The crypto world is always buzzing with new developments, and lately, all eyes are on Tron’s algorithmic stablecoin, USDD. Yes, you heard that right – algorithmic stablecoin! In a market still reeling from the Terra (LUNA) and UST debacle, the emergence and surprising growth of USDD have sparked both curiosity and cautious optimism. Let’s dive into what’s making USDD tick and why it’s becoming a significant player in the DeFi space.

USDD: Rising from the Ashes of Algorithmic Stablecoins?

Remember the dramatic collapse of Terra’s UST? It sent shockwaves through the crypto industry, leaving many wary of algorithmic stablecoins. Yet, just as the dust began to settle, Tron introduced USDD in May 2022. Against the odds, USDD has not only survived but thrived, amassing a market capitalization exceeding $600 million in a relatively short time. This growth story is quite remarkable, especially when you consider the skepticism surrounding algorithmic stablecoins post-UST.

While it’s still a considerable distance from UST’s peak valuation, USDD’s steady climb is undeniable. According to CoinGecko data, its market cap is constantly expanding, demonstrating increasing user confidence and adoption. But what’s fueling this growth, and is it sustainable?

DeFi on Tron: A TVL Surge Driven by USDD?

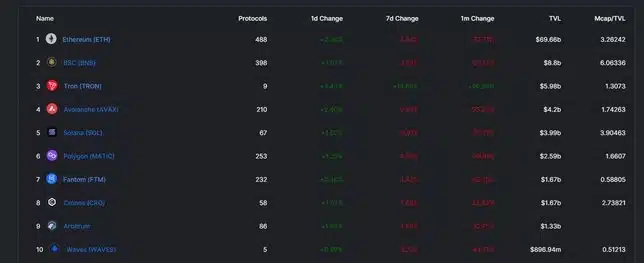

The impact of USDD’s rise isn’t limited to its own market cap. It’s acting as a catalyst for Tron’s entire Decentralized Finance (DeFi) ecosystem. The numbers speak for themselves: the Total Value Locked (TVL) in Tron-based DeFi protocols is rapidly approaching a whopping $6 billion! This surge in TVL signifies a significant influx of assets and activity within the Tron network, making it a vibrant hub for DeFi enthusiasts.

Tron: Climbing the DeFi Ladder

Looking at the bigger picture, Tron’s DeFi ecosystem, boosted by USDD, is now a force to be reckoned with. Take a look at the image above, sourced from DeFi Llama. It clearly illustrates Tron’s impressive ascent in the DeFi rankings. Tron has surpassed established blockchains like Avalanche, Solana, and Polygon in terms of TVL, securing its position as the third-largest chain in the DeFi space. Only Ethereum and BNB Chain currently boast higher TVLs. This is a testament to the growing strength and appeal of the Tron network.

But where is all this value concentrated within Tron’s DeFi landscape?

Spotlight on JustLend and Tron’s DeFi Protocols

Within Tron’s DeFi ecosystem, several protocols are contributing to its impressive TVL. However, one platform stands out: JustLend (JST). JustLend is the protocol with the lion’s share of the value locked within it. It’s a prominent lending and borrowing platform on Tron, playing a crucial role in the network’s DeFi activity. Interestingly, there are currently nine protocols on the Tron network that are significantly contributing to its overall TVL, indicating a diverse and growing DeFi landscape.

Here’s a quick breakdown of what makes Tron’s DeFi ecosystem attractive:

- Rising TVL: Approaching $6 billion, showcasing strong growth and user adoption.

- USDD Catalyst: The growth of USDD is a significant driver of DeFi activity on Tron.

- Top 3 Chain: Tron ranks third in TVL, surpassing major blockchains like Avalanche and Solana.

- Diverse Protocols: Nine protocols contribute significantly, indicating a healthy and varied DeFi ecosystem.

- JustLend Dominance: JustLend is the leading protocol in terms of TVL, highlighting its importance in Tron DeFi.

Is USDD Sustainable? The Algorithmic Stablecoin Question

The elephant in the room, of course, is the algorithmic nature of USDD. The collapse of UST serves as a stark reminder of the potential risks associated with this type of stablecoin. While USDD has shown resilience and growth so far, the long-term sustainability of algorithmic stablecoins remains a topic of debate and scrutiny. Factors like peg stability mechanisms, reserve management, and overall market conditions will play a crucial role in USDD’s future.

It’s important to remember that while USDD is gaining traction, the crypto market is inherently volatile. Users and investors should always conduct thorough research and understand the risks involved before engaging with any cryptocurrency or DeFi protocol, especially algorithmic stablecoins.

Looking Ahead: Tron, USDD, and the DeFi Future

Tron’s DeFi ecosystem is undeniably experiencing a period of significant growth, with USDD playing a pivotal role. Whether USDD can maintain its peg and continue to drive DeFi activity on Tron remains to be seen. However, its current trajectory is certainly noteworthy. For crypto enthusiasts and DeFi participants, keeping a close eye on Tron and USDD will be crucial in understanding the evolving landscape of decentralized finance and the role of algorithmic stablecoins within it.

Related Posts – The Indian Finance Minister hails blockchain technology

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.