- Toncoin has reached its highest level in almost a year.

- Price has increased to overbought levels, indicating that a reversal is imminent.

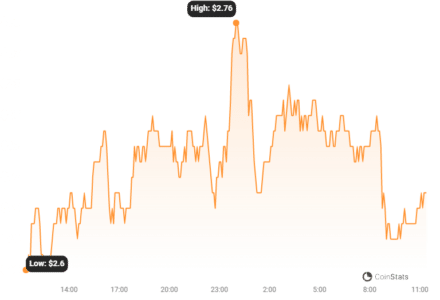

Toncoin [TON], the cryptocurrency associated with the popular messaging service Telegram, has risen to its highest value since February 2022, according to Coinstats data.

At press time, the altcoin was trading at $2.76, up nearly 50% in the previous month. While the it’s value has consistently increased over the last month, the most of the increases have occurred in the last two days.

The cause of this might be traced to Pavel Durov, the inventor of Telegram, who announced a giveaway of 10,000 premium memberships for his messaging app on November 7th.

Durov stated in his announcement that he obtained the premium accounts with TON tokens worth roughly $200,000.

As a result, TON’s price jumped by 8.4% during the intraday trading session on November 8th, temporarily overtaking leading meme coin Dogecoin [DOGE] in terms of market capitalization.

As expected, Durov’s statement increased demand for TON. According to Santiment data, the daily count of unique addresses involved in TON transactions has increased by 46% since November 6th.

Similarly, the number of new addresses created to trade TON everyday has climbed by more than 70% over the same time period.

This demonstrated that, in addition to increased demand for TON from existing addresses, there has been a bigger volume of fresh demand for the altcoin in recent days, resulting in the price surge.

Read Also: SUI Gains 12% While Chainlink and Polygon Keep Alt Rally Rolling

A TON-around Imminent?

A daily chart analysis of TON’s price movements revealed that heightened trading activity in the last two days drove the token’s main momentum indicators to overbought highs.

Its Relative Strength Index (RSI) and Money Flow Index (MFI) were 80.11 and 87.75, respectively, at the time of publication.

Overbought levels are often defined as an RSI reading above 70 and an MFI rating above 80. This suggests that the asset’s price has increased too quickly, and that a reverse or correction is imminent.

Following Durov’s announcement, the gap between the upper and lower bars of TON’s Bollinger bars indicator grew.

An increasing gap between the upper and lower bands usually indicates that price fluctuations are highly volatile. Traders frequently interpret this to suggest that the market is becoming more volatile. There is also the possibility of huge price swings.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.