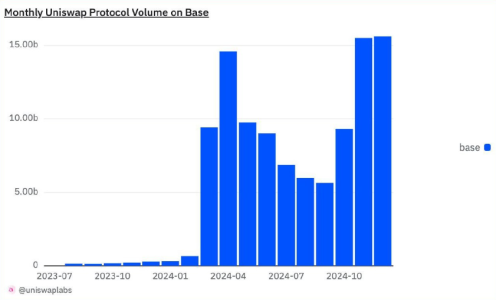

The Uniswap Protocol, a cornerstone of decentralized finance (DeFi), has reached a new milestone. According to Unfolded, Uniswap’s monthly trading volume on the Base network hit an all-time high of $15.65 billion. This remarkable achievement underscores the increasing adoption of decentralized exchanges (DEXs) and the expanding reach of Base, an Ethereum Layer 2 network.

Let’s explore the factors driving this record-breaking performance, its implications for the DeFi ecosystem, and what it means for Uniswap’s continued dominance.

What Is the Uniswap Protocol?

Uniswap is a leading decentralized exchange (DEX) built on the Ethereum blockchain. It enables:

- Permissionless Trading: Users can trade tokens directly from their wallets without intermediaries.

- Liquidity Pools: Allows users to provide liquidity in exchange for fees.

- Decentralized Governance: Governed by the UNI token, holders vote on protocol upgrades and decisions.

Uniswap has consistently led the DeFi space in trading volume and innovation, making this new milestone on Base even more significant.

What Is the Base Network?

The Base network is an Ethereum Layer 2 solution developed by Coinbase to enhance scalability and reduce transaction costs for DeFi applications.

Key Features of Base

- Low Fees: Enables cost-effective transactions for DeFi users.

- Scalability: Supports higher throughput than Ethereum’s mainnet.

- Developer-Friendly: Provides robust tools for building DeFi protocols.

Base has quickly gained traction among projects seeking to improve user experiences, with Uniswap leading the charge.

Factors Behind Uniswap’s Record Volume on Base

1. Growing DeFi Adoption

- The increasing demand for decentralized trading solutions has driven users to platforms like Uniswap.

- Users are turning to Base for its low fees and fast transaction speeds, contributing to higher trading volumes.

2. Enhanced User Experience

- Base’s lower gas fees and seamless integration with Ethereum wallets have attracted both retail and institutional traders.

3. Expanding Liquidity Pools

- Uniswap’s liquidity pools on Base have grown significantly, providing tighter spreads and more efficient trading for users.

4. Market Volatility

- Increased market activity and price volatility in the crypto market often lead to higher trading volumes, benefiting platforms like Uniswap.

Implications of the Record Volume

1. Strengthening Uniswap’s Position in DeFi

- The $15.65 billion volume solidifies Uniswap’s dominance in the DEX space, demonstrating its ability to adapt to emerging networks like Base.

2. Boosting Base Network Adoption

- Uniswap’s success on Base highlights the network’s potential to support high-volume DeFi applications, attracting more protocols and users.

3. Increased Competition Among Layer 2 Solutions

- Base’s growing success could intensify competition among Layer 2 networks like Arbitrum, Optimism, and Polygon.

4. Validating Decentralized Trading

- The milestone reinforces the viability of decentralized exchanges as alternatives to centralized platforms, particularly amid regulatory scrutiny.

What’s Next for Uniswap and Base?

1. Expanding Features and Ecosystem

- Uniswap may introduce new features or support additional token pairs to capitalize on its success on Base.

2. Scaling to Other Networks

- Building on its success with Base, Uniswap could explore integration with other emerging Layer 2 solutions.

3. Driving Institutional Adoption

- As Uniswap continues to grow, it may attract more institutional traders looking for transparent, cost-effective trading options.

4. Enhancing User Incentives

- Expect Uniswap to roll out initiatives like liquidity mining or fee-sharing programs to sustain its growth momentum.

FAQs

1. What caused Uniswap’s record volume on Base?

The record was driven by growing DeFi adoption, low transaction fees on Base, and increased market activity.

2. How does Base contribute to Uniswap’s growth?

Base offers scalability and low fees, creating an ideal environment for high-volume trading on Uniswap.

3. What does this mean for the DeFi ecosystem?

This milestone underscores the increasing adoption of decentralized exchanges and validates Layer 2 networks like Base.

4. Will Uniswap expand to other Layer 2 networks?

It’s likely, given Uniswap’s focus on scalability and improving user experience across networks.

5. How does this impact Base’s future?

Uniswap’s success on Base positions the network as a major player in the Layer 2 space, attracting more developers and users.

Conclusion

The $15.65 billion trading volume milestone achieved by Uniswap Protocol on Base highlights the growing adoption of decentralized finance and Layer 2 solutions. This achievement not only solidifies Uniswap’s position as a leader in the DeFi space but also underscores the potential of Base as a scalable, user-friendly network for next-generation financial applications.

As the DeFi ecosystem continues to expand, milestones like this demonstrate the transformative power of blockchain technology in reshaping traditional finance.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.