Navigating the volatile world of cryptocurrency can feel like riding a rollercoaster. If you’re keeping an eye on THORChain (RUNE), you might have noticed some recent turbulence. Let’s dive into the latest price movements of RUNE and break down what’s happening in the market.

THORChain (RUNE) Price Decline: A Closer Look

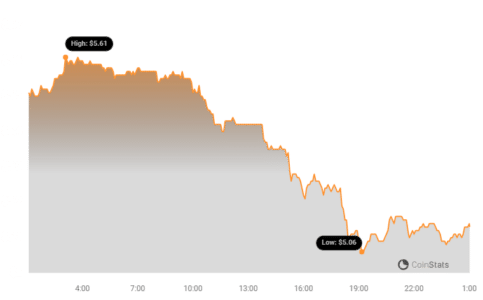

As of today, THORChain (RUNE) is trading at $5.13. This reflects a 5.34% decrease in price over the last 24 hours. Looking at the bigger picture, this downward pressure isn’t isolated to just today. Over the past week, RUNE has experienced a 10.0% drop, sliding from $5.67 to its current level.

To better understand these movements, let’s visualize the price action and volatility.

Decoding RUNE’s Price Movements and Volatility

Price fluctuations are part and parcel of the crypto market, but understanding volatility can offer valuable insights. The charts below compare THORChain’s price movement and volatility over two key periods: the last 24 hours (left) and the past week (right).

Notice the gray bands in these charts? These are Bollinger Bands, a popular technical analysis tool used to measure volatility. Essentially, Bollinger Bands illustrate the range within which the price of an asset typically trades.

Here’s what the Bollinger Bands tell us:

- Wider Bands = Higher Volatility: When the gray bands widen, it indicates increased price fluctuations. A larger gray area suggests greater volatility during that period.

- Narrower Bands = Lower Volatility: Conversely, narrower bands suggest periods of relative price stability.

By examining the Bollinger Bands, we can quickly gauge the level of price volatility for THORChain over both the daily and weekly timeframes.

See Also: Filecoin (FIL) Decreases More Than 4% Within 24 Hours

Trading Volume and Circulating Supply: What’s the Story?

Beyond price and volatility, other metrics can provide a more complete picture of THORChain’s market dynamics. Let’s consider trading volume and circulating supply.

Interestingly, the trading volume for RUNE has decreased by 32.0% over the past week. This is a significant drop and often signals reduced investor interest or activity. Lower trading volume can sometimes exacerbate price swings, as fewer trades are needed to move the price.

On the other hand, the circulating supply of RUNE has slightly increased by 0.06% in the same week. While seemingly small, any increase in circulating supply can potentially exert downward pressure on price, assuming demand remains constant or decreases.

Currently, the circulating supply of RUNE stands at 300.70 million coins. This represents approximately 60.14% of its total maximum supply of 500.00 million RUNE. Understanding the tokenomics – the supply and distribution of a cryptocurrency – is crucial for long-term investment considerations.

THORChain’s Market Position: Where Does RUNE Stand?

Market capitalization is a key metric for evaluating the size and dominance of a cryptocurrency. As per our data, THORChain (RUNE) currently holds the #50 rank in market capitalization, with a market cap of $1.53 billion.

This ranking places RUNE among the established cryptocurrencies in the market. However, market rankings are dynamic and can shift rapidly based on price movements and broader market trends.

What Could Be Driving RUNE’s Price Decline?

While this article focuses on the data, it’s important to consider potential factors contributing to RUNE’s recent price decrease. Here are a few possibilities:

- Broader Market Sentiment: The entire cryptocurrency market can be influenced by overall market sentiment. Negative news or a general downturn in Bitcoin (BTC) and Ethereum (ETH) prices can often drag down altcoins like RUNE.

- Profit-Taking: After periods of potential gains, some investors may choose to take profits, leading to selling pressure and price declines.

- THORChain Specific News: Any negative news or developments specific to the THORChain network, its technology, or adoption could impact investor confidence and price. (It’s always recommended to stay updated on the latest THORChain news).

- Increased Circulating Supply: As mentioned earlier, even a slight increase in circulating supply, without a corresponding increase in demand, can contribute to price depreciation.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry significant risk. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

In Conclusion: Navigating RUNE’s Price Volatility

THORChain (RUNE) is currently experiencing downward price pressure, as evidenced by its recent price declines, reduced trading volume, and increased volatility. While the market cap and ranking still place RUNE among the top cryptocurrencies, understanding the underlying dynamics and potential contributing factors is crucial for investors.

Keep a close watch on market sentiment, THORChain-specific developments, and broader crypto trends to make informed decisions. The cryptocurrency market is ever-evolving, and staying informed is your best tool for navigating its inherent volatility.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.