The crypto community is holding its breath. With the bear market in full swing, the big question on everyone’s mind is: are we heading for a crypto crash? Bitcoin, the king of crypto, is currently trading around $39,986 (at press time), a dip of about 2.15% from yesterday. Ethereum isn’t faring much better, down 0.14% in the last 24 hours. And if you look at the bigger picture, the crypto market has shed a staggering $300 billion in just the past week!

Bitcoin and Nasdaq: An Uncomfortably Tight Relationship

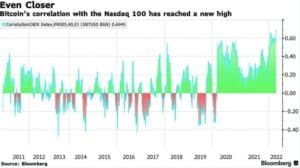

Here’s a concerning trend that market watchers have spotted: Bitcoin’s price is now more closely tied to the Nasdaq than ever before. Bloomberg experts have highlighted this record 40-day correlation, and it’s raising eyebrows.

What does this mean? Essentially, the argument that Bitcoin acts as a safe haven, a diversifier in your investment portfolio, is weakening. Proponents have long touted this as a key advantage of Bitcoin, but this increasing correlation throws a wrench in those claims.

This chart is what’s fueling the unease. This pattern of Bitcoin and Nasdaq moving in sync has become more pronounced in recent months, especially after the Federal Reserve started hiking interest rates. This interest rate hike seems to have triggered a sell-off across the board, impacting both traditional stocks and crypto assets.

Interestingly, this strong link between Bitcoin and Nasdaq isn’t entirely new. It’s been developing since 2020. Anthony Pompliano, a well-known cryptocurrency analyst, believes this shift is due to a change in who’s holding Bitcoin now.

According to Pompliano, the Bitcoin investor landscape is now dominated by two main groups:

- Wall Street Institutions: These are the big players who, according to Pompliano, largely view Bitcoin as a risky asset, behaving much like tech stocks.

- Everyday Citizens: These are individuals who still see Bitcoin as a store of value, a ‘reserve asset’ to protect against inflation and economic uncertainty.

Arthur Hayes Weighs In: Echoes Pompliano’s Sentiment

Arthur Hayes, the co-founder of BitMEX, a prominent crypto exchange, shares a similar perspective on this growing relationship between Bitcoin and the Nasdaq. He also emphasizes the distinction between how different investor groups perceive Bitcoin.

Pompliano highlights that understanding these two distinct viewpoints is crucial for interpreting market data. One group sees Bitcoin as a risk-on asset, the other as a safe haven. This divergence in perception contributes to the current market volatility and correlation with traditional markets.

Adding to the market jitters, Crypto Whale, a popular anonymous Twitter account with a massive following, recently highlighted significant liquidations in the crypto market.

Crypto Market Bloodbath: Liquidations Soar

Crypto Whale’s data paints a stark picture. Over the past 24 hours, a staggering $460 million in crypto positions were liquidated. What’s even more telling is that over 90% of these were long positions. This massive wave of liquidations, primarily targeting those betting on price increases, strongly suggests a market that’s not just weak, but potentially on the brink of a deeper downturn.

What Does This Mean for Crypto Traders?

This confluence of factors – the strong Bitcoin-Nasdaq correlation, the rising interest rates, and the heavy liquidations – points towards a period of heightened volatility and uncertainty in the crypto market. Here’s a quick summary of the key takeaways for crypto traders:

- Increased Risk: The correlation with Nasdaq means Bitcoin is behaving more like a risk asset. Traditional market downturns will likely impact Bitcoin and the broader crypto market more significantly.

- Monitor Traditional Markets: Keep a close eye on the Nasdaq and broader stock market trends. They can offer clues about Bitcoin’s potential direction.

- Liquidation Risks: High liquidation volumes signal market fragility. Be cautious with leverage and manage your risk carefully.

- Bear Market Mentality: The current market sentiment is undeniably bearish. Adjust your trading strategies accordingly and consider protective measures.

Related Read: If this pattern holds, Bitcoin might fall to $26,000 – Explore a deeper dive into potential Bitcoin price drops.

Navigating the Crypto Bear Market

The crypto market is currently facing headwinds. The strong correlation with Nasdaq, coupled with macroeconomic factors and significant liquidations, creates a challenging environment. While the long-term potential of crypto remains, traders need to be prepared for potential further downturns and volatility in the short to medium term. Staying informed, managing risk effectively, and understanding market correlations are crucial for navigating this crypto bear market and making informed decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.