Remember the shocking collapse of crypto exchange FTX in 2022? It sent shockwaves through the crypto world, leaving countless creditors in the lurch. But there’s a glimmer of hope on the horizon! A recent US court decision has given FTX the go-ahead to sell off a significant chunk of its assets – a whopping $873 million – to start repaying those affected. Let’s dive into what this means for FTX creditors and the broader crypto landscape.

What’s Happening with FTX’s Assets?

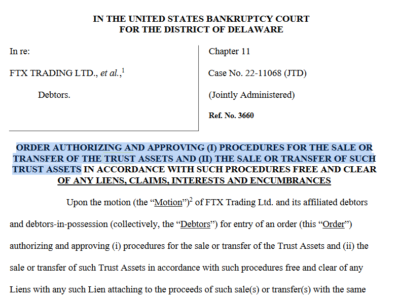

In a nutshell, a bankruptcy court in Delaware has authorized FTX to liquidate nearly $873 million of its holdings. These aren’t just any assets; they’re primarily stakes in cryptocurrency trusts managed by Grayscale Investments and Bitwise. Think of it as FTX turning its crypto investments back into cash to distribute among its creditors.

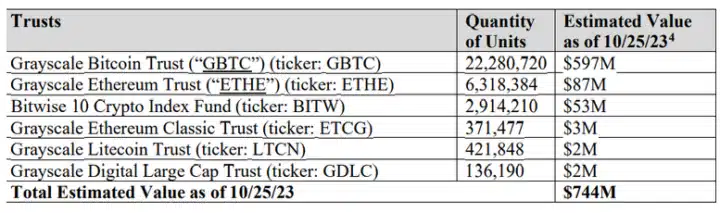

Specifically, the breakdown looks like this:

- Grayscale Investments Trusts: Valued at approximately $807 million.

- Bitwise Trusts: Valued at around $66 million.

These assets are held in trusts like Grayscale Bitcoin Trust (GBTC), Grayscale Ethereum Trust (ETHE), and Bitwise 10 Crypto Index Fund (BITW), among others. The court order, filed on November 29th, marks a significant step in the complex process of recovering funds for FTX users.

According to the court document, the initial valuation presented was $744 million as of October 25, 2023. However, due to the fluctuating nature of crypto markets and recent price surges, the estimated value has since increased to $873 million. This is good news for creditors, as a higher asset value means potentially more funds available for repayment.

Which Crypto Trusts are Involved?

The sale order covers six cryptocurrency trusts, giving FTX the green light to liquidate its holdings in these specific investment vehicles. These include:

- Grayscale Bitcoin Trust (GBTC): FTX holds a substantial 22 million units of GBTC, currently valued around $691 million.

- Grayscale Ethereum Trust (ETHE): With 6.3 million shares, FTX’s ETHE holdings are worth approximately $106 million.

- Grayscale Ethereum Classic Trust (ETCG)

- Grayscale Litecoin Trust (LTCN)

- Grayscale Digital Large Cap Trust (GDLC)

- Bitwise 10 Crypto Index Fund (BITW)

Selling these diverse crypto assets is a strategic move to convert them into more readily distributable funds for creditors.

The Road to Recovery: A Long and Winding Path

The approval to sell these assets is a victory for FTX administrators, led by John J. Ray III, who have been tirelessly working to recover assets since the exchange’s dramatic downfall in November 2022. So far, their efforts have yielded around $7 billion in recovered assets, with a significant portion – about $3.4 billion – in cryptocurrencies.

However, the scale of the FTX collapse is immense. Estimates from June 2023 suggest that customer asset misappropriation could be as high as $8.7 billion. While $873 million from this asset sale is a substantial amount, it’s still just a part of the total funds needed to make creditors whole.

See Also: FTX Users Sued New Targets In Class-Action Lawsuit To Recover Lost Funds

What About Sam Bankman-Fried?

Amidst these financial recovery efforts, the legal proceedings against FTX founder Sam Bankman-Fried (SBF) are also unfolding. Convicted on seven fraud-related charges on November 2nd, SBF is awaiting sentencing, scheduled for March 28th. He is currently detained at Brooklyn’s Metropolitan Detention Center. His fate and the asset recovery process are intertwined, as the legal outcomes could further impact the distribution of funds to creditors.

Looking Ahead: What Does This Mean for FTX Creditors?

This court approval is undoubtedly a positive step for FTX creditors. It signifies tangible progress in the long and complex bankruptcy proceedings. The sale of these assets will provide a pool of funds that can be used for repayments. However, it’s crucial to remember:

- Partial Recovery: Even with the $873 million sale, and the $7 billion already recovered, it’s unlikely that all creditors will receive full compensation for their losses. The total misappropriated amount is significant, and recovery is an ongoing process.

- Timeline Uncertainty: Bankruptcy proceedings are notoriously lengthy. While asset sales are approved, the actual distribution of funds to creditors can take considerable time, potentially months or even years.

- Market Volatility: The value of crypto assets can fluctuate. While the current valuation is positive, future market downturns could impact the final amount recovered from these sales.

In Conclusion: A Step Forward, But the Journey Continues

The FTX asset sale approval is a welcome development for creditors eager to recoup their losses. It demonstrates that efforts to recover funds are yielding results. However, it’s essential to maintain realistic expectations. The road to full recovery is still long, and the complexities of the FTX bankruptcy case will continue to unfold. This asset sale is a significant milestone, but just one step in a much larger journey towards resolution for those affected by the FTX collapse.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.