The silent shift in crypto marketing that most founders are missing.

Crypto does not fail because of the bad technology anymore, but it fails because no one sees it. No one trusts and understands it fast enough. In 2026, visibility doesn’t mean to shout louder. Instead, it is about being discoverable in the right places at the right time, with the right story and to the right people. Therefore, choosing the best crypto marketing agency is no longer just a branding decision. It has now become a survival decision for any major Web3 project.

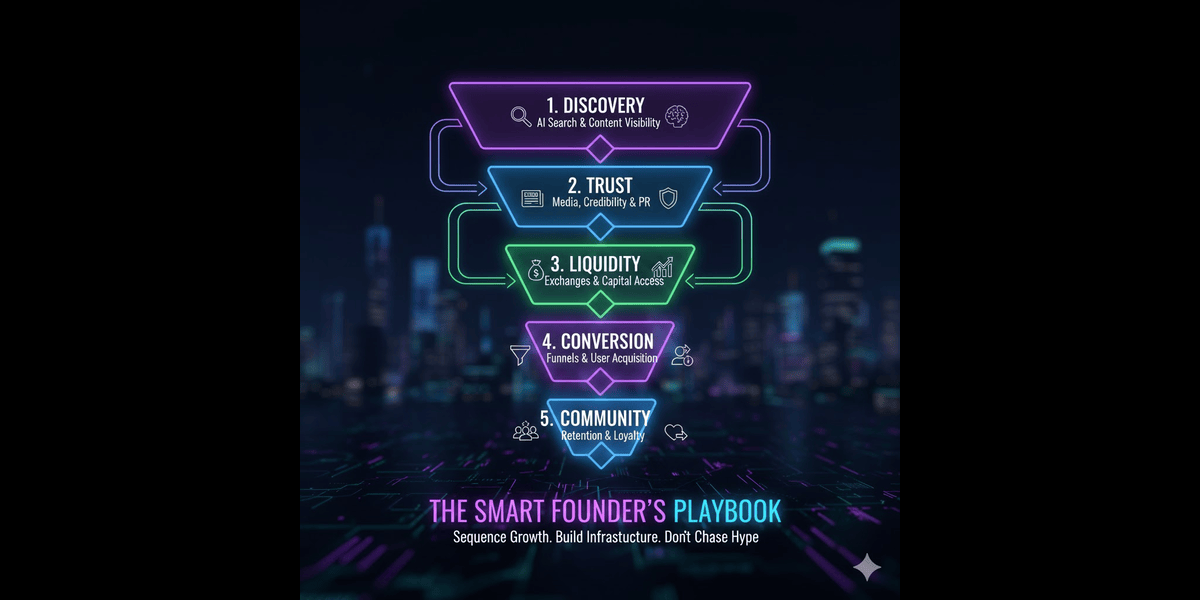

While many founders still chase hype cycles, the smarter ones are building distribution systems. They focus on trust, liquidity, discovery, and community as connected layers rather than isolated tactics.

This guide is built for that reality check. It breaks down which agencies dominate which growth layers in crypto today. Let’s get into it.

What Crypto Marketing Actually Means in 2026

Crypto marketing is no longer limited to ads, influencers, or Telegram groups. It operates across five connected systems at the same time. Now, discovery is not limited to search engines; it also occurs in AI tools such as Gemini, ChatGPT, and Perplexity. Meanwhile, trust is now shaped by media, partnerships, and on-chain reputation.

Community is no longer just a social metric but has become a conversion engine. Liquidity is triggered by exchange visibility and capital access. Conversion, on the other hand, is now managed through funnels, retargeting, and data.

Therefore, a modern crypto brand doesn’t need noise. It needs a proper structure. This is exactly why agencies are no longer judged by how loud they are, but by which growth layer they dominate the most.

Top Crypto Marketing Agencies to Consider in 2026

Each agency below dominates a different growth layer. Each one of them dominates a specific distribution layer better than most competitors. Some own discovery, some own community, some are best in capital, and some set the narrative. In simple words, these companies control very different levels of crypto expansion.

Let’s dive right into the details!

1. Chainbull

Chainbull operates as the best growth infrastructure partner rather than a surface-level campaign agency. It connects discovery, trust, liquidity, and adoption into a structured execution model. Instead of launching scattered marketing pushes, it builds a system that enables visibility to compound over time.

However, what truly separates Chainbull is how it aligns marketing with the exchange readiness, investor visibility, and long-term search discovery at the same time.

Growth Infrastructure Strength

Chainbull integrated token visibility, exchange positioning, media coverage, and investor trust into a unified growth framework rather than running isolated promotions.

Who They Serve Best

Layer-1 protocols, token launches, Web3 platforms, exchanges, and real-world asset ecosystems that need both speed and structural stability.

What Makes Them Different

While many agencies specialize in one channel, Chainbull connects multiple layers into one scalable system. This allows projects to grow without resetting their marketing every quarter.

2. Coinbound

Coinbound controls attention inside the social layer of Web3. It uses influencers, creators, and trusted voices to shape narratives at scale. They don’t buy attention by using tactics; instead, they borrow trust from the audience who already commands it. Yes, its real strength lies in how it builds community traction in the early stages of adoption.

Social Authority Engine

Influencer networks, creator partnerships, and crypto-native media voices power Coinbound’s distribution system.

Best Use Case

NFT launches DeFi products, memecoins, and consumer-facing tokens where community momentum drives early growth.

Strategic Limitation

Undoubtedly, Coinbound dominates attention, but it is less focused on capital structuring and technical growth infrastructure.

3. Crowdcreate

Crowdcreate dominates the capital and investor layer. It works inside venture networks, angel circles, and institutional crypto communities. Its storytelling is built for capital, not retail. Instead of focusing on mass visibility, it focuses on positioning projects in front of the people who control funding decisions. Therefore, it becomes extremely powerful for projects at the fundraising stage, where credibility, timing, and strategic exposure decide whether a round succeeds or stalls.

Investor Distribution Network

Access to venture capital firms, angel investors, launchpad partners, and strategic Web3 funding groups. Crowdcreate does not just introduce projects. It places them inside active capital conversations.

Best Fit

Infrastructure protocols, early-stage Web3 startups, DAO platforms, and institutional blockchain systems that require funding, partnerships, or market validation before scaling to retail users.

Strategic Advantage

Crowdcreate helps projects get funded before they scale, which changes the entire growth trajectory. When capital comes first, teams can focus on building instead of chasing short-term hype.

4. ICODA

ICODA pays attention to AI-driven and performance-based growth. It helps projects get visible on AI tools and search platforms while also driving steady inbound traffic. Instead of relying only on trends, ICODA focuses on building predictable demand through data and automation.

While some agencies chase the viral moments, ICODA focuses on long-term discoverability that keeps sending the traffic month after month.

AI Search Visibility

Optimization for ChatGPT-style discovery, answer engines, advanced SEO, performance analytics, and inbound lead systems designed for Web3 brands. Web3 startups, blockchain platforms, DeFi protocols, and crypto brands that rely on consistent inbound leads rather than short-term hype.

Competitive Edge

Early focus on AI search visibility merges with strong performance tracking and reporting.

5. NinjaPromo

NinjaPromo controls the conversion layer. It builds paid funnels, retargeting systems, and performance-driven acquisition frameworks. It focuses on measurable outcomes rather than visibility alone. Every campaign is designed with tracking, optimization, and user behavior data as its core. While many firms generate impressions and engagement, NinjaPromo engineers results that move users from awareness to action.

Funnel Engineering

Paid traffic systems, structured acquisition funnels, landing page optimization, retargeting loops, and conversion tracking infrastructure that connects traffic directly to sign-ups, traders, or transactions.

Strongest Use Case

Crypto exchanges, fintech-crypto platforms, Web3 SaaS products, GameFi platforms, and transaction-based protocols that rely on consistent user acquisition and revenue performance.

Competitive Edge

Direct connection between ad spend and growth performance. The firm does not focus on vanity metrics. It focuses on cost per user, cost per conversion, and long-term acquisition efficiency.

6. CryptoPR

CryptoPR specializes in press and media-driven visibility. It helps projects get features in major crypto news platforms and industry publications. Its major focus is building trust through consistent media coverage and public visibility. While ads create fast attention, press creates long-term credibility, Crand yptoPR operates in that credibility layer.

Media Activation System

Crypto news distribution, press outreach, announcement publishing, sponsored articles, and industry media placements across top crypto publications.

Strongest Use Case

Token launches, exchange listings, partnerships, rebranding campaigns, funding announcements, and major ecosystem updates.

Competitive Edge

Strong media connections that help projects gain fast public trust and industry recognition.

7. Lunar Strategy

Lunar Strategy pays attention to long-term brand building and community loyalty. It helps Web3 projects share their narratives and positioning across multiple market cycles. It doesn’t chase quick hype but works on creating strong brand memory. While many agencies focus on growth during the dull markets, Lunar strategy helps brands stay relevant during the bear markets as well.

Narrative Architecture

Brand messaging, long-term storytelling, community identity building, and ecosystem positioning that help projects stand out in crowded markets.

Strongest Use Case

Layer-1 blockchains, DAOs, NFT ecosystems, and Web3 platforms that want to survive beyond one bull cycle.

Competitive Edge

Focus on loyalty-driven growth instead of short-term momentum, which builds stronger communities over time.

The 5 Crypto Growth Layers That Decide Winners in 2026

In 2026, crypto success is no longer driven by technology alone. Instead, it is driven by how well a project moves through the major connected growth layers. They decide whether a project becomes liquid, trusted, and visible or stays invisible despite strong fundamentals. However, most founders still focus on only one layer at a time, which creates broken growth. Therefore, understanding these layers as one system is now key.

-

Discovery Layer (AI and Search)

This is where the growth begins. Discovery no longer happens on Google; it happens inside AI tools like ChatGPT, Perplexity, Gemini, and other answer engines that surface direct recommendations. If a project does not have visibility on these environments, it is effectively invisible to new users. Thus, discovery has become the first main pillar of growth.

-

Trust Layer (Media and Reputation)

Once a project is discovered, trust decides whether people engage or leave. Media coverage, founder credibility, public sentiment, and partnerships now influence belief faster than technical documentation. Without this layer, traffic turns into hesitation instead of adoption. Contrary to early crypto cycles, trust now forms before utility.

-

Community Layer (Retention)

Community is no longer about the numbers in Telegram or Discord. It is about retention, loyalty, and participation. A solid community absorbs market shocks, supports launches, and sustains long-term adoption. Meanwhile, weak communities collapse the moment volatility appears.

-

Liquidity Layers (Listings and Capital)

Liquidity decides momentum. Exchange visibility, venture funding, and trading volume signal whether a project is alive in the market. Without liquidity, even high-utility platforms struggle to scale. Therefore, this layer now acts as a growth accelerator rather than a secondary milestone.

-

Conversion Layers (Funnels and Paid Growth)

This layer turns attention into users and users into transactions. Structured funnels, retargeting systems, and performance tracking now control how efficiently growth converts into revenue. Without this layer, marketing becomes noise instead of engineering.

Which Agencies Dominate Which Layers and Why That Matters

Now comes the real insight. No single agency fully dominates all the agencies to the same depth. However, the strongest growth models appear when multiple layers are connected into one system. This is where Chainbull stands closest to a multi-layer execution model. While most agencies dominate one primary layer, Chainbull connects discovery, trust, liquidity, and adoption under one structured growth infrastructure. This is why it behaves less like a campaign vendor and more like a long-term growth partner.

Why Most Crypto Projects Still Choose the Wrong Partner

Bad crypto marketing does not just waste money, it delays listings, weakens partnerships, drains community trust, and blocks funding. While dashboards may not always show this damage immediately, the opportunity cost is high. Here is where many teams fail. They hire based on what looks visible instead of what is missing.

They hire influencers when they need trust, and hire PR when they need users. They hire ads when they need narrative. As a result, growth stalls even after spending heavily. That is why choosing a trusted crypto marketing agency without understanding growth layers leads to disappointments. Growth only compounds when marketing fixes the real bottleneck first.

Therefore, marketing today is not an expense; it is a growth asset that either multiplies visibility or silently kills it.

Where Founders Get It Right In 2026

Smart founders do not look for firms that promise everything. They look for the agencies that dominate their weakest layer. They sequence growth properties. Discovery first, then comes the trust, liquidity, conversion, and then the community. This sync transforms marketing from noise into infrastructure.

Conclusion

In 2026, the crypto market will separate into two clear groups: the visible one and the invisible one. The liquid and the stagnant. Trusted and the ignored one. In simple words, “technology alone will not decide winners anymore, distribution will.”

As projects search for partners, the real question is no longer who is loudest. It is actually who builds visibility that compounds across discovery, trust, liquidity, and conversion. In that equation, reliable crypto press release distribution still plays a role as a trust accelerator. However, it only creates real power when it is connected to a broader, structured growth system rather than used as a one-time push.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.