Is your crypto portfolio feeling a little shaky today? You’re not alone. The stablecoin world, usually seen as a safe harbor in the volatile crypto sea, just experienced a tremor. TrueUSD (TUSD), a popular stablecoin pegged to the US dollar, briefly lost its footing, dipping to $0.985 on Tuesday morning in Asia. Let’s dive into what happened, why it happened, and what it means for you.

TUSD’s Slip: What Exactly Happened?

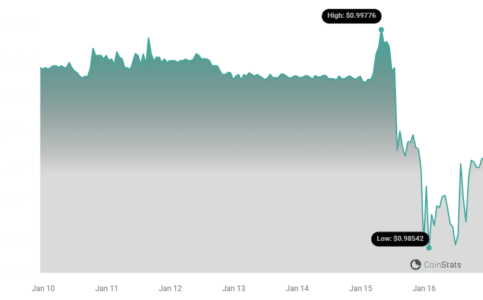

Imagine a stablecoin as a digital dollar, always supposed to be worth, well, a dollar. That’s the promise of stablecoins, and TrueUSD (TUSD) is no exception. However, on Tuesday morning, according to Coinstats data, TUSD wobbled. It depegged, meaning it traded below its intended $1 value, hitting a low of $0.9837 before settling around $0.985.

- TUSD stablecoin depegged to $0.985 on Tuesday morning Asia time.

- The depeg was observed during Asian trading hours.

- Selling pressure was particularly noticeable on the Binance exchange.

Here’s a snapshot of the price action:

Binance Sell-Off: Where Did the Pressure Come From?

Looking at Binance, one of the largest crypto exchanges globally, we can see significant TUSD trading activity. In the last 24 hours, the TUSD-USDT pair on Binance witnessed a hefty $435.4 million in TUSD sell volume. While buy orders were also substantial at around $369.3 million, the data points to a net outflow of roughly $66.1 million. This net selling pressure likely contributed to the depeg.

Why the Sell-Off? Unpacking the Potential Reasons

So, why the sudden urge to sell TUSD? Several factors might be at play, according to crypto experts:

- Poloniex Hacking Concerns: Nick Ruck, COO of ContentFi Labs, suggests that the recent hacking incident targeting Poloniex, an exchange with ties to TUSD, could be fueling uncertainty. Investors might be worried about the reserves backing TUSD, leading to a ‘panic selloff’.

- Binance Launchpool Shift: Justin d’Anethan from Keyrock points to Binance’s new Launchpool program featuring MANTA. This program incentivizes staking BNB or FDUSD. The catch? It might be at the expense of other stablecoins like TUSD, which were previously used for Launchpool staking. Investors might be switching from TUSD to FDUSD to participate in the MANTA Launchpool, triggering the TUSD selloff.

In simpler terms, it could be a combination of fear and opportunity driving the TUSD depeg. Concerns about security, coupled with a potentially more lucrative staking opportunity, might have created the perfect storm for a temporary dip.

See Also: Glassnode: Tether (USDT) Dominance Reaches 71% As Market Cap Surges To Record $95B

Expert Take: What They Are Saying

Let’s break down the expert opinions to understand the situation better:

“The massive selloff of TUSD reveals panic for its holders over the uncertainties of its reserves and instability related to Poloniex. After a recent hacking incident that targeted Poloniex, TUSD holders find themselves in an increasingly difficult situation to find stability with the USD-pegged stablecoin,” – Nick Ruck, chief operating officer of ContentFi Labs

Nick Ruck’s perspective: He emphasizes the ‘panic’ element. The Poloniex hack seems to have shaken confidence in TUSD’s stability and reserve security. This fear is driving holders to sell, leading to the depeg.

“It feels like such a little catalyst, but with the recent announcement of MANTA in Binance’s launchpool program and the need to stake BNB or FDUSD — at the expense of other stablecoins like TUSD that might have been used in the past for launchpool staking — it seems that a horde of investors are selling the latter for the former,” – Justin d’Anethan, head of APAC business development of crypto market maker Keyrock

Justin d’Anethan’s perspective: He highlights a more practical, market-driven reason. The Binance Launchpool for MANTA, requiring FDUSD or BNB staking, is pulling investors away from TUSD. It’s a strategic shift in assets for yield farming opportunities, rather than pure panic.

Should You Be Worried About TUSD?

A slight depeg like this isn’t necessarily a cause for immediate alarm, especially in the crypto world known for its volatility. Stablecoins, while designed to be stable, can experience minor fluctuations. However, it’s crucial to monitor the situation. Here’s what to consider:

- Temporary Blip or Trend? Keep an eye on TUSD’s peg in the coming days. If it quickly recovers and stabilizes back at $1, it might be a temporary market reaction. If the depeg persists or worsens, it could indicate deeper issues.

- Reserve Transparency: Stablecoins rely on reserves to maintain their peg. Increased scrutiny on TUSD’s reserve transparency might emerge. Look for updates from TrueUSD regarding their reserves and any reassurances they provide.

- Market Sentiment: This event serves as a reminder of the importance of market sentiment. Even stablecoins are not immune to fear, uncertainty, and doubt (FUD).

In Conclusion: Stablecoins and the Need for Vigilance

The TUSD depeg is a timely reminder that even stablecoins, designed for stability, are not without risk. While it might be a transient event driven by market dynamics and temporary concerns, it underscores the importance of due diligence and staying informed in the crypto space. Keep an eye on TUSD’s recovery, monitor market sentiment, and remember that in crypto, vigilance is key.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.