USA Spot Bitcoin ETFs Record Net Inflow of $25.6M on October 4, Led by Bitwise and Fidelity

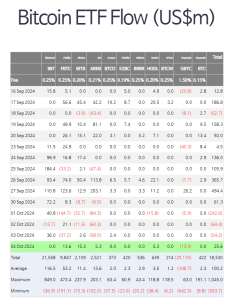

On October 4, U.S. spot Bitcoin ETFs witnessed a significant net inflow of $25.6 million, according to data from Farside Investors. The inflows were driven primarily by Bitwise’s BITB, which recorded the largest inflow of $15.3 million, followed by Fidelity’s FBTC with $13.6 million, Ark Invest’s ARKB and VanEck’s HODL, both registering $5.3 million.

In contrast, Grayscale’s GBTC saw a net outflow of $13.9 million, making it the only major ETF to experience a negative flow on the day. Other ETFs did not see any notable changes in net inflows or outflows.

Breakdown of ETF Movements

- Bitwise’s BITB led the market with $15.3 million in net inflows, reflecting growing confidence in its strategy for tracking spot Bitcoin prices.

- Fidelity’s FBTC followed closely with $13.6 million, demonstrating strong investor interest in Bitcoin ETFs offered by traditional financial institutions.

- Ark Invest’s ARKB and VanEck’s HODL both recorded $5.3 million in net inflows, further highlighting the broader investor demand for Bitcoin exposure.

- Grayscale’s GBTC, which has traditionally been a major player in the Bitcoin ETF space, faced $13.9 million in net outflows, signaling a potential shift in investor preferences as newer ETFs gain traction.

Investor Sentiment Shifting Toward Spot Bitcoin ETFs

The latest net inflows indicate a growing appetite for Bitcoin ETFs, as more institutional and retail investors seek to gain exposure to Bitcoin’s price movements without directly holding the cryptocurrency. The performance of Bitwise, Fidelity, and Ark Invest’s ETFs suggests a shift in market sentiment toward newer, more dynamic Bitcoin offerings, with spot ETFs becoming the preferred vehicle for gaining exposure.

Grayscale’s Outflow: A Sign of Shifting Preferences?

The $13.9 million outflow from Grayscale’s GBTC could reflect a growing preference for more liquid and straightforward Bitcoin ETFs, particularly those structured around spot prices. As newer ETFs with lower fees and better liquidity enter the market, GBTC’s traditional appeal may be waning, leading to increased outflows in favor of alternative products.

Conclusion

The net inflow of $25.6 million into U.S. spot Bitcoin ETFs on October 4 highlights the sustained demand for Bitcoin exposure via ETFs. With Bitwise and Fidelity leading the charge, investors are showing increasing confidence in the spot ETF market. However, Grayscale’s GBTC outflow serves as a reminder that competition in the space is intensifying, as newer ETFs gain favor among investors seeking better liquidity and transparency.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.