Exciting news from Türkiye! The Central Bank of the Republic of Türkiye (CBRT) has officially announced the completion of the first phase of its ambitious digital Turkish lira project. For those keeping a close eye on the evolving world of digital currencies, this is a significant step forward for Türkiye in the CBDC (Central Bank Digital Currency) space.

What Happened in Phase 1?

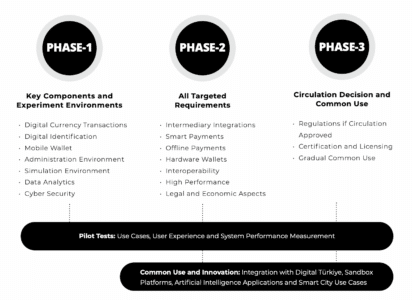

Think of Phase 1 as the foundational stage. The CBRT wasn’t just dipping its toes in the water; they were rigorously testing the underlying technologies that will power the digital Turkish lira. According to their official evaluation report, the focus was on:

- Strategic Technology Testing: The CBRT put key technologies through their paces to ensure they are robust and reliable for a national digital currency.

- User Experience and System Performance: Pilot tests were conducted in specific locations to gauge how users interact with the digital lira and to assess the system’s overall efficiency.

- Exploring Core Functionalities: This phase involved in-depth analysis of digital currency transactions, digital wallet applications, and digital identification systems – the essential building blocks of any CBDC.

Essentially, Phase 1 was about building a solid groundwork and learning crucial lessons before wider implementation.

Key Takeaway: It’s About Principles, Not Just Tech

The CBRT’s evaluation report emphasized a critical point: “What is important for the digital Turkish lira is to prepare a system that fully meets the requirements and principles of digital currency rather than the technology itself.”

This highlights a thoughtful approach. It’s not just about adopting cutting-edge tech for the sake of it. Türkiye wants to ensure its digital lira aligns with the fundamental principles of a sound and effective digital currency system. This includes things like security, accessibility, and regulatory compliance.

A Timeline of Türkiye’s Digital Lira Journey

Let’s take a quick look at the key milestones in Türkiye’s CBDC journey:

- 2021: CBRT officially kicks off the digital lira project, focusing on feasibility studies and implementation strategies.

- December 2022: A landmark moment! The first successful payment transaction using the digital Turkish lira network is executed.

- September 2023: Chainalysis research reveals a significant surge in crypto adoption in Türkiye, jumping from 16% to 40%. This underlines the growing public interest in digital assets within the country.

- Present: Completion of Phase 1 and announcement of Phase 2, signaling continued momentum in the project.

What’s Next? Digital Turkish Lira Enters Phase 2!

Phase 1 is done, but the journey is far from over. The CBRT has already set its sights on Phase 2, which promises to be even more expansive and exploratory.

Here’s a sneak peek into what Phase 2 will entail:

- Expanded Collaboration: The “Digital Turkish Lira Collaboration Platform” will welcome new participants, broadening the expertise and input into the project.

- Diverse Pilot Scenarios: Get ready for more varied and complex pilot tests! Phase 2 will explore:

- CBDC Form Conversions: Testing how different forms of the digital lira can be exchanged.

- Smart Payments: Investigating the potential of programmable and automated payments.

- Offline Payments: Exploring the feasibility of digital lira transactions without internet connectivity.

- Legal and Economic Dimensions: Delving deeper into the regulatory and economic implications of a digital lira.

Still in the Design Phase

It’s important to remember that the CBRT is still in the process of finalizing the architecture and design of the digital lira. They are carefully evaluating various design options to ensure the CBDC aligns with Türkiye’s unique economic, legal, and fiscal landscape.

“Following the assessments, a decision will be made on its circulation,” the CBRT stated, emphasizing a cautious and data-driven approach.

The Road Ahead for Digital Turkish Lira

Türkiye’s progress with the digital Turkish lira is noteworthy. By completing Phase 1 and moving decisively into Phase 2, the CBRT is demonstrating a serious commitment to exploring the potential of CBDCs. While the final design and rollout are still to be determined, these steps signal a significant development in Türkiye’s financial ecosystem and its engagement with the future of digital currency.

Stay tuned for more updates as Phase 2 unfolds and Türkiye continues to shape its digital financial future!

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.