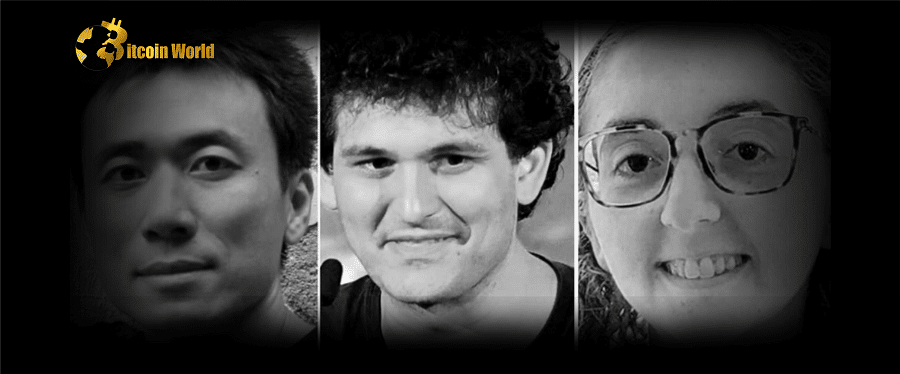

In the ongoing FTX case, two of Sam Bankman-top Fried’s executives have pleaded guilty to federal fraud charges. Meanwhile, the man could appear in front of a US judge as early as today.

Caroline Ellison and Gary Wang pleaded guilty late Wednesday, December 21, according to the United States Attorney’s Office for the Southern District of New York. Ellison was the former CEO of Alameda Research, and Wang was a founding member of the FTX exchange.

According to the New York Times, the pair has also agreed to cooperate in the case against crypto’s public enemy number one, Sam Bankman-Fried.

Sam Bankman-Fried is now in the custody of the FBI after agreeing to be extradited from the Bahamas earlier this month. Attorneys said he would be brought before a judge as soon as possible, possibly on December 22.

He must be brought before a court in Manhattan within two days of his arrival, according to US law.

“Gary has accepted responsibility for his actions and takes seriously his obligations as a cooperating witness,” Gary Wang’s lawyer said. According to the report, Ellison’s lawyer made no comment.

Sam Bankman-Fried is accused of defrauding customers, investors, and lenders, according to prosecutors. Furthermore, liquidators are sifting through the FTX wreckage in search of up to $8 billion in missing funds.

Fraud and diverting customer funds to buy real estate, lend out, make dubious investments through Alameda, and make political donations are among the charges levelled against him.

“I do wish to waive my rights to formal extradition proceedings,” Sam Bankman-Fried told judge Shaka Serville during a hearing on December 21.

As BeInCrypto reported on December 21, distressed investors have begun inquiring about the claims of customers with assets stuck on FTX.

Ellison and Wang, according to SEC Chair Gary Gensler, “played an active role in a scheme to misuse FTX customer assets to prop up Alameda and to post collateral for margin trading.”

According to Mary Cilia, FTX’s new chief financial officer, the company has over $1 billion in assets. It has discovered approximately $720 million in cash assets in US financial institutions. The Department of Justice has authorised these to hold funds.

She also stated that approximately $130 million was held in Japan, with $6 million set aside for operational expenses such as payroll. She confirmed that the remaining $423 million in unauthorised U.S. institutions is primarily with a single broker.

Blockchain.com CEO Peter Smith has been thinking about using on-chain analysis to track down the FTX funds.

Smith told Fox Business on December 20 that the banking system is the most difficult barrier to tracking money.

“The most difficult thing for firms working on this today is when money moves off chain and into the banking system, because they can’t track it anymore.”