Bitcoin’s recent struggle below the $20,000 mark has many crypto enthusiasts on edge. Let’s face it, that level didn’t exactly put up a fight, did it? This lack of resistance has understandably sparked fear, uncertainty, and doubt (FUD) in the market. Could we see Bitcoin tumble further, perhaps even down to $17,000? Several macroeconomic factors are pointing in that direction, with next week’s inflation data release being a critical catalyst. If inflation doesn’t show signs of easing, brace yourselves – the Federal Reserve might have no choice but to hike interest rates again, potentially sending shockwaves through the crypto market.

What’s the Market Outlook for the Week Ahead?

Let’s dive into some key indicators that crypto traders are watching closely:

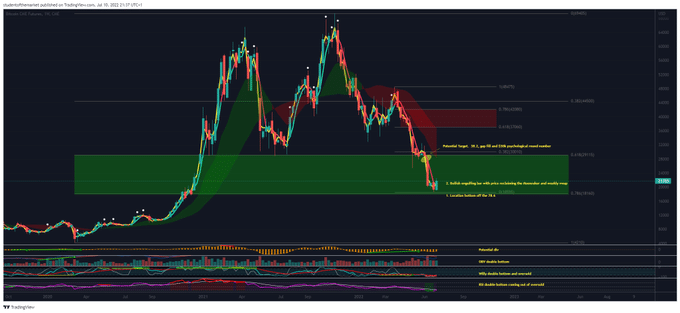

The Bearish 200-Day Moving Average (MA)

Remember that brief glimmer of hope back in July when Bitcoin managed to climb? The price saw a decent $1600 surge, but unfortunately, that upward momentum couldn’t hold. Now, Bitcoin is trading below its 200-Day Moving Average. Why is this significant? Historically, the 200 MA has acted as a crucial support level during bear markets. If this level is decisively broken, it would mark the first time this key support has been breached in the current downturn. This could signal further bearish sentiment and potentially trigger more selling pressure.

The Strengthening Dollar: A Headwind for Bitcoin?

Across the globe, we’re seeing shifts in economic landscapes. Recent social media unrest in China has cast a shadow over the Asian markets. Consequently, the US dollar has been gaining strength against a basket of other currencies, including those in Asia. For instance, the Hong Kong and Shanghai composite indexes have seen significant drops. Simultaneously, the US Dollar Index (DXY) has experienced a sharp rise.

Here’s the interesting part for crypto traders: Bitcoin often moves inversely to the DXY. As the dollar strengthens, Bitcoin tends to face downward pressure, and vice-versa. We’ve seen this dynamic play out recently, with Bitcoin experiencing some upside as the DXY saw a temporary dip. However, the big question remains: how long can this inverse relationship hold in the face of broader macroeconomic pressures?

Inflation Data: The Key to Bitcoin’s Fate?

All eyes are now on the upcoming inflation data release. This data will be a crucial indicator of whether the measures taken to curb inflation are proving effective. Why is this so important for Bitcoin?

- Interest Rate Hikes: Persistently high inflation will likely force the Federal Reserve to implement further interest rate hikes.

- Risk-Off Sentiment: Rising interest rates tend to make riskier assets, like cryptocurrencies, less attractive to investors. They often flock to safer havens like government bonds.

- Impact on Liquidity: Higher interest rates can also reduce overall liquidity in the market, potentially impacting the flow of capital into crypto.

Think of it like this: if inflation remains stubbornly high, the Fed’s response could act as a significant headwind for Bitcoin, potentially pushing its price lower. Conversely, if the inflation data shows a significant drop, it could ease the pressure on the Fed, potentially providing some relief and even a positive catalyst for the crypto market.

Navigating the Uncertainty: Tips for Crypto Traders

The current market conditions present both challenges and opportunities for crypto traders. Here are a few things to keep in mind:

- Stay Informed: Keep a close watch on macroeconomic news, particularly inflation data releases and statements from the Federal Reserve.

- Manage Risk: Given the volatility, it’s crucial to manage your risk effectively. Consider using stop-loss orders and avoid investing more than you can afford to lose.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversifying your investments across different asset classes can help mitigate risk.

- Do Your Own Research (DYOR): Don’t rely solely on the opinions of others. Conduct thorough research before making any investment decisions.

- Consider Dollar-Cost Averaging (DCA): Instead of trying to time the market, consider investing a fixed amount at regular intervals. This strategy can help smooth out the impact of price volatility.

The Bitcoin Community’s Sentiment

Despite the current bearish sentiment, the Bitcoin community remains a vibrant and resilient group. Discussions around price predictions, potential bottom levels, and long-term adoption continue to be active. While some fear the possibility of further downside, others see this as an opportunity to accumulate Bitcoin at lower prices. The community’s long-term belief in Bitcoin’s potential as a store of value and a hedge against inflation persists, even amidst short-term market fluctuations.

Looking Ahead: What’s Next for Bitcoin?

Predicting the future of Bitcoin is never an exact science. However, by closely monitoring macroeconomic indicators, understanding market dynamics, and staying informed, crypto traders can navigate the current uncertainty more effectively. The upcoming inflation data release is undoubtedly a pivotal moment that could significantly influence Bitcoin’s price trajectory in the short term. Whether it triggers a further drop to $17,000 or provides a much-needed bounce remains to be seen. One thing is certain: the crypto market is never boring, and the coming week promises to be an eventful one for Bitcoin and its traders.

In Conclusion: Staying Agile in a Volatile Market

The cryptocurrency market, particularly Bitcoin, is currently navigating a complex landscape influenced by macroeconomic factors like US inflation and the strength of the dollar. The potential breach of the 200-day moving average adds another layer of concern for Bitcoin bulls. As we approach the release of critical inflation data, traders need to remain agile, informed, and prepared for potential volatility. While the possibility of a further drop exists, understanding the underlying factors and employing sound risk management strategies are crucial for navigating these uncertain times. The long-term potential of Bitcoin remains a topic of much debate and optimism within the crypto community, but in the short term, attention remains firmly fixed on the signals coming from the broader economic environment.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.