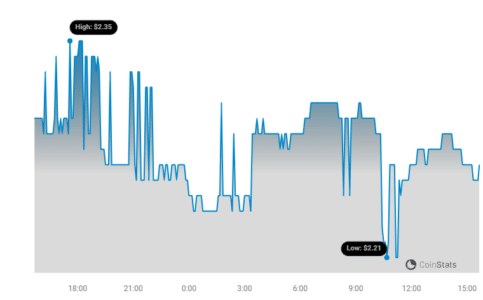

Buckle up, crypto enthusiasts! The Toncoin (TON) market is experiencing some turbulence. Over the past 24 hours, the price of Toncoin has taken a noticeable dip, falling by 8.29% to settle at $2.27. If you’ve been keeping an eye on TON, you’ll know this isn’t an isolated blip. This downward movement extends a negative trend from the past week, where Toncoin has shed 4.0% of its value, sliding from $2.44 to its current price point. Let’s dive into the details and understand what’s influencing this price action.

Toncoin Price Chart | Source: Coinstats[/caption>

Toncoin Price Chart | Source: Coinstats[/caption>Decoding Toncoin’s Price Movements: Daily vs. Weekly Volatility

To get a clearer picture of what’s happening with Toncoin, let’s analyze its price fluctuations and volatility. The chart below offers a visual comparison, showcasing price movement over the last 24 hours on the left, and the broader weekly trend on the right.

Price movement and volatility for Toncoin[/caption>

Price movement and volatility for Toncoin[/caption>Notice those gray bands in the charts? Those are Bollinger Bands, a handy tool for measuring volatility in price movements, both daily and weekly. Think of them as volatility indicators. When these bands widen, meaning the gray area expands, it signals heightened volatility. Conversely, narrower bands suggest less price fluctuation. Currently, the charts give us a snapshot of Toncoin’s volatility over different timeframes.

See Also: Upbit Announced That It Will Add Axelar (AXL) Trading Pair To Its Platform

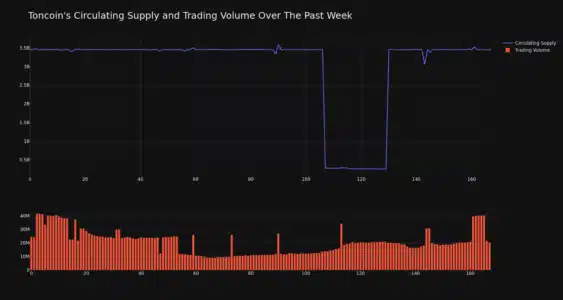

Trading Volume Dips While Circulating Supply Sees a Slight Increase

Interestingly, while the price is declining, other key metrics are also shifting. The trading volume for Toncoin has decreased by a significant 16.0% over the past week. This contrasts with the coin’s circulating supply, which has edged up by a modest 0.14% during the same period.

Toncoin circulating supply and trading volume[/caption>

Toncoin circulating supply and trading volume[/caption>This slight increase in supply brings the total circulating Toncoin to 3.45 billion. According to the latest data, Toncoin currently holds the #15 rank in market capitalization, boasting a market cap of $7.84 billion.

What Does This Mean for Toncoin?

The recent price drop in Toncoin, coupled with decreased trading volume and a slight supply increase, paints a mixed picture. Here’s a breakdown of what these factors could indicate:

- Price Decline: The 8% drop in 24 hours and 4% weekly decline signals bearish momentum. This could be due to various market factors, including profit-taking, broader market corrections, or negative news sentiment surrounding Toncoin or the crypto market in general.

- Reduced Trading Volume: A 16% decrease in trading volume suggests less interest or activity in the Toncoin market currently. Lower volume can sometimes exacerbate price swings, making the market more volatile.

- Slight Supply Increase: A 0.14% increase in circulating supply is relatively small. However, in a market experiencing decreased demand (indicated by price and volume drops), even a small supply increase can contribute to downward pressure on price.

- Market Cap Ranking: Despite the recent downturn, Toncoin remains a top 15 cryptocurrency by market cap. This indicates it still holds significant value and market presence within the crypto space.

Navigating Toncoin’s Price Fluctuations: Key Takeaways

For those watching Toncoin, here are some key points to consider:

- Volatility is Present: The Bollinger Bands and price charts highlight ongoing volatility in Toncoin. Traders should be prepared for potential price swings.

- Market Sentiment: Monitor overall crypto market sentiment and news related to Toncoin. External factors can significantly influence price action.

- Long-Term Perspective: Consider your investment horizon. Short-term price fluctuations are common in crypto. Assess Toncoin’s long-term fundamentals and potential if you are a long-term holder.

- Further Research: Always conduct thorough research before making any investment decisions. Analyze market trends, Toncoin’s development updates, and broader economic factors.

In Conclusion: Staying Informed in the Toncoin Market

Toncoin, like the broader cryptocurrency market, is subject to dynamic price movements. The recent price decrease, coupled with shifts in trading volume and circulating supply, requires attention from investors and market watchers. Staying informed, understanding market indicators like volatility and trading volume, and considering both short-term fluctuations and long-term potential are crucial for navigating the Toncoin market effectively. Keep a close eye on market developments and always remember to conduct your own due diligence before making any investment decisions in the crypto space.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.