Uniswap (UNI), a leading decentralized exchange (DEX), has shown promising price movement recently. Is this a sign of sustained growth, or just a temporary surge? Let’s dive into the latest data to understand what’s driving UNI’s price and what to expect moving forward.

Uniswap (UNI) Price Overview

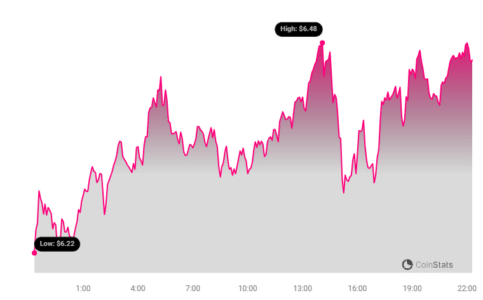

Over the past 24 hours, the price of Uniswap has increased by 3.39%, reaching $6.41. This upward trend extends to the past week, where UNI has gained 7.0%, climbing from $6.02 to its current price of $6.46. The coin’s all-time high stands at $6.48.

Analyzing Price Movement and Volatility

To better understand Uniswap’s recent performance, let’s examine its price movement and volatility.

The chart above compares Uniswap’s price movement and volatility over the past 24 hours (left) with its price movement over the past week (right). The gray bands represent Bollinger Bands, which measure volatility for both daily and weekly price movements. Wider bands indicate higher volatility.

Key Metrics: Trading Volume and Circulating Supply

Here’s a look at some critical metrics influencing Uniswap’s market dynamics:

- Trading Volume: Decreased by 41.0% over the past week.

- Circulating Supply: Increased by 0.16% over the same period.

Currently, the circulating supply is 753.77 million UNI, representing approximately 75.38% of its maximum supply of 1.00 billion. Uniswap holds the #22 market cap ranking at $4.85 billion.

What Does This Mean for Uniswap?

The recent price increase suggests growing investor interest in Uniswap. However, the decreased trading volume indicates potential caution or consolidation. The slight increase in circulating supply could exert downward pressure on the price if demand doesn’t keep pace.

Factors Influencing Uniswap’s Price

Several factors could be influencing Uniswap’s price:

- Overall Market Sentiment: Positive trends in the broader cryptocurrency market often lift individual coins.

- DeFi Developments: Advancements and innovations within the decentralized finance (DeFi) space can increase demand for DEXs like Uniswap.

- Protocol Upgrades: Any updates or improvements to the Uniswap protocol itself can impact investor confidence.

- Regulatory Landscape: Changes in regulations surrounding cryptocurrencies can significantly affect market dynamics.

Looking Ahead

Uniswap’s recent performance presents a mixed picture. While the price has shown positive momentum, declining trading volume warrants caution. Monitoring circulating supply, market sentiment, and developments in the DeFi space will be crucial for making informed decisions about UNI.

See Also: ‘BTC Has Significantly Outperformed JPMorgan’s Shares,’ Mike Novogratz Slams Jamie Dimon

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.