Have you noticed a shift in the crypto landscape lately? It seems like more and more people are turning towards decentralized exchanges (DEXs) like Uniswap. What’s driving this change? Well, recent events have certainly played a role, and the numbers don’t lie. Uniswap’s own data reveals a significant surge in web app users, reaching a new high for 2022. This isn’t just a random blip; it signals a potentially significant shift in how crypto users are managing their assets.

The Trust Factor: Why the Move to Decentralized Exchanges?

Let’s face it, the crypto world has seen its fair share of drama. Recent events have cast a shadow of doubt over the security and transparency of some centralized exchanges. The possibility of insufficient reserves at these platforms has understandably made users nervous. The result? A noticeable trend of users withdrawing their funds and seeking safer harbors. This is where DEXs like Uniswap step into the spotlight.

Uniswap, being a decentralized platform, offers something that centralized exchanges often don’t: self-custody. This means you, and only you, control your private keys and, therefore, your assets. This fundamental difference is a major draw for users prioritizing security and control.

The FTX Effect: A Catalyst for Decentralization?

The collapse of FTX has undoubtedly been a pivotal moment. It served as a stark reminder of the risks associated with holding crypto on centralized platforms. The trust that many users placed in these exchanges has been shaken, leading to a realization: perhaps keeping your bitcoins on an exchange isn’t the safest bet after all. This newfound awareness is a significant driver behind the migration to DeFi and platforms like Uniswap.

Think about it: if more traders embrace DEXs, what could that mean for the future? During the next bull run, the utility and importance of decentralized exchanges could skyrocket. This shift towards self-custody empowers individuals and aligns with the core principles of blockchain technology.

Uniswap’s Numbers Speak Volumes: What Do the Trends Show?

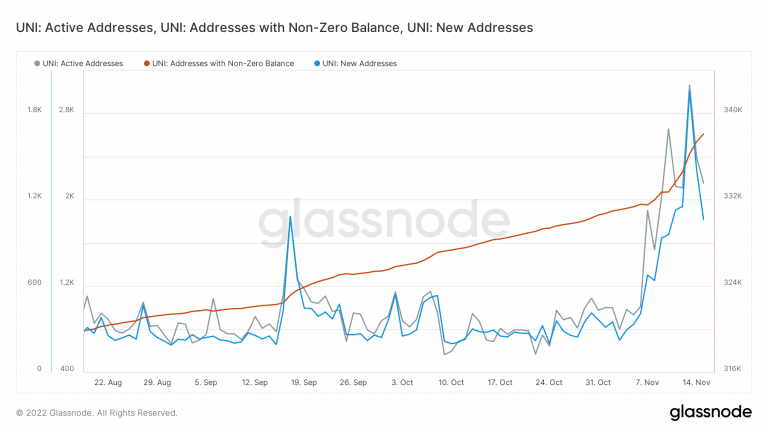

The impact of this shift is already evident in Uniswap’s metrics. We’re seeing a clear increase in the number of unique addresses interacting with the DEX. Specifically, the number of addresses holding a non-zero balance of UNI, Uniswap’s native token, has reached a three-month high. This indicates not just new users joining but also existing users actively engaging with the platform.

Looking closer at the data, both new addresses and active addresses on Uniswap have been on a generally upward trend since mid-October, peaking in mid-November. While there was a slight dip after that peak, this can be attributed to a natural cooling off after a period of high demand. The overall trend points towards sustained interest in the platform.

Short-Term Spikes or a Long-Term Trend? Examining Uniswap’s Transaction Data

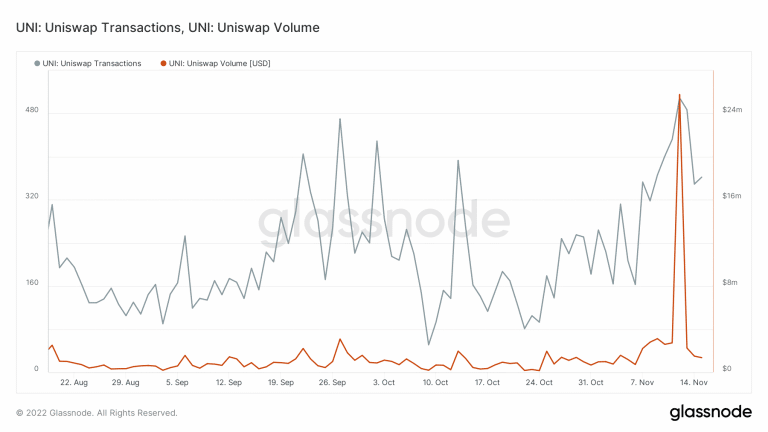

While the user numbers paint a positive picture, let’s delve into the transaction data to get a more comprehensive understanding. Uniswap has indeed seen a noticeable surge in both trading volume and the number of transactions this week. This aligns with the increased user activity and suggests a direct correlation between user growth and platform utilization.

However, it’s important to note the dynamic nature of the crypto market. Just as quickly as these metrics spiked, they can also adjust. This volatility is inherent in the space, and it’s crucial to analyze trends over longer periods to discern lasting shifts from short-term fluctuations.

The fact that this week marked new three-month highs for both volume and transactions is significant. It strongly indicates a recent surge in activity, potentially fueled by the ongoing migration of investors towards DeFi solutions like Uniswap.

Key Takeaways: What Does This Mean for You?

- Increased Trust in Decentralization: The recent events have highlighted the importance of self-custody and the transparency offered by DEXs.

- Potential for Growth: As more users embrace DEXs, platforms like Uniswap are positioned for significant growth, especially during future bull markets.

- Active Engagement: The increase in active addresses and transaction volume on Uniswap demonstrates a growing user base that is actively utilizing the platform.

- Volatility Remains: While the trend is positive, it’s important to remember that the crypto market is dynamic, and short-term fluctuations are expected.

Looking Ahead: The Future of Decentralized Trading

The recent surge in Uniswap users and activity is more than just a temporary spike. It reflects a growing awareness and adoption of decentralized finance principles. As users seek greater control and transparency over their assets, DEXs like Uniswap are likely to play an increasingly important role in the crypto ecosystem. Whether this current trend solidifies into a long-term shift remains to be seen, but the initial signs are compelling. The demand for secure, self-custodial solutions is undeniable, and Uniswap appears to be well-positioned to meet that demand.

In Conclusion: A Shift Towards Empowerment

The increasing popularity of Uniswap isn’t just about numbers; it’s about a fundamental shift in how crypto users are approaching asset management. The desire for self-custody, driven by a need for greater security and transparency, is pushing users towards decentralized solutions. While the market will undoubtedly continue to evolve, the current trend highlights the growing importance of DEXs like Uniswap and the empowering potential of decentralized finance.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.