Hold onto your hats, crypto enthusiasts! The market is always in motion, and today we’re diving deep into the recent price action of THORChain (RUNE). If you’ve been keeping an eye on RUNE, you might have noticed a bit of a pullback. Let’s break down what’s been happening and what it could mean for the future of this exciting decentralized exchange protocol.

THORChain (RUNE) Price Performance: A Closer Look

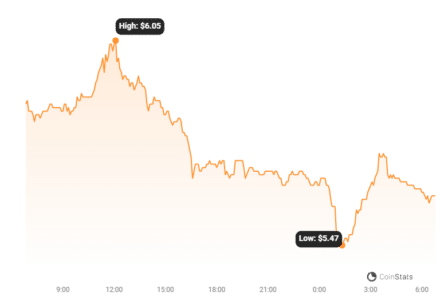

Over the last 24 hours, THORChain’s native token, RUNE, has experienced a 4.1% decrease in price, settling at $5.69. Zooming out a bit, the past week tells a similar story, with an overall 11.0% drop from $6.35. While market fluctuations are part and parcel of the crypto world, understanding these movements is crucial. Let’s delve into the details.

Decoding Volatility: Are Things Getting Shaky?

Volatility is the name of the game in crypto, and THORChain is no exception. To get a clearer picture of these price swings, let’s examine the volatility using Bollinger Bands. These bands help us visualize the range within which RUNE’s price has been moving, both in the short term (24 hours) and over the past week.

Take a look at the charts below:

The gray bands you see are the Bollinger Bands. Here’s a simple way to understand them:

- Wider Bands = Higher Volatility: When the gray area expands, it signifies increased price fluctuations.

- Narrower Bands = Lower Volatility: Conversely, tighter bands suggest a period of relative price stability.

By observing the charts, we can gauge the level of risk and potential price swings associated with RUNE at different timeframes.

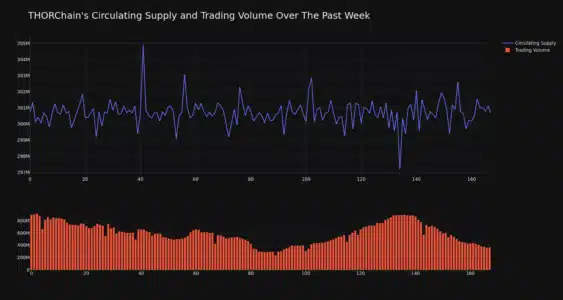

Trading Volume and Circulating Supply: What’s the Connection?

Another key metric to consider is trading volume. Interestingly, THORChain’s trading volume has decreased by a significant 59.0% over the past week. This decline in trading activity often moves in tandem with the circulating supply of a cryptocurrency. In the case of RUNE, the circulating supply has also seen a slight decrease of 0.01%.

Let’s break down why these factors are important:

- Decreasing Trading Volume: A drop in trading volume can sometimes indicate reduced market interest or a period of consolidation. It could also precede larger price movements in either direction.

- Circulating Supply: This refers to the number of RUNE tokens currently available in the market. Changes in circulating supply can influence price dynamics, although in this case, the 0.01% decrease is minimal.

Currently, the circulating supply of RUNE stands at 300.70 million tokens. This represents approximately 60.14% of its maximum supply of 500.00 million. Understanding the tokenomics of a cryptocurrency, including its supply metrics, is vital for long-term investment considerations.

See Also: RUNE Soars 40% Weekly as THORChain Claims 2nd Place in DEX Daily Trading Volumes

THORChain’s Market Position: Where Does RUNE Stand?

Despite the recent price dip, THORChain remains a significant player in the crypto space. Currently, RUNE holds the #40 rank in market capitalization, with a market cap of $1.71 billion. This ranking highlights its position among the top cryptocurrencies globally.

Key Takeaway: Even with short-term price fluctuations, THORChain’s solid market cap and ranking suggest a degree of established presence and investor confidence in the project.

What is THORChain and Why Should You Care?

For those new to the scene, THORChain is a decentralized liquidity protocol that allows users to seamlessly swap crypto assets across different blockchains without relying on intermediaries. Think of it as a bridge connecting various crypto ecosystems, enabling true cross-chain trading.

Why is this important?

- Decentralization: THORChain champions the core principles of crypto by eliminating central points of control and single points of failure.

- Cross-Chain Swaps: It solves a major challenge in crypto – the fragmented nature of different blockchains – making it easier to move assets between them.

- Native Asset Trading: Unlike wrapped tokens, THORChain facilitates trading of native assets, reducing complexity and potential risks.

- Yield Opportunities: Users can earn yield by providing liquidity to THORChain pools.

Factors Influencing RUNE Price: What to Consider?

Like all cryptocurrencies, RUNE’s price is influenced by a multitude of factors. Here are some key elements that can play a role:

- Overall Crypto Market Sentiment: Broader market trends, especially the performance of Bitcoin and Ethereum, often impact altcoins like RUNE.

- THORChain Network Developments: Upgrades, new features, partnerships, and adoption metrics within the THORChain ecosystem can significantly affect RUNE’s price.

- DeFi Sector Trends: The overall health and growth of the Decentralized Finance (DeFi) sector, where THORChain operates, is a crucial factor.

- Competition: The emergence of competing cross-chain solutions or DEX platforms can influence market share and investor interest in RUNE.

- Regulatory Landscape: Changes in crypto regulations globally can impact market sentiment and investor behavior.

Is This Dip a Buying Opportunity? (Disclaimer Alert!)

Now, for the million-dollar question: Is this price dip a chance to buy RUNE at a lower price? While it might be tempting to see it as a buying opportunity, it’s crucial to remember that this is not financial advice. The cryptocurrency market is inherently risky, and price movements can be unpredictable.

Before making any investment decisions, consider the following:

- Do Your Own Research (DYOR): Thoroughly investigate THORChain, its technology, team, roadmap, and community.

- Assess Your Risk Tolerance: Understand your comfort level with market volatility and potential losses.

- Diversify Your Portfolio: Never put all your eggs in one basket. Diversification is key to managing risk.

- Consult a Financial Advisor: Seek advice from a qualified professional who can provide personalized guidance based on your financial situation.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

In Conclusion: Navigating the THORChain (RUNE) Price Landscape

The recent price dip in THORChain’s RUNE token is a reminder of the dynamic nature of the crypto market. While short-term fluctuations are common, understanding the underlying trends, volatility, and market context is essential for informed decision-making.

THORChain remains a noteworthy project with a strong value proposition in the DeFi space. By staying informed, conducting thorough research, and exercising caution, you can navigate the exciting, yet sometimes turbulent, world of cryptocurrency investments.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.