In Conclusion:

TRON (TRX) is currently presenting an interesting case study in the crypto market. Its recent price action suggests a degree of resilience and bullishness that’s somewhat contrarian to the prevailing market fear and Bitcoin’s struggles. While technical indicators and price charts offer valuable insights, remember that the cryptocurrency market is inherently volatile and unpredictable. Always conduct thorough research and consider your risk tolerance before making any investment decisions. Keep an eye on TRX as it attempts to retest the $0.09 level – it could be a key point for determining its next move. Will TRX continue to defy market fear, or will broader market pressures eventually catch up? Only time will tell, but for now, TRX is definitely a cryptocurrency to watch.

Related Posts – AMC Theatres Explores Accepting Dogecoin, CEO Sees Awing DOGE Poll Results

Key Takeaways for TRX Investors:

- TRX Showing Bullish Divergence: While the overall crypto market is experiencing fear and Bitcoin is struggling, TRX has demonstrated notable bullish momentum. This divergence could indicate underlying strength and investor confidence in TRX.

- Fibonacci Retracement Hold: TRX’s ability to hold the 61.8% Fibonacci retracement level during a Bitcoin pullback is a positive sign. It suggests strong support and a potential continuation of the upward trend.

- Reclaiming Demand Zone: TRX moving back above the $0.082 demand zone and turning it into support further strengthens the bullish outlook in the short term.

- Watch Bitcoin and Market Sentiment: Despite TRX’s positive indicators, always monitor Bitcoin’s price movements and the overall Crypto Fear and Greed Index. Major market shifts can influence even the strongest altcoins.

In Conclusion:

TRON (TRX) is currently presenting an interesting case study in the crypto market. Its recent price action suggests a degree of resilience and bullishness that’s somewhat contrarian to the prevailing market fear and Bitcoin’s struggles. While technical indicators and price charts offer valuable insights, remember that the cryptocurrency market is inherently volatile and unpredictable. Always conduct thorough research and consider your risk tolerance before making any investment decisions. Keep an eye on TRX as it attempts to retest the $0.09 level – it could be a key point for determining its next move. Will TRX continue to defy market fear, or will broader market pressures eventually catch up? Only time will tell, but for now, TRX is definitely a cryptocurrency to watch.

Related Posts – AMC Theatres Explores Accepting Dogecoin, CEO Sees Awing DOGE Poll Results

Key Takeaways for TRX Investors:

- TRX Showing Bullish Divergence: While the overall crypto market is experiencing fear and Bitcoin is struggling, TRX has demonstrated notable bullish momentum. This divergence could indicate underlying strength and investor confidence in TRX.

- Fibonacci Retracement Hold: TRX’s ability to hold the 61.8% Fibonacci retracement level during a Bitcoin pullback is a positive sign. It suggests strong support and a potential continuation of the upward trend.

- Reclaiming Demand Zone: TRX moving back above the $0.082 demand zone and turning it into support further strengthens the bullish outlook in the short term.

- Watch Bitcoin and Market Sentiment: Despite TRX’s positive indicators, always monitor Bitcoin’s price movements and the overall Crypto Fear and Greed Index. Major market shifts can influence even the strongest altcoins.

In Conclusion:

TRON (TRX) is currently presenting an interesting case study in the crypto market. Its recent price action suggests a degree of resilience and bullishness that’s somewhat contrarian to the prevailing market fear and Bitcoin’s struggles. While technical indicators and price charts offer valuable insights, remember that the cryptocurrency market is inherently volatile and unpredictable. Always conduct thorough research and consider your risk tolerance before making any investment decisions. Keep an eye on TRX as it attempts to retest the $0.09 level – it could be a key point for determining its next move. Will TRX continue to defy market fear, or will broader market pressures eventually catch up? Only time will tell, but for now, TRX is definitely a cryptocurrency to watch.

Related Posts – AMC Theatres Explores Accepting Dogecoin, CEO Sees Awing DOGE Poll Results

Feeling the crypto market jitters? You’re not alone. The Crypto Fear and Greed Index is currently flashing a stark ’23’ – that’s deep into ‘Extreme Fear’ territory. Think of this index as a market mood ring, gauging investor sentiment based on factors like trading volume, social media buzz, and market polls. While it’s not a crystal ball for trades, it definitely paints a picture of the prevailing market atmosphere. And right now, it’s painting a picture of apprehension.

Adding to the anxiety, Bitcoin, the crypto king, has been wrestling with the $40,000 ceiling, failing to decisively break through. Even the $38,000 support level looked shaky recently. But amidst this widespread market unease, an interesting narrative is unfolding in the altcoin space. Enter TRON (TRX). While Bitcoin was battling headwinds, TRX was quietly charting a bullish course. Let’s dive into what’s been happening with TRX and see if it’s truly bucking the market trend.

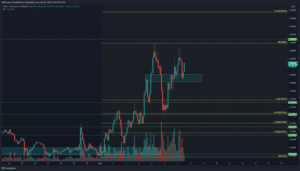

Looking at the TRX price chart, we can see a dip down to around $0.064 in late April (highlighted in the cyan box on the chart). For a while there, TRX seemed to be drifting without a clear direction on the lower timeframes. Bulls even attempted a quick rally towards $0.07, but bears stepped in to push back. It was a period of uncertainty, mirroring the broader market sentiment.

However, as we moved into May, things started to shift. Bitcoin initiated a recovery, climbing from around $37,600 towards the $40,000 mark. And TRX? It followed suit, staging an impressive climb from approximately $0.0616 all the way up to $0.09. To understand the significance of this move, let’s bring in some technical analysis tools. We’ve plotted Fibonacci retracement levels using these recent swing lows and highs (marked in yellow on the chart). Fibonacci retracement is a popular tool that helps identify potential support and resistance levels based on key ratios.

Here’s where it gets interesting. Bitcoin faced a strong rejection at $40,000, indicating significant selling pressure. Typically, when Bitcoin stumbles, altcoins tend to follow. But TRX showed remarkable resilience. Instead of a sharp drop, TRX only retraced to the 61.8% Fibonacci retracement level. This level is often considered a key area of support in an uptrend. The fact that TRX bounced back from this level suggests underlying strength and buyer interest.

As of writing, TRX has not only bounced, but it’s also climbed back above the $0.082 demand zone (the upper cyan box on the chart). This zone previously acted as a resistance, and flipping it back into support is a bullish signal. So, what’s next for TRX? The immediate target appears to be a retest of the $0.09 level. If TRX can successfully break and hold above $0.09, it could pave the way for further gains. However, it’s crucial to keep an eye on Bitcoin’s price action and overall market sentiment. While TRX is showing strength, broader market downturns can still impact its trajectory.

Key Takeaways for TRX Investors:

- TRX Showing Bullish Divergence: While the overall crypto market is experiencing fear and Bitcoin is struggling, TRX has demonstrated notable bullish momentum. This divergence could indicate underlying strength and investor confidence in TRX.

- Fibonacci Retracement Hold: TRX’s ability to hold the 61.8% Fibonacci retracement level during a Bitcoin pullback is a positive sign. It suggests strong support and a potential continuation of the upward trend.

- Reclaiming Demand Zone: TRX moving back above the $0.082 demand zone and turning it into support further strengthens the bullish outlook in the short term.

- Watch Bitcoin and Market Sentiment: Despite TRX’s positive indicators, always monitor Bitcoin’s price movements and the overall Crypto Fear and Greed Index. Major market shifts can influence even the strongest altcoins.

In Conclusion:

TRON (TRX) is currently presenting an interesting case study in the crypto market. Its recent price action suggests a degree of resilience and bullishness that’s somewhat contrarian to the prevailing market fear and Bitcoin’s struggles. While technical indicators and price charts offer valuable insights, remember that the cryptocurrency market is inherently volatile and unpredictable. Always conduct thorough research and consider your risk tolerance before making any investment decisions. Keep an eye on TRX as it attempts to retest the $0.09 level – it could be a key point for determining its next move. Will TRX continue to defy market fear, or will broader market pressures eventually catch up? Only time will tell, but for now, TRX is definitely a cryptocurrency to watch.

Related Posts – AMC Theatres Explores Accepting Dogecoin, CEO Sees Awing DOGE Poll Results

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.