Hold onto your hats, crypto enthusiasts! Toncoin [TON], the digital currency deeply intertwined with the Telegram messaging giant, is making waves. It’s not just any ripple; we’re talking about a surge to levels unseen since February 2022, according to data from Coinstats. If you’ve been watching the crypto markets, you’ve likely noticed TON’s impressive climb, but what’s fueling this ascent and, more importantly, can it last?

Toncoin’s Bull Run: By the Numbers

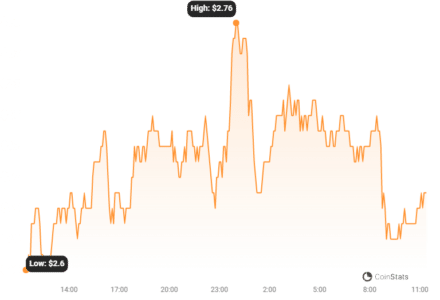

Let’s dive into the specifics. As of now, Toncoin is trading at $2.76. That’s a jump of nearly 50% in just the last month! While the upward trend has been consistent, the most significant gains have been concentrated in the past couple of days. Here’s a quick snapshot:

- Recent Peak: Reached its highest value since February 2022.

- Current Price: Hovering around $2.76.

- Monthly Growth: Up almost 50% in the last month.

- Recent Surge: Most gains observed in the last 48 hours.

To visualize this impressive growth, take a look at the Toncoin price chart:

The Pavel Durov Effect: Telegram Premium and TON’s Ascent

So, what’s the secret ingredient behind this price surge? Many signs point towards Pavel Durov, the mastermind behind Telegram. On November 7th, Durov announced a giveaway of a whopping 10,000 Telegram Premium memberships. The catch? He acquired these memberships using TON tokens, valued at approximately $200,000!

This announcement acted as a significant catalyst. On November 8th, TON’s price jumped by 8.4% during intraday trading. For a brief moment, it even surpassed the market capitalization of Dogecoin [DOGE], a leading meme coin, showcasing the sheer momentum behind Toncoin.

Durov’s announcement wasn’t just a feel-good moment; it demonstrably boosted demand for TON. Santiment data reveals some compelling metrics:

- Unique Address Transactions: Increased by 46% since November 6th.

- New Addresses Created: Spiked by over 70% in the same period.

These figures clearly indicate a surge in both existing and new users engaging with Toncoin, directly contributing to the recent price appreciation. It’s a classic case of increased demand driving prices higher.

Read Also: SUI Gains 12% While Chainlink and Polygon Keep Alt Rally Rolling

Is a ‘TON-around’ (Correction) Coming?

Now, for the crucial question: Is this rally sustainable, or are we heading for a price correction? Analyzing TON’s daily chart provides some insights. The recent trading frenzy has pushed key momentum indicators into ‘overbought’ territory.

Specifically:

- Relative Strength Index (RSI): Reached 80.11.

- Money Flow Index (MFI): Hit 87.75.

Generally, an RSI above 70 and an MFI above 80 are considered overbought signals. This suggests that the asset’s price might have climbed too rapidly and could be due for a pullback or consolidation. Think of it like stretching a rubber band too far – it’s likely to snap back!

Adding to this, the Bollinger Bands, a volatility indicator, show an increasing gap between the upper and lower bands after Durov’s announcement. A widening gap usually signals heightened price volatility, implying potential for significant price swings in either direction. Traders often interpret this as a sign of increased market uncertainty and the possibility of a sharp reversal.

Key Takeaways & Actionable Insights

Let’s summarize what we’ve learned and consider what it means for you:

- TON’s Price Surge is Real: Driven by genuine demand and Pavel Durov’s initiative.

- Market Momentum is Strong: Evidenced by increased transaction volume and new user adoption.

- Overbought Indicators Signal Caution: RSI and MFI suggest a potential price correction.

- Volatility is Rising: Bollinger Bands indicate possible price swings.

Actionable Insights:

- For TON Holders: Be aware of potential short-term volatility and consider setting stop-loss orders to protect profits.

- For Potential Investors: Exercise caution. While TON has shown strong momentum, overbought conditions suggest waiting for a potential correction before entering.

- Monitor Market Indicators: Keep an eye on RSI, MFI, and Bollinger Bands to gauge market sentiment and potential trend changes.

In Conclusion: Riding the TON Wave Responsibly

Toncoin’s recent surge is undoubtedly exciting, showcasing the powerful influence of Telegram and Pavel Durov on the crypto market. However, the overbought indicators and rising volatility suggest that caution is warranted. While the long-term potential of TON remains to be seen, in the short term, we might witness a price correction as the market digests the recent gains. As always, in the world of crypto, informed decisions and risk management are paramount. Stay informed, trade wisely, and remember to do your own research before making any investment decisions.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.