Traditional Banking Systems Consume Twice as Much Energy as Bitcoin, Reveals Galaxy Digital Research

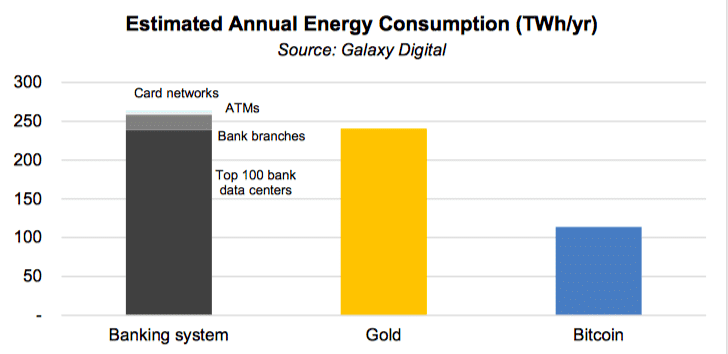

Concerns over Bitcoin’s energy consumption have been a persistent topic within the cryptocurrency community. However, recent research by Galaxy Digital, a prominent cryptocurrency investment firm led by billionaire Michael Novogratz, sheds new light on the broader financial industry’s energy usage. Contrary to popular belief, traditional banking systems consume approximately twice as much energy as the Bitcoin network, challenging the narrative that Bitcoin is disproportionately energy-intensive.

Comparative Energy Consumption: Banking vs. Bitcoin

According to Galaxy Digital’s latest report released on Friday, the annual energy usage of Bitcoin stands close to 114 TWh (terawatt-hours). In stark contrast, the yearly energy consumption of the traditional banking industry exceeds 260 TWh. This significant difference highlights that the global financial system, encompassing retail and commercial banking, utilizes more energy than the entire Bitcoin network.

Key Insights:

- Bitcoin Energy Usage: 114 TWh annually.

- Traditional Banking Energy Usage: Over 260 TWh annually.

Methodology and Transparency

Galaxy Digital has committed to transparency by providing open-source access to its methodology and calculations. This allows independent verification of their findings and fosters trust within the financial and cryptocurrency communities. The firm’s approach underscores the importance of comprehensive and comparative analysis when evaluating energy consumption across different sectors.

Tracking Energy Consumption: Bitcoin vs. Traditional Systems

While Bitcoin’s energy consumption can be easily tracked in real-time using tools like the Cambridge Bitcoin Electricity Consumption Index, assessing the energy usage of traditional financial systems presents a more complex challenge. Unlike Bitcoin, the banking industry does not directly report its electricity consumption. Additionally, traditional banking operations involve multiple layers of settlement and intermediaries, contributing to higher energy usage.

Challenges in Comparison:

- Transparency: Traditional banks do not publicly disclose their energy consumption.

- Complexity: Multiple settlement layers in banking increase overall energy usage.

- Final Settlement: Bitcoin offers a final settlement mechanism, reducing the need for ongoing transactions and thus energy consumption.

Market Context: Crypto Crash and Environmental Concerns

Galaxy Digital’s analysis arrives amid a significant crypto market crash, further intensifying debates about the environmental impact of cryptocurrencies. This downturn has prompted influential figures in the crypto space to reassess their stance on digital assets.

Elon Musk’s Reversal: Tesla Stops Accepting Bitcoin

Adding to the environmental discourse, Elon Musk, CEO of Tesla, recently announced that the company would no longer accept Bitcoin for car purchases. Musk cited environmental concerns as the primary reason for this decision, despite Tesla having previously purchased $1.5 billion worth of Bitcoin in March 2020.

Musk’s Statement:

“Though cryptocurrency is a good idea on many levels and promises a great future, this cannot come at a great cost to the environment.”

This move sparked widespread criticism within the crypto community, with many arguing that Musk’s companies should adopt more sustainable energy practices across all operations to avoid appearing hypocritical.

The Role of Renewable Energy in Bitcoin Mining

Despite the criticism, Galaxy Digital emphasizes that Bitcoin mining is increasingly powered by renewable energy sources. In their report, Michael Novogratz highlights that a substantial portion of Bitcoin’s energy consumption is derived from renewables, challenging the notion that Bitcoin is inherently environmentally unfriendly.

Renewable Energy Adoption:

- Percentage of Renewable Energy: Approximately 75% of Bitcoin mining operations utilize renewable energy.

- Incentives for Miners: Miners are motivated to adopt renewable energy to reduce operational costs and comply with environmental regulations.

Implications for the Future of Finance

Galaxy Digital’s findings suggest that when evaluating the environmental impact of financial systems, it is crucial to consider the entire landscape, including traditional banking’s substantial energy footprint. This comparative analysis urges policymakers and investors to adopt a more nuanced view of energy consumption across different financial sectors.

Future Considerations:

- Regulatory Policies: Policymakers should consider the energy usage of all financial systems, not just cryptocurrencies.

- Sustainable Practices: Both traditional banks and cryptocurrency networks should continue to prioritize renewable energy adoption.

- Technological Innovations: Advances in blockchain technology and energy-efficient mining practices can further reduce Bitcoin’s environmental impact.

Conclusion

The revelation that traditional banking systems consume twice as much energy as Bitcoin challenges prevailing narratives about the environmental sustainability of cryptocurrencies. Galaxy Digital’s transparent and comparative analysis underscores the importance of evaluating energy consumption across all financial sectors to make informed decisions about sustainable practices.

As the cryptocurrency market continues to evolve and integrate more renewable energy sources, the debate over Bitcoin’s environmental impact may shift. Meanwhile, traditional banks face the task of addressing their substantial energy usage, potentially leading to greater adoption of sustainable technologies within the financial industry.

For more insights into the latest developments in cryptocurrency and financial sustainability, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.