Buckle up, crypto enthusiasts! The world of digital assets never sleeps, and just when you thought you’d seen it all, another whirlwind event shakes the market. This time, it’s Tellor (TRB) that’s making headlines, and not for the reasons anyone expected. Imagine witnessing a token skyrocket to an all-time high, only to crash down to earth in a matter of hours. That’s exactly what happened with TRB, leaving traders in shock and liquidations soaring.

From Peak to Plunge: The Tellor (TRB) Price Crash Explained

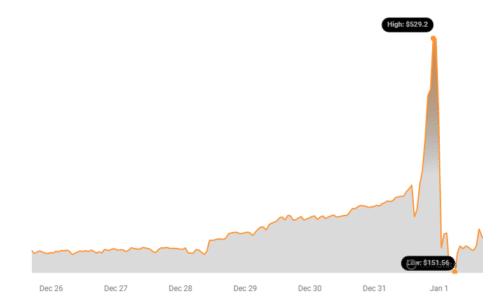

In a stunning 24-hour period, Tellor (TRB) experienced a wild ride. After reaching a dizzying peak of $529, the price dramatically plummeted to $151, according to Coinstats data. This sudden nosedive is captured in the chart below, illustrating the sheer volatility that can grip the crypto market.

This extreme price movement wasn’t just a blip on the radar; it triggered a massive wave of liquidations. A staggering $68 million in leveraged positions were wiped out, making TRB the most liquidated token in the recent crypto trading frenzy. Think about it – millions gone in a flash due to a single token’s price action.

Crypto analytics platform Lookonchain was quick to point out the severity of the situation on X (formerly Twitter). Their alert highlighted the $68 million liquidation figure, emphasizing TRB’s position as the top liquidated token during this period of volatility.

😱$TRB crashed!

In the past 24 hours,

The price of $TRB pumped to $529 and then crashed to $151.And $TRB is the token with the most liquidations, reaching $68M.@lookonchain found that the Tellor team deposited 4,211 $TRB($2.4M) after the price of $TRB pumped.

Did the team sell $TRB at a high price? pic.twitter.com/fWvJvnLwjy

— Lookonchain (@lookonchain) December 31, 2023

Adding another layer to the unfolding drama, Lookonchain also noted that the Tellor team moved 4,211 TRB, worth approximately $2.4 million, shortly after the price surge. This observation has fueled speculation and raised eyebrows within the crypto community. Was this move timed perfectly to capitalize on the peak price?

For those unfamiliar, Tellor is a decentralized oracle network, designed to bring real-world data onto blockchains. Usually, oracles are crucial but not typically associated with this level of price volatility. This unexpected surge and subsequent crash have definitely put Tellor in the spotlight.

The sheer speed and magnitude of the price drop caught many off guard. Traders holding leveraged positions on TRB faced automatic liquidation, leading to substantial financial losses. It’s a harsh reminder of the risks inherent in trading highly volatile crypto assets.

See Also: Ripple XRP Plunged After Whales Send 47M Tokens to Exchanges

As of the latest update, Tellor’s price has shown some signs of recovery, currently hovering around $185. However, this still represents a significant 34.05% decrease over the past 24 hours, leaving the market in a state of unease and uncertainty. Will it recover further, or is this just a temporary bounce?

Was Market Manipulation at Play? The Big Question

The crypto community is buzzing with questions, and a prominent one is: Was this a case of market manipulation? The Tellor team’s decision to deposit a significant amount of TRB immediately after the price spike has intensified these discussions.

Why deposit such a large amount right after the price peaks? This action, whether intentional or not, has raised questions about potential insider activity or market manipulation. The timing is certainly suspicious to many observers.

Adding fuel to the fire, crypto tracking service Spot On Chain chimed in, suggesting that both long and short positions were targeted by large players, often called ‘whales’.

🤯 Both longs and shorts were cleared out by whales in $TRB!

The price of $TRB pumped to $529 and then crashed to $151 in 24 hours.

Whales made a killing by clearing out both longs and shorts.

– 3 whales withdrew 15,852 $TRB($8.6M) from #Binance 12 hrs before pumping.

– 1 whale deposited 10,036 $TRB($5.4M) to #Binance at the peak and sold.Follow us to learn more on-chain data! pic.twitter.com/I1Itm1ogJ9

— Spot On Chain (@spotonchain) December 31, 2023

Spot On Chain’s tweet indicates that whales may have strategically orchestrated these price movements, profiting from both the pump and the dump. This highlights the power large holders can wield in the often-unregulated crypto space.

Incidents like the Tellor price crash serve as a stark reminder of the inherent risks in the cryptocurrency market. Extreme volatility is a constant companion, and events like these can lead to significant financial consequences for traders and investors.

The Tellor community and the broader crypto market are now keenly watching for further developments. Clarity is needed regarding the factors that contributed to this extreme price fluctuation and its long-term impact on the Tellor project. Was it simply market volatility, or was there something more sinister at play?

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.