Trump’s Polymarket 61.3% Win Probability Likely Overstated

In a critical analysis of decentralized prediction markets, CryptoQuant CEO Ju Ki-young has expressed skepticism regarding Polymarket’s reported 61.3% probability of a Donald Trump victory in the upcoming U.S. presidential election. According to Ki-young, this figure may be overstated, highlighting the inherent limitations of prediction markets in accurately forecasting electoral outcomes.

Introduction to Polymarket’s Election Predictions

Overview of Polymarket

Polymarket is a decentralized prediction platform that allows users to bet on the outcomes of real-world events, including elections. Utilizing blockchain technology, Polymarket aggregates bets from participating users to generate probability metrics for various outcomes.

Polymarket’s Trump Win Probability

Polymarket recently reported a 61.3% probability of Donald Trump winning the presidential race. This figure has attracted significant attention, positioning Trump as the frontrunner in the eyes of the platform’s participants.

CryptoQuant CEO Ju Ki-young’s Critique

Overstated Probabilities

Ju Ki-young, CEO of CryptoQuant, has raised concerns that Polymarket’s 61.3% win probability for Trump may be overstated. He emphasizes that elections are ultimately decided by votes, not the size or volume of bets placed on prediction platforms.

Alternative Probability Metrics

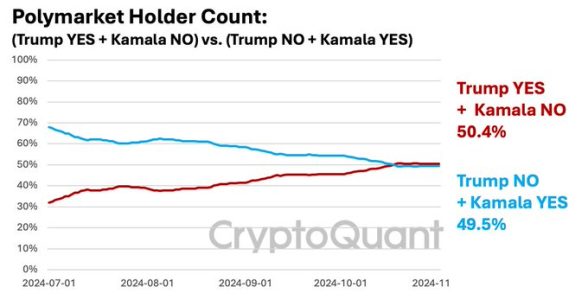

Based on participating addresses on Polymarket, Ki-young provides alternative probability estimates:

- Trump YES: 57.4%

- Trump NO: 50.4%

These figures suggest a closer race than Polymarket’s initial projection indicates.

Detailed Outcome Probabilities

Ki-young further breaks down the probabilities for specific electoral scenarios:

- Trump YES + Kamala Harris NO: 50.4%

- Trump NO + Kamala Harris YES: 49.5%

This near-even split underscores the uncertainty surrounding the election outcome.

Discrepancies Between Prediction Markets and Actual Elections

Understanding Prediction Markets

Prediction markets like Polymarket aggregate user bets to forecast event outcomes. However, they are influenced by factors such as:

- User Sentiment: Dominance of certain user groups with specific biases.

- Liquidity: Availability of funds to support bets, which can skew probabilities.

- Manipulation Risks: Potential for coordinated betting to influence outcomes.

Limitations Highlighted by Ki-young

Ki-young points out that prediction markets may not fully account for:

- Voter Turnout: Actual voting behavior can differ significantly from betting patterns.

- Swing States: Electoral outcomes often hinge on a few key states, which may not be adequately represented in prediction market data.

- External Factors: Campaign developments, debates, and unforeseen events can dramatically alter voter preferences.

Implications for the U.S. Presidential Election

Close Race Indicated by Alternative Metrics

The alternative probabilities provided by Ki-young suggest that the race between Trump and Vice President Kamala Harris is more competitive than initially portrayed by Polymarket. This could indicate a potentially close election, where small shifts in voter sentiment could determine the outcome.

Investor and Voter Behavior

The uncertainty reflected in these probabilities has implications for:

- Investors: May influence strategic decisions in financial markets based on perceived election outcomes.

- Voters: Reflects the need for voters to stay informed and engaged, as prediction markets may not provide a complete picture of electoral dynamics.

Expert Opinions

Dr. Emily Carter, Political Analyst

“Prediction markets offer valuable insights into public sentiment, but they are not infallible predictors of electoral outcomes. Factors such as voter mobilization and last-minute campaign strategies play a crucial role in determining the final result.”

Mark Thompson, Financial Strategist

“While decentralized platforms like Polymarket provide interesting data points, investors should exercise caution and consider multiple sources of information before making decisions based solely on prediction market probabilities.”

Sarah Lee, Cryptocurrency Researcher

“The critique by Ju Ki-young highlights the importance of understanding the underlying mechanics of prediction markets. Users should be aware of the limitations and potential biases inherent in these platforms when interpreting their predictions.”

Future Outlook

Enhancing Prediction Market Accuracy

To improve the reliability of prediction markets, several measures can be considered:

- Increased Transparency: Providing more detailed data on user demographics and betting patterns.

- Enhanced Security: Implementing safeguards to prevent manipulation and ensure fair participation.

- Integration with Traditional Data Sources: Combining prediction market data with polls and other traditional forecasting methods for a more comprehensive view.

Continued Role of Blockchain in Prediction Markets

Blockchain technology offers unique advantages for prediction markets, such as transparency and decentralization. As the technology evolves, it could enhance the accuracy and trustworthiness of platforms like Polymarket, provided that they address current limitations.

Voter Engagement and Information Dissemination

As the election approaches, it is crucial for voters to rely on a diverse array of information sources. Engaging with traditional polling, candidate platforms, and independent analyses can provide a more balanced perspective compared to prediction market data alone.

Conclusion

CryptoQuant CEO Ju Ki-young’s assessment that Polymarket’s 61.3% probability of Donald Trump’s election victory may be overstated serves as a critical reminder of the limitations inherent in prediction markets. While these platforms offer intriguing insights into public sentiment, they should be interpreted with caution and supplemented with broader analyses to gauge the true dynamics of electoral races.

As the U.S. presidential election draws near, the convergence of traditional polling, blockchain-based prediction markets, and real-time voter behavior will continue to shape the narrative. Investors, voters, and analysts alike must navigate these complex data sources to form informed opinions and make strategic decisions.

To stay updated on the latest developments in cryptocurrency prediction markets and their impact on political outcomes, explore our article on latest news, where we cover significant events and their influence on the digital asset ecosystem.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.