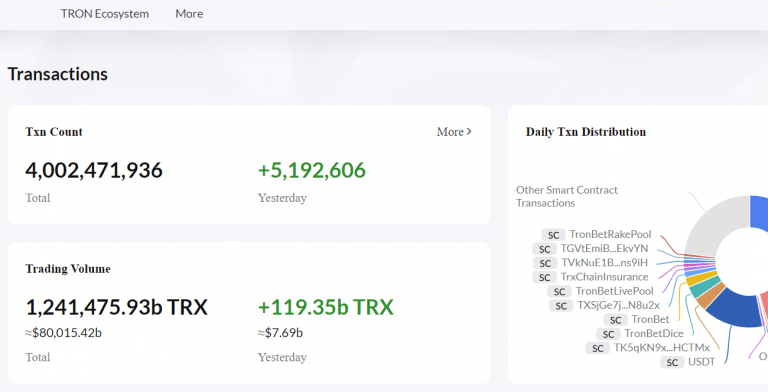

In the fast-paced world of cryptocurrency, milestones are constantly being achieved, but some resonate louder than others. Recently, the TRON network quietly celebrated a monumental achievement: the total transaction volume on its blockchain blasted past the $4 billion mark! Yes, you read that right – over $4 billion worth of transactions have been processed on the TRON network, according to data from Tronscan, the official blockchain explorer. This isn’t just a number; it’s a testament to TRON’s growing influence and adoption within the crypto ecosystem.

What’s fueling this impressive growth? Well, TRON has carved out a reputation for itself by offering something many crypto users crave: speed and affordability. In a landscape often dominated by concerns about high gas fees and slow transaction times, TRON emerged as a viable alternative, particularly when compared to networks like Ethereum [ETH]. This focus on user experience has been a key ingredient in TRON’s recipe for success.

TRON vs. The Giants: Standing Tall in the Smart Contract Arena

But TRON’s story isn’t just about transaction volume. It’s about establishing itself as a significant player in the competitive smart contract platform space. According to Messari, a leading crypto analytics platform, TRON has ascended to the sixth position among the most valuable smart contract platforms. Think about that for a moment – TRON is rubbing shoulders with some of the biggest names in crypto!

This ranking isn’t just based on hype; it’s backed by real market value. TRON’s market capitalization is reported to be around $6 billion, putting it in the same league as established cryptocurrencies like Poloniex, Cardano, and of course, Ethereum. This market confidence underscores the growing belief in TRON’s long-term potential and its ability to deliver value to its users.

Diving Deeper: TRON’s Total Value Locked (TVL) and DeFi Growth

For those deeply involved in the crypto world, especially in Decentralized Finance (DeFi), Total Value Locked (TVL) is a crucial metric. It essentially represents the total value of assets locked within a particular blockchain’s DeFi ecosystem. And guess what? TRON is making waves here too!

Data from DefiLlama reveals that TRON boasts a TVL exceeding $5.6 billion. That’s a substantial amount of capital entrusted to the TRON network for various DeFi activities like lending, borrowing, and staking. What’s even more encouraging is that this TVL isn’t stagnant; it’s growing! In the 24 hours prior to the data collection, TRON’s TVL saw an increase of 0.89%, indicating continued momentum and user confidence in its DeFi offerings.

The TVL Rollercoaster: From Lows to New Heights

The journey to a $5.6 billion TVL wasn’t a straight line. Like many projects in the crypto space, TRON experienced fluctuations. Back in June, the TVL dipped to around $3 billion. However, this dip proved to be temporary. The network demonstrated resilience, bouncing back and surging to over $5 billion and maintaining that level in recent months. This recovery highlights the underlying strength and the continued interest in the TRON ecosystem, even amidst market volatility.

[The original article mentions a picture showing the TVL trend here. If you have access to this image, you can include it here with the appropriate WordPress shortcode, similar to the image already included. If not, you can remove this sentence.]

Why is TRON Gaining Traction? Key Advantages

So, what’s the secret sauce behind TRON’s growing popularity? Let’s break down some of the key advantages that are attracting users and developers alike:

- Lower Transaction Fees: This is a major draw. Compared to networks like Ethereum, TRON offers significantly lower transaction fees, making it more accessible for everyday users and applications that involve frequent transactions. Imagine paying pennies instead of dollars for each transaction – that’s the TRON advantage.

- Faster Transaction Speeds: Nobody likes waiting for transactions to confirm. TRON boasts faster transaction speeds, ensuring a smoother and more efficient user experience. This speed is crucial for applications like gaming, decentralized exchanges, and payment processing.

- Scalability: The TRON network is designed to handle a large volume of transactions, making it scalable for future growth and adoption. This scalability is essential for supporting a growing ecosystem of applications and users.

- Developer-Friendly Environment: TRON provides a robust and developer-friendly platform for building decentralized applications (dApps). Its compatibility with Ethereum’s Virtual Machine (EVM) makes it easier for developers to migrate or build dApps on TRON.

- Focus on Decentralization: TRON emphasizes decentralization, aiming to create a more open and democratic internet. This aligns with the core principles of blockchain technology and appeals to users who value decentralization.

TRON’s TRX Token: The Engine of the Ecosystem

At the heart of the TRON network is its native cryptocurrency, TRX. TRX is more than just a token; it’s the fuel that powers the entire TRON ecosystem. Here’s how TRX plays a vital role:

- Transaction Fees: TRX is used to pay for transaction fees on the TRON network. This creates demand for TRX as network activity increases.

- Staking and Governance: TRX holders can stake their tokens to participate in network governance and earn rewards. This incentivizes long-term holding and network security.

- Access to dApps and Services: Many dApps and services within the TRON ecosystem utilize TRX for various functionalities, further driving demand.

- Value Transfer: TRX can be easily transferred and traded, serving as a medium of exchange within the crypto world.

Is TRX a Good Investment? Things to Consider

With TRON’s impressive growth and the increasing popularity of TRX, you might be wondering if it’s a good investment. Here are some factors to consider:

- Network Growth and Adoption: TRON’s continued growth in transaction volume, TVL, and dApp development are positive indicators. Monitor these metrics to gauge the network’s health and potential.

- Market Sentiment: Like all cryptocurrencies, TRX’s price is influenced by overall market sentiment and trends. Stay informed about the broader crypto market.

- Competition: The smart contract platform space is competitive. Keep an eye on how TRON fares against its rivals and its ability to innovate and adapt.

- Risk Tolerance: Investing in cryptocurrencies involves risks. Assess your risk tolerance and invest responsibly. Never invest more than you can afford to lose.

- Do Your Own Research (DYOR): Before making any investment decisions, conduct thorough research on TRON, TRX, and the broader crypto market. Understand the technology, the team, and the potential risks and rewards.

The Road Ahead for TRON

TRON’s journey is far from over. With its strong focus on speed, affordability, and scalability, the network is well-positioned to continue its growth trajectory. As the DeFi space evolves and the demand for efficient blockchain solutions increases, TRON is likely to play an increasingly important role. The $4 billion transaction milestone is not just a number; it’s a signpost pointing towards a future where TRON continues to innovate, expand its ecosystem, and solidify its place as a leading force in the crypto world.

In Conclusion: TRON – A Network to Watch

TRON’s recent achievements, particularly surpassing $4 billion in transaction volume and its strong TVL, are compelling evidence of its growing prominence in the cryptocurrency landscape. By prioritizing speed, low fees, and developer accessibility, TRON has attracted a significant user base and fostered a thriving ecosystem. Whether you are a crypto enthusiast, a DeFi user, or a developer looking for a robust platform, TRON deserves your attention. Keep an eye on TRON – its journey is just beginning, and the future looks bright for this dynamic blockchain network.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.