Is Uniswap taking a significant step towards true decentralization? The platform’s governance is buzzing with a new proposal that could reshape voting power within its Decentralized Autonomous Organization (DAO). And guess what? The market seems to love it, with UNI, Uniswap’s native token, skyrocketing by a whopping 20%! Let’s dive into what’s cooking in the Uniswap ecosystem and why this proposal is generating so much excitement.

Uniswap Governance: Leveling the Playing Field?

For those unfamiliar, Uniswap’s DAO allows UNI token holders to participate in governance decisions. Think of it as a digital democracy where token holders can vote on proposals that shape the future of the protocol. You can either cast your votes directly or delegate your voting power to someone else. Currently, there are over 30 delegates who wield significant influence, each holding at least 2.5 million delegated votes. These are considered the heavyweights, but the new proposal is focusing on those who might be getting overshadowed.

- The core of the proposal? To delegate a substantial 10 million UNI tokens from the DAO treasury to delegates who are active but currently underrepresented.

- The distribution plan is strategic: the top four candidates will each receive up to 2.5 million UNI, while the remaining tokens will be distributed equally among other eligible candidates.

This isn’t just a casual suggestion; it’s a serious move currently undergoing a ‘temperature check’ on the official governance forum. If it passes this initial stage, it will proceed to an on-chain vote. If approved there, these underrepresented delegates will receive the delegated UNI, boosting their voting clout significantly.

Crucially, these delegated tokens aren’t for trading or selling. They are purely for governance purposes, designed to amplify the voices of these delegates and ensure a more balanced and participatory decision-making process within the Uniswap ecosystem.

1/ Just in: Uniswap governance is considering a proposal to delegate 10M $UNI to underrepresented delegates.

This could be a game changer for DAO decentralization and participation.

Here's a quick rundown 🧵 pic.twitter.com/asPZuvkCmG

— Wintermute (@wintermute_t) November 22, 2023

Why is This Proposal Necessary? Addressing Centralization Concerns

Uniswap governance, despite its DAO structure, hasn’t been without its critics. A recurring concern is the centralization of voting power in the hands of a few major UNI holders, often referred to as ‘whales.’ Think of entities like a16z, Dharma, and Gauntlet – these are names that have historically held significant sway in Uniswap’s governance decisions.

The problem? When a small number of large token holders dominate voting, it can lead to a system where the voices of smaller delegates and the broader community are drowned out. As the proposal itself points out:

“Many top delegates with considerable voting power have less than 50% vote participation rate, and some even as low as 10% or 0%,”

This highlights a crucial point: even with substantial voting power, not all top delegates are actively participating. Meanwhile, smaller, potentially more engaged delegates struggle to make their voices heard. This proposal, spearheaded by StableLab, a governance service provider, aims to rectify this imbalance and foster a more vibrant and representative governance landscape.

See Also: Uniswap Earned More Than $1m In Transaction Fees In One Month

Past incidents underscore the need for change. Remember back in 2020 when Dharma proposed lowering the quorum threshold from 40 million UNI to 3%? While seemingly technical, this move effectively amplified the voting power of large holders even further. Such instances have fueled criticism and calls for a more decentralized and inclusive governance model.

See Also: A Uniswap User Lost $700,000 to an MEV Bot — But it Only Made $260

UNI Price Reacts Positively: A Sign of Confidence?

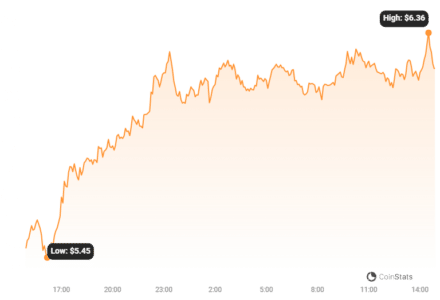

The crypto market is often a direct reflection of sentiment and anticipation, and UNI’s recent price surge seems to be a clear indicator of positive vibes surrounding this governance proposal. Over the past 24 hours, UNI has experienced a significant climb, jumping from around $5.25 to an intraday high of $6.26 during Thursday’s Asian trading session. That’s an impressive 20% increase, outperforming much of the broader crypto market.

While it’s always tricky to pinpoint exact causes in the volatile crypto world, the timing of this price jump coinciding with the governance proposal is hard to ignore. It suggests that investors are viewing this decentralization effort favorably, perhaps seeing it as a step towards a healthier and more robust Uniswap ecosystem.

Looking at the bigger picture, UNI has been on a recovery trend, gaining 42% over the past month as the overall crypto market shows signs of thawing. However, it’s important to remember that UNI, like many cryptocurrencies, is still significantly down from its all-time highs. It remains about 86% below its May 2021 peak of $44.92, leaving plenty of room for potential growth and recovery.

Looking Ahead: Will Decentralization Drive Uniswap’s Future?

The proposal to delegate UNI tokens to underrepresented delegates is more than just a minor adjustment; it’s a statement of intent. It signals a willingness within the Uniswap DAO to address valid criticisms and actively work towards a more decentralized and inclusive governance model. Whether this proposal will fully solve the challenges of centralization remains to be seen, but it’s undoubtedly a step in the right direction.

If the on-chain vote mirrors the positive sentiment reflected in the UNI price, we could witness a significant shift in Uniswap governance. Empowering a wider range of delegates could lead to more diverse perspectives, increased participation, and ultimately, a more resilient and community-driven Uniswap protocol. Keep an eye on this developing story – it could be a defining moment for Uniswap and a blueprint for other DAOs striving for genuine decentralization.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.