Exciting news is breaking from Brazil’s burgeoning crypto scene! ECSA Finance, a Brazil-based stablecoin issuer, has just announced a successful $3 million pre-seed funding round. This injection of fresh capital, backed by prominent investors including Y Combinator and Arca Capital, signals a significant step forward for stablecoin adoption in Latin America and beyond. But what does this mean for you, the crypto enthusiast, investor, or business looking to tap into the Brazilian market?

What is ECSA Finance and BRLe? Bridging Traditional Finance and Crypto in Brazil

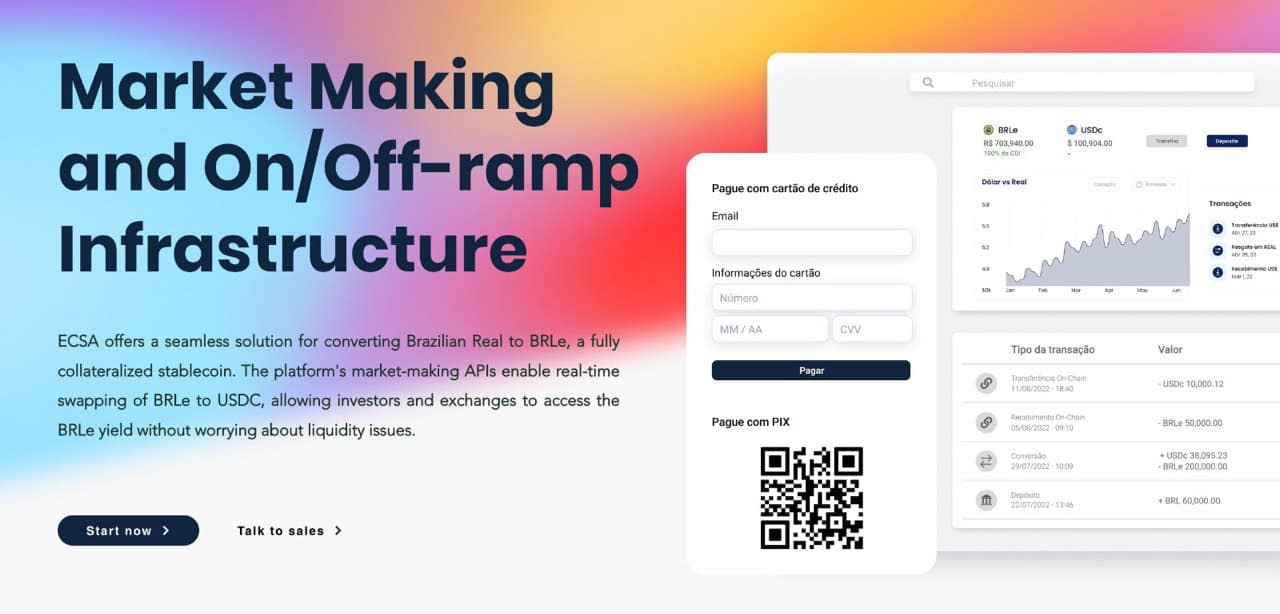

ECSA Finance is not just another crypto startup; they’re building a crucial bridge between traditional finance and the rapidly evolving world of digital assets in Brazil. At the heart of their mission is BRLe, a Brazilian Real-backed stablecoin. Think of stablecoins as the stable backbone of the crypto world – digital currencies designed to maintain a steady value, often pegged to a fiat currency like the US dollar or, in this case, the Brazilian Real.

BRLe stands out because it’s fully collateralized by Brazilian Treasury Bills and held securely in major Latin American banks. This robust backing aims to provide users with the confidence and stability they need when navigating the crypto landscape. And with audits on the horizon from Grant Thornton, ECSA is emphasizing transparency and trust.

$3 Million Pre-Seed: Fueling Stablecoin Expansion

The successful $3 million pre-seed funding round is a major vote of confidence in ECSA’s vision and execution. Let’s break down why this funding is significant and who’s backing it:

- Fresh Capital Injection: The $3 million will be strategically deployed to expand the reach of BRLe stablecoin. ECSA aims to make BRLe readily available to a wider audience, including:

- Crypto Exchanges: Facilitating smoother and faster on and off-ramp transactions for Brazilian users and international exchanges entering the Brazilian market.

- Payment Processors: Enabling businesses to leverage stablecoins for efficient and cost-effective payments within Brazil.

- Institutional Investors and Family Offices: Providing institutional players with a regulated and reliable gateway to access the Brazilian crypto market.

- Individual Investors: Making stablecoins more accessible to everyday Brazilians looking for stable and efficient digital assets.

- Investor Powerhouse: The funding round attracted a diverse and influential group of investors:

- Y Combinator: A renowned startup accelerator known for backing companies like Airbnb and Dropbox, signaling strong belief in ECSA’s potential.

- Arca Capital: A crypto-focused fund, bringing deep industry expertise and network to the table.

- DP88 Capital (Hong Kong) and Artichoke Capital (Singapore): International investors indicating global interest in ECSA’s Brazil-centric approach.

Why Stablecoins and Why Now? The On/Off-Ramp Revolution

In the fast-paced world of cryptocurrency trading and investment, speed and efficiency are paramount. This is where stablecoins truly shine. Traditional methods for moving funds to and from crypto exchanges can be slow and costly. Think about:

- Swift Transfers: Often taking 2+ days for settlement and incurring significant fees. This delay can be frustrating for traders and investors needing quick access to funds.

- Tied-Up Capital: Exchanges need to hold substantial working capital to provide clients with immediate access to funds while waiting for traditional transfers to clear.

Stablecoins like BRLe offer a game-changing alternative:

- Instant Settlements: Stablecoin transactions are processed rapidly, often within minutes, enabling near-instantaneous on and off-ramps.

- Reduced Costs: Significantly lower transaction fees compared to traditional banking systems, making crypto more accessible and cost-effective.

- Enhanced Efficiency: Exchanges can operate more efficiently, reducing the need to tie up large amounts of working capital.

ECSA’s PIX Gateway: Tapping into Brazil’s Payment Revolution

ECSA is taking its commitment to efficiency a step further by leveraging PIX, Brazil’s incredibly popular instant payment system. Launched by the Central Bank of Brazil in 2020, PIX has taken the nation by storm. Consider these stats:

- Massive Adoption: Over 142 million individuals in Brazil are already using PIX.

- Instant Payments: PIX enables instant transfers 24/7, including weekends and holidays.

- Ubiquitous Use: PIX is used for everything from small retail purchases to larger transactions, becoming the preferred payment method for many Brazilians.

By offering a PIX Gateway, ECSA is empowering international exchanges to seamlessly integrate into the Brazilian market. As João Aguiar, ECSA’s co-founder, explains:

“Our goal is to serve as the gateway for international exchanges looking to enter the Brazilian market, simplifying the process of acquiring clients and allowing them to concentrate on their Go to Market strategies, while relying on us as an On and Off-ramp partner. By offering access to our PIX Gateway, we enable these foreign exchanges to cater to the needs of their clients through the most popular payment method in Brazil, PIX, utilized by 142 million individuals across the country. This approach enables seamless integration into the local market and ensures a smooth customer experience.”

BRLe: Built for Liquidity and Interoperability

ECSA is focused on making BRLe not just stable, but also highly liquid and interoperable within the broader crypto ecosystem. Key aspects include:

- Multi-Network Support: Currently issued on the Stellar network, BRLe is expanding to Ethereum ERC-20, increasing its accessibility and compatibility with various crypto platforms and wallets.

- Market-Making Solutions: ECSA is committed to providing liquidity for BRLe, ensuring smooth and efficient exchange with other major stablecoins like USDT and USDC. This is crucial for traders and investors who need to move between different digital assets.

Rodrigo Marino, ECSA’s co-founder, emphasizes this commitment: “Currently, BRLe is issued on the Stellar network and is in the process of being issued on Ethereum ERC-20. ECSA is committed to offering a market-making solution that ensures liquidity for BRLe, facilitating seamless exchange with other tokens like USDc and USDt.”

Experienced Founders at the Helm

Behind ECSA’s ambitious vision are co-founders João Aguiar and Rodrigo Marino, university friends who bring a wealth of experience from both traditional finance and the emerging crypto space.

João Aguiar:

- Background in hedge funds and trading companies, including Leste Global Investments and Comexport.

- Deep understanding of financial markets and trading dynamics.

Rodrigo Marino:

- Experience in Offshore Structured Products and Venture Capital at companies like Itau-BBA and Indicator Capital.

- Expertise in structured finance and identifying high-growth opportunities.

Prior to ECSA, João and Rodrigo were partners at DIF Markets, a successful Latin American stock brokerage firm that was acquired in 2021. This entrepreneurial track record and combined expertise position them strongly to lead ECSA in its mission to revolutionize stablecoins in Brazil.

Looking Ahead: BRLe and the Future of Brazilian Crypto

ECSA Finance’s $3 million pre-seed funding marks an exciting chapter for stablecoin adoption in Brazil and Latin America. With BRLe, they are building a robust, reliable, and efficient bridge between traditional finance and the digital asset world. By leveraging the power of stablecoins and Brazil’s revolutionary PIX payment system, ECSA is poised to:

- Simplify Crypto Access in Brazil: Making it easier and faster for Brazilians to enter and exit the crypto market.

- Empower International Exchanges: Providing a seamless pathway for global exchanges to tap into the growing Brazilian crypto market.

- Drive Stablecoin Adoption: Showcasing the real-world utility of stablecoins for payments, trading, and institutional investment.

As ECSA continues to build and expand BRLe, keep an eye on this Brazilian fintech innovator – they are likely to play a key role in shaping the future of crypto in the region and beyond.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.