Buckle up, crypto enthusiasts! Bitcoin (BTC), the king of cryptocurrencies, has taken a bit of a tumble, sliding towards the $40,000 mark. If you’ve been watching the charts, you’ve probably seen the recent attempts at recovery, but let’s be honest, the bears seem to be calling the shots right now.

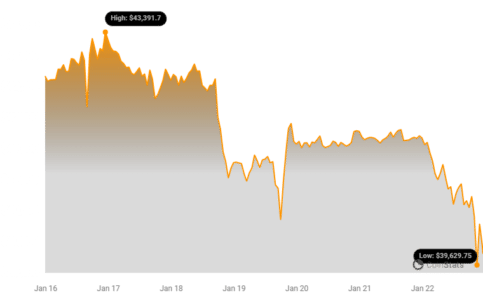

Over the past week, Bitcoin’s price has decreased by 4.4%, and if we zoom out a bit, it’s down roughly 16% from its January 11th peak of $48,500. That’s a significant move! Now, as BTC hovers around this critical $40K level, everyone’s asking the same question: Is this just a temporary dip, or are we in for a deeper correction?

Let’s dive into the potential reasons behind this recent price pullback. We’ll also explore some factors that could potentially spark a positive turnaround in the near future. Ready to decode the Bitcoin dip?

Why Did Bitcoin’s Price Crash? Possible Reasons

Several factors could be contributing to the current Bitcoin price correction. Let’s break down some of the most prominent ones:

Underwhelming Bitcoin ETF Launch: Hype vs. Reality?

After years of anticipation and regulatory hurdles, the spot Bitcoin Exchange Traded Fund (ETF) finally became a reality in the US, approved by the Securities and Exchange Commission (SEC) earlier this month. This was a monumental event many in the crypto space had been waiting for.

Want a quick recap of the long road to ETF approval? We’ve got you covered:

[See Also: Previous article link about Bitcoin ETF timeline]

However, the launch itself was… well, let’s just say it didn’t quite live up to the hype. There were some serious bumps in the road, starting with the SEC’s own X account getting hacked just days before the expected approval. A false tweet announcing approval sent the price on a wild ride, triggering massive liquidations of leveraged positions. Talk about a rollercoaster!

Even on the official launch day, there was a hiccup – the SEC briefly took down the official order because it was initially published during trading hours, which wasn’t the standard procedure. Despite all this drama, Bitcoin’s price did surge the day after the official announcement, hitting that January peak of around $48,500.

But here’s the twist: it seems the ETF launch turned out to be a classic “sell-the-news” event. The inflows into these new ETFs haven’t been strong enough to offset the existing selling pressure. This suggests that many investors may have bought the rumor and sold the news, contributing to the current downward trend as Bitcoin tests the $40K support.

See Also: LUNC Price Drops As Crypto.com Announced Plan To Delist LUNC

Crypto Market Overheating: Time for a Cooldown?

Looking at the bigger picture, the entire cryptocurrency market had been on a pretty significant upward trajectory for quite some time leading up to this correction. We saw sustained gains without any major pullbacks. What fueled this rally?

The primary driver was undoubtedly the anticipation surrounding the spot Bitcoin ETF approval. Take a look at the price chart again:

[Insert Chart Image Again if possible, or refer back to the first image]

As you can see, Bitcoin’s price jumped from around $26,000 in mid-October to that $48,500 high in January, with barely any significant corrections along the way. That’s an impressive climb of roughly 86% in just a few months! Such rapid growth can often lead to overheated market conditions.

And speaking of overheated, the Crypto Fear & Greed Index, a popular gauge of market sentiment, had been flashing warning signs for a while. For an extended period, the index was consistently showing high levels of greed or even extreme greed, indicating that market participants were perhaps a little too enthusiastic.

Interestingly, on January 15th, the index finally dipped into “Neutral” territory for the first time in three months, as BitcoinWorld reported. This shift suggests a cooling off of market sentiment and potentially signals a healthy correction after a period of exuberance.

Will the Bitcoin Bulls Return? Potential Catalysts for Recovery

Right now, it’s clear that sellers have been in control for the past couple of weeks. Many investors are wondering when, or if, the bulls will regain momentum. Predicting Bitcoin’s price with certainty is impossible, but there are some potentially positive developments on the horizon that could act as catalysts for a recovery.

The Bitcoin Halving: A Historically Bullish Event

One of the most significant events on the Bitcoin calendar is the halving, and it’s fast approaching! Scheduled for April this year, the halving is a pre-programmed event that reduces the block reward for miners by 50%. This means that the amount of new Bitcoin entering circulation will be cut in half, effectively reducing the supply of newly minted BTC while also halving its built-in inflation rate.

Historically, Bitcoin halvings have been followed by major bull markets. Why? Because reduced supply, coupled with consistent or increasing demand, tends to drive prices up. Many analysts believe that this halving cycle will follow a similar pattern. While past performance is never a guarantee of future results, the halving is definitely a factor to watch closely.

ETF Inflows: Still Early Days?

While the initial ETF launch might have been underwhelming in terms of immediate price impact, it’s crucial to remember that these ETFs are still very new. It often takes time for new investment products to gain traction and for significant capital to flow in. As investors become more familiar with these ETFs and potentially see Bitcoin’s long-term potential, we could see increased inflows in the coming months. Sustained and growing ETF inflows could provide significant buying pressure and help push Bitcoin’s price back up.

Institutional Adoption: The Long Game

Beyond ETFs, the broader trend of institutional adoption of Bitcoin and cryptocurrencies is still very much in play. Major institutions are increasingly exploring and investing in digital assets. This long-term trend suggests growing mainstream acceptance and could provide a solid foundation for future price appreciation. Institutional interest often translates to larger, more stable investments compared to retail speculation, which can contribute to a more mature and less volatile market over time.

Bitcoin Price Crash: Key Takeaways and What to Watch For

To summarize, the recent Bitcoin price correction appears to be a combination of factors:

- “Sell-the-News” ETF Launch: Initial hype didn’t translate into immediate sustained buying pressure.

- Overheated Market: A significant price run-up leading to overextended market sentiment and a need for correction.

- Profit-Taking: Some investors likely took profits after the ETF launch and the preceding rally.

However, it’s not all doom and gloom. Potential positive catalysts include:

- The Upcoming Bitcoin Halving: Historically a bullish event due to reduced supply.

- Growing ETF Inflows (Potentially): New ETFs need time to mature and attract larger investments.

- Continued Institutional Adoption: Long-term trend suggesting growing mainstream acceptance of Bitcoin.

What should you do now? It’s crucial to stay informed and do your own research. Keep an eye on:

- Bitcoin ETF Inflow Data: Are inflows picking up?

- Market Sentiment: Is the Fear & Greed Index shifting back towards greed?

- Halving Countdown: As we get closer to April, expect increased discussion and anticipation.

- Broader Market Conditions: Keep an eye on traditional financial markets as well, as they can sometimes influence crypto.

Bitcoin, like all cryptocurrencies, is known for its volatility. Corrections are a normal part of the market cycle. While no one can predict the future with certainty, understanding the potential reasons behind the current dip and the factors that could drive a recovery can help you navigate the crypto landscape with more confidence. Stay tuned, stay informed, and happy trading!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.