Key Takeaways

- TRON reinforced its role as a stablecoin-first settlement layer in 2025, sustaining leadership in P2P stablecoin payment flows as one of the dominant global rails.

- Stablecoin fundamentals strengthened, with stablecoin supply up 41% (led by USDT expansion) and monthly active stablecoin users up 38% to over 10M.

- Network activity accelerated into H2, surpassing 300M monthly transactions for the first time since mid-2023 and reaching around 20M monthly active accounts by year-end.

- TRON prioritized execution and distribution, shipping a steady cadence of fintech, interoperability, and developer infra integrations that positioned it as financial infrastructure amid intensifying competition.

TRON H2 2025 Rewind

In our previous report, we covered the events that shaped TRON in the first half of 2025. We looked at how TRON expanded its lineup of Super Representatives. We also covered its technical integrations to support developers and the broader ecosystem. Finally, we discussed the launch of another stablecoin on its network, USD1.

In the second half of 2025, the focus of the TRON team was on operational execution and targeted growth. Rather than chasing speculative integrations, TRON prioritized initiatives with clear ROI and real-world adoption. The team also doubled down on TRON’s core value proposition of low fees, fast settlement, and predictable costs. Together, these efforts improved TRON’s positioning as a blockchain financial infrastructure.

Ecosystem Growth

In H2 2025, TRON’s ecosystem growth strategy centered on distribution and execution, with an emphasis on consumer-facing integrations and coordinated enhancement of TRON’s go-to-market strategy. The network expanded fintech and wallet integrations, including WireX Pay and other user tools, broadening access points for TRX and USDT on TRON across everyday payment and wallet surfaces.

A key example was TRON’s integration with Kalshi, which enabled deposits and withdrawals via TRX and USDT on TRON and positioned TRON as a liquidity rail supporting prediction market activity. In parallel, Revolut selected TRON for a blockchain infrastructure integration tied to its “Crypto 2.0” initiative, adding in-app TRX staking, supporting stablecoin remittances, and 1:1 fiat-to-stablecoin conversion across its European footprint. Together, these launches emphasized TRON’s strengths as a settlement layer: fast confirmations, low fees, and deep stablecoin liquidity.

Explore TRON ecosystem on CryptoRank.io.

TRON also expanded into chain abstraction and intent-based UX, reflecting a push to reduce friction for both users and developers. Through a strategic collaboration with NEAR, TRON integrated NEAR Intents, enabling intent-based swaps and cross-chain transfers that abstract away bridging and chain mechanics. This positioned TRON within a broader multichain execution stack designed to simplify onboarding and make interoperability feel native, while also opening up a wider design space for DeFi and emerging AI-driven workflows.

On developer infrastructure, TRON added Alchemy RPC support, improving reliability and scalability for builders, and continued strengthening wallet connectivity through MetaMask and WalletConnect. It also enhanced security and monitoring tooling via ecosystem integrations, supporting more mature production workflows as partner activity scaled. Complementing these upgrades, Ledger added full native TRON support, enabling organizations to manage TRX and TRC20 tokens like USDT with governance controls, multi-approval flows, and whitelisting, with an emphasis on clear-signing protections. This broadened TRON’s enterprise readiness by connecting stablecoin-heavy workflows to higher-assurance operational and security tooling.

The FSRA of ADGM accepted USDT on TRON as an Accepted Fiat-Referenced Token, allowing ADGM-licensed entities to use it in regulated activity. The milestone strengthened TRON’s institutional positioning as a compliant, low-fee stablecoin settlement rail, supported by ongoing regulator engagement and financial crime prevention efforts.

TRX Performance and Cross-Chain Expansion

Amid the ecosystem expansion and ongoing infra improvements, TRX, the native token of the TRON blockchain, delivered a strong performance in 2025. TRX was up 26% since Jan 1, 2025, with a significant share of that upside concentrated in Q2 to Q3.

TRON also pushed deeper into interoperability through an integration with Base, the Ethereum L2 incubated by Coinbase. Enabled by LayerZero, the bridge allows TRX to move onto Base and be accessed directly in the Base App via Base-native DEXs such as Aerodrome, expanding TRX liquidity and utility beyond TRON’s own execution environment. In the context of TRON’s scale and payments-first positioning, the Base connection reinforced the broader trend toward multichain participation and lower-friction capital movement across ecosystems.

TRON is Leading Stablecoin Settlement Despite Increased Competition

One of TRON’s key competitive advantages is its strength in stablecoin settlement. Despite the launch of several stablecoin-focused blockchains, including Plasma and Stable, TRON maintained leading positions across multiple stablecoin indicators throughout 2025.

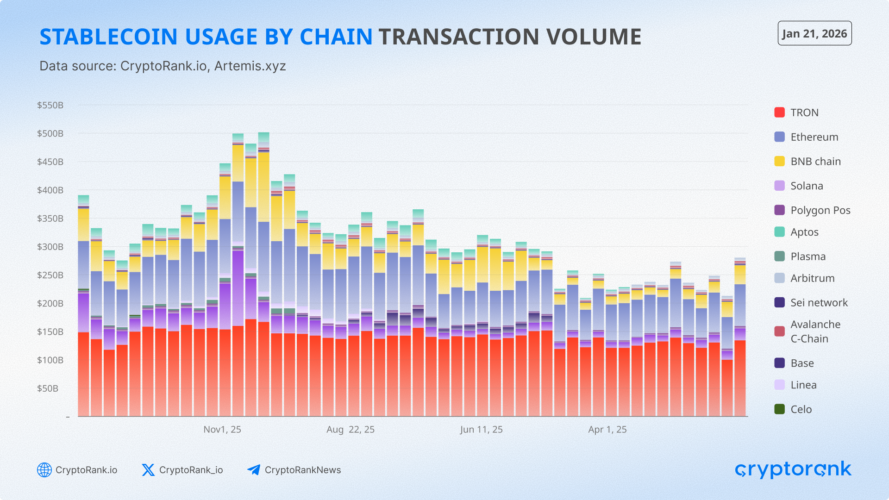

Across the year, TRON ranked among the top chains by P2P stablecoin transaction volume, closely followed by Ethereum. This reflected TRON’s role as a global stablecoin settlement rail, processing trillions in annual payment volume and continuing to serve high-frequency, cost-sensitive flows.

This performance was supported by expanding real-world usage, including merchant payments, payroll, and remittances, particularly across LATAM, Africa, and Asia. In parallel, TRON deepened engagement with global payment providers and PSPs, strengthening settlement efficiency and stablecoin treasury operations to support larger, more consistent transaction throughput.

Source: Artemis, CryptoRank

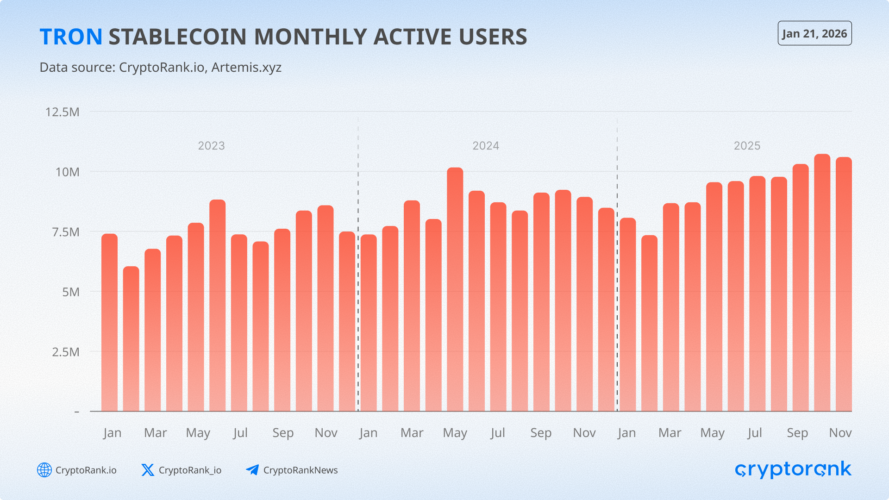

In 2025, monthly active stablecoin users on TRON grew 38% and surpassed 10 million. This reflects steady growth in stablecoin-using addresses over time, signaling more sustainable, recurring adoption rather than one-off activity.

Stablecoin Monthly Active Users on TRON

Source: Artemis, CryptoRank

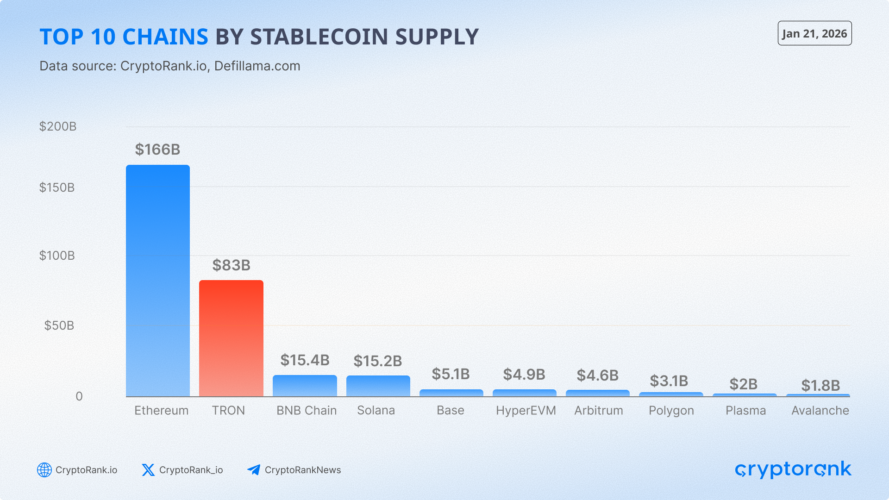

However, TRON still ranked second behind Ethereum, which continued to lead in stablecoin supply due in part to its large USDC supply. The gap to the next tier of chains remained wide, reinforcing a clear separation between the top two settlement networks and the rest.

That said, competition in stablecoin settlement continued to intensify. New entrants and fast-growing environments began appearing in the top 10, including HyperEVM and stablecoin-focused Plasma, signaling a broader push to capture stablecoin-driven payments and transfer flows.

Source: DeFiLlama, CryptoRank

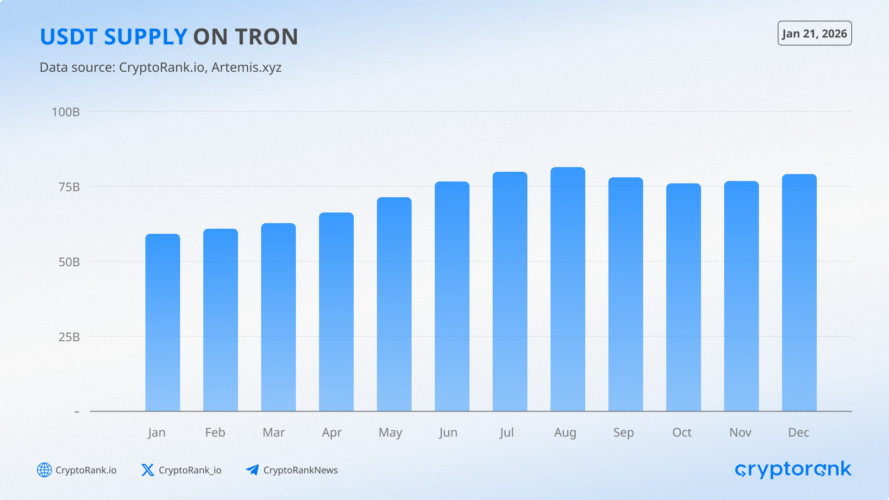

Stablecoin supply on TRON rose 41% in 2025, primarily driven by USDT growth. Beyond USDT, TRON’s stablecoin base also expanded through higher supply of USDD and TUSD, alongside several newly added stablecoins.

Source: Artemis, CryptoRank

TRON On-Chain Metrics Overview

Usage Metrics

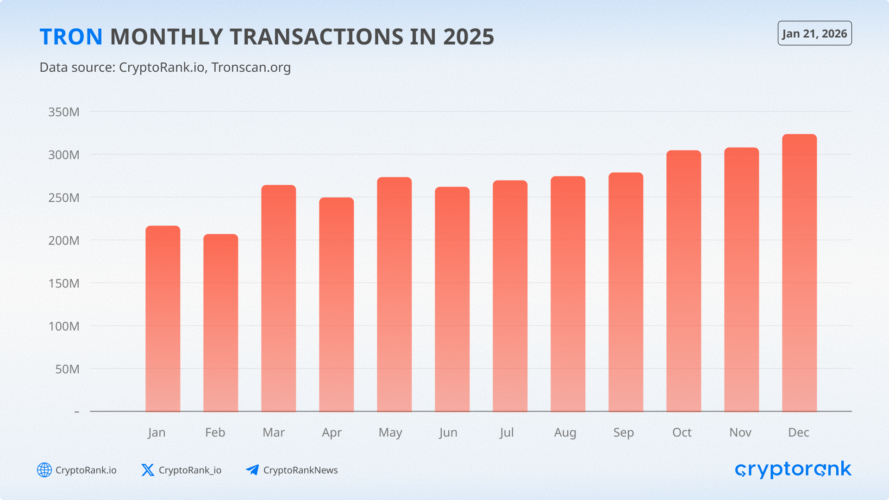

In 2025, TRON’s transaction count followed a steady uptrend and surpassed 300M monthly transactions for the first time since mid-2023. Versus January 2025, monthly transactions were up by nearly 50%.

Source: TRONSCAN, CryptoRank

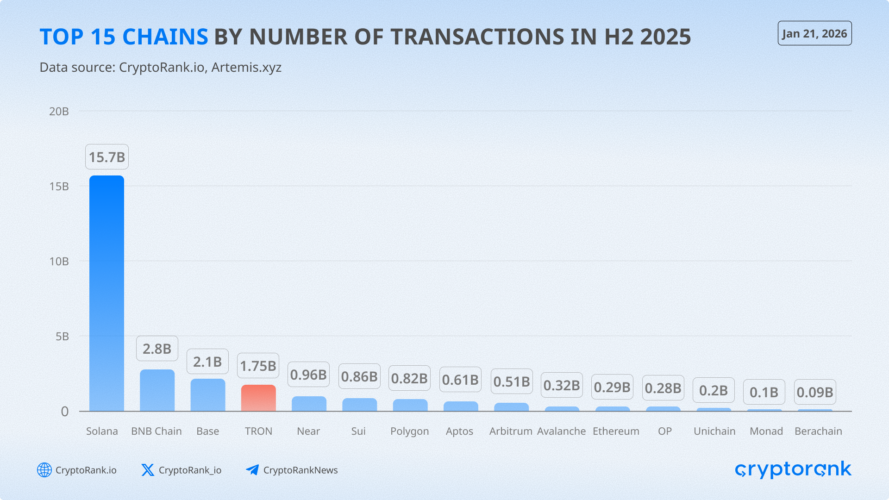

However, TRON faced strong competition from major general-purpose chains. Solana, BNB Chain, and Base saw periods of elevated activity driven largely by memecoin trading and other user-facing dApps. By contrast, TRON’s activity was primarily stablecoin-led, reflecting its role as a settlement network rather than a memecoin trading venue.

Source: Artemis, CryptoRank

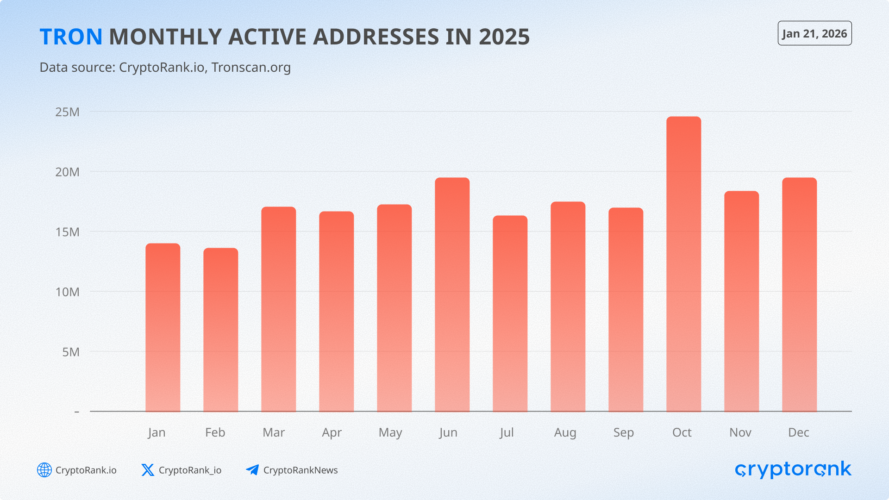

By the end of 2025, TRON averaged around 20M monthly active accounts, up 33% versus the start of the year. As shown above, just over 50% of these accounts were stablecoin users, while the remainder was primarily driven by TRX transfers and smart contract activity that did not involve stablecoins.

Monthly Active Addresses

Source: TRONSCAN, CryptoRank

Revenue Outlook

Revenue trended up through the first three quarters of 2025. In Q3 2025, TRON’s staking revenue reached a new all-time high of nearly $900M, while burn-related revenue remained relatively stable at around $150M to $180M. In Q4, total revenue declined sharply, driven primarily by broader market weakness and the corresponding drop in TRX price.

Source: TRONSCAN, CryptoRank

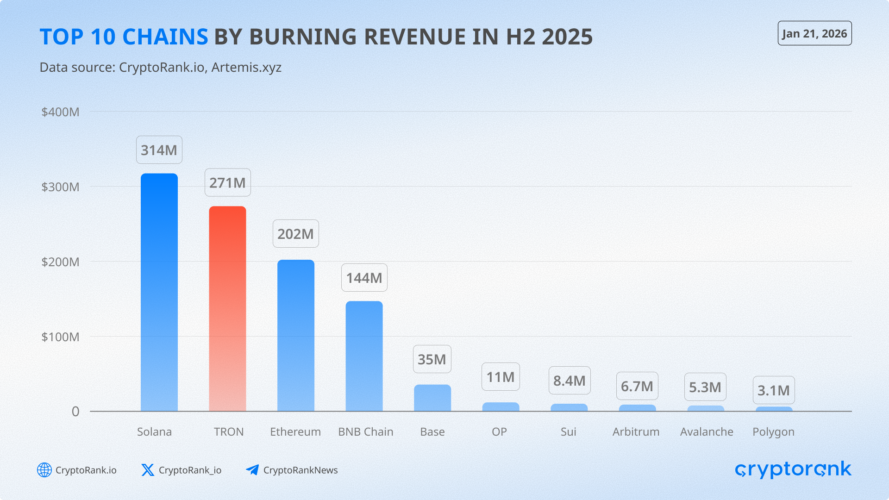

Compared with H1 2025, Solana outpaced TRON (and Ethereum) in H2, moving into the top spot for burn-related revenue. TRON’s position remained relatively stable, and it retains a credible path to reclaim the top rank if Solana’s activity cools, particularly if on-chain trading flows become more competitive and fragmented across venues and chains.

Source: Artemis, CryptoRank

TRON DeFi Landscape Overview

Throughout 2025, TVL on TRON was volatile, largely reflecting TRX price action. Even so, TVL was up 15% versus the start of 2025. That growth was not enough to keep TRON in the top five chains by TVL, as it ceded rank to Bitcoin, Base, and BNB Chain, according to DeFiLlama.

Source: TRONSCAN, CryptoRank

The Bottom Line

2025 reinforced TRON’s core positioning as a stablecoin-led settlement network. Stablecoin supply grew 41%, monthly active stablecoin users rose 38% to over 10M, and activity rebounded to 300M+ monthly transactions, reflecting sustained demand for low-fee, high-throughput transfers.

In 2026, competition should intensify from both stablecoin-focused chains like Plasma and fast-growing general-purpose ecosystems like Solana, Base, and BNB Chain. For TRON, defending share will likely come down to keeping fees and settlement predictable, expanding distribution through payment providers and fintech partners, and continuing to reduce UX friction through interoperability and developer tooling.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.