daily trading volume reaching $107 million. This price correction is typical as early airdrop recipients might choose to realize profits, contributing to selling pressure.

PYTH Today: Market Cap and Trading Volume

As of now, PYTH boasts a market capitalization exceeding $719 million, indicating a strong level of investor interest and valuation. The 24-hour trading volume remains healthy at $132.5 million, showing active trading and liquidity in the market. Out of a total supply of 10 billion PYTH tokens, approximately 1.5 billion are currently in circulation. It’s also important to note that airdrop recipients have until February 18, 2024, to claim their tokens, meaning the circulating supply could potentially increase in the coming months.

Pyth Network: A Key Player in DeFi Oracles

Pyth Network isn’t just another crypto project; it plays a crucial role in the decentralized finance (DeFi) ecosystem. It’s a decentralized oracle network, meaning it provides real-world data to blockchains, enabling smart contracts to interact with off-chain information. Think of it as a bridge connecting the real world with the blockchain world. Oracles are essential for many DeFi applications, including:

- Decentralized Exchanges (DEXs): Providing accurate price feeds for trading pairs.

- Lending and Borrowing Platforms: Determining collateral values and interest rates.

- Stablecoins: Maintaining peg stability by referencing real-world asset prices.

- Prediction Markets: Sourcing outcomes for events.

Pyth Network distinguishes itself by sourcing data directly from high-quality institutional providers, including some of the world’s largest exchanges and trading firms. This focus on institutional-grade data aims to provide more reliable and accurate information to DeFi protocols.

PYTH Token Utility and Network Ranking

The PYTH token itself plays a vital role within the Pyth Network ecosystem. Its primary utilities include:

- Governance: PYTH holders are expected to participate in the governance of the Pyth Network, influencing its future development and direction.

- Staking (Potential Future Utility): While not explicitly stated in the provided text, it’s common for native tokens in oracle networks to have staking mechanisms in the future, allowing holders to earn rewards for securing the network.

Currently, Pyth Network holds a strong position in the oracle landscape, ranking fourth in total value secured (TVS). Furthermore, the PYTH token is ranked #75 on CoinGecko’s market capitalization ranking, showcasing its significant market presence within a short period.

Why the Recent Price Drop? Potential Factors

While pinpointing the exact reasons for a price drop in crypto markets is always challenging, here are some potential contributing factors to PYTH’s recent 12% decrease:

- Profit Taking After Initial Hype: Following the initial post-airdrop excitement and price surge, some early investors and airdrop recipients may be taking profits, leading to selling pressure.

- Broader Market Sentiment: The overall cryptocurrency market can be influenced by macro-economic factors and general investor sentiment. If the broader market is experiencing a downturn, PYTH, like many other tokens, could be affected.

- Volatility of New Tokens: Newly launched tokens are often more volatile than established cryptocurrencies. Price discovery takes time, and markets can overreact in the initial phases.

- Airdrop Claim Deadline Approaching: While the deadline is still in February, the anticipation of more tokens entering circulation as recipients claim their airdrops might be creating some downward pressure.

Looking Ahead: What’s Next for PYTH?

Despite the recent price dip, PYTH and Pyth Network remain promising projects in the DeFi space. Here are a few key points to consider moving forward:

- Continued Network Growth: The success of PYTH is closely tied to the adoption and growth of the Pyth Network itself. As more DeFi protocols integrate Pyth oracles, the demand and utility of PYTH could increase.

- Governance and Community Participation: Active community participation and effective governance are crucial for the long-term health of decentralized projects. PYTH token holders’ involvement in governance will be important.

- Market Conditions: Like all cryptocurrencies, PYTH’s price will be influenced by broader market trends and overall crypto adoption.

Key Takeaways: PYTH Price Dip in Perspective

To summarize, PYTH token has experienced a 12% price drop in the last 24 hours. While this is a significant correction, it’s essential to view it within the context of PYTH’s recent launch and the inherent volatility of crypto markets. PYTH remains significantly above its all-time low and boasts a substantial market cap and trading volume. Pyth Network’s strong position as a leading DeFi oracle and the utility of the PYTH token suggest continued potential. As always, remember that the cryptocurrency market is dynamic, and thorough research and risk management are crucial for any investment decisions.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.