Hold onto your hats, crypto enthusiasts! The world of stablecoins just got a little less stable, or at least temporarily. On October 11th, USDR, a stablecoin that’s been making waves for its unique real estate backing, experienced a dramatic dip. We’re talking about a plunge down to $0.53 per coin! That’s a significant drop from its intended $1 peg. So, what exactly happened, and should you be worried about real estate-backed stablecoins?

USDR Depeg: A Flash Crash or Something More?

Imagine waking up to find your stablecoin, designed to be as steady as the dollar, suddenly worth half its value. That’s essentially what happened with USDR. This stablecoin, the brainchild of the Tangible protocol, is designed to bridge the gap between the traditional real estate market and the exciting world of decentralized finance (DeFi). But even with the promise of bricks and mortar backing it up, USDR wasn’t immune to market turbulence.

The culprit? According to the Tangible team, it was a sudden and massive wave of redemptions. Think of it like a bank run, but in the crypto space. These redemptions quickly drained the liquid assets – specifically Dai – from the USDR treasury. This swift outflow led to a depegging event, meaning USDR’s price detached from its intended $1 value against the US dollar.

Let’s break down the timeline:

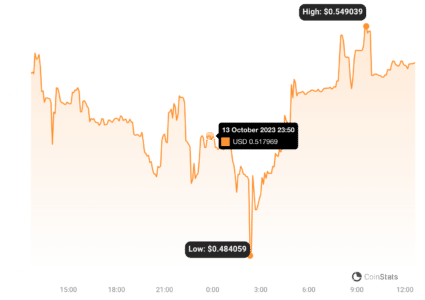

- October 11th, 11:30 am UTC: A surge of selling hits USDR.

- Price Plummets: USDR’s value drops as low as $0.5040.

- Partial Recovery: The price bounces back slightly to around $0.53.

Check the latest USDR price here

Tangible Protocol’s Reassurance: “Just a Liquidity Hiccup!”

In the face of this dramatic price drop, the Tangible team was quick to address the community. Their message? Don’t panic! They characterized the depeg as a “momentary liquidity challenge,” not a fundamental flaw in the project itself.

Here’s the core of their reassurance:

- Real Estate Backing Intact: They emphasized that the real estate assets and digital holdings backing USDR are still in place.

- Solutions in the Works: The team pledged to develop “solutions” to address the liquidity issue and restore the peg.

- Assets Exceed Market Cap: Even after the depeg, their official website claimed that the value of their backing assets was greater than USDR’s total market capitalization. This suggests that, in theory, there are enough assets to support the coin’s intended value.

What is USDR and Tangible Protocol Anyway?

For those new to the scene, let’s quickly unpack what USDR and the Tangible protocol are all about.

Tangible Protocol: Tokenizing Real-World Assets

Tangible is a DeFi project with a mission to bring real-world assets, especially real estate, into the crypto space. They aim to tokenize these assets, making them more accessible and usable within the decentralized finance ecosystem. USDR is a key part of this vision.

USDR: The Real Estate-Backed Stablecoin

USDR is Tangible’s flagship stablecoin. It’s designed to maintain a 1:1 peg with the US dollar, but with a twist – it’s backed not just by fiat reserves or other cryptocurrencies, but also by tangible real estate holdings. This is a relatively novel approach in the stablecoin world.

Where Does USDR Trade?

Currently, USDR primarily trades on Pearl DEX, a decentralized exchange built on the Polygon network. Polygon is known for its faster and cheaper transactions compared to the Ethereum mainnet, making it a popular choice for DeFi projects.

The Collateral Breakdown: Real Estate, Crypto, and Insurance

Understanding what backs a stablecoin is crucial. In the case of USDR, the collateral is a mix of different asset types:

- Real-World Housing (85.26%): The majority of USDR’s backing comes from real estate. This is what sets it apart from many other stablecoins.

- Tangible (TNGBL) Tokens (14.74%): A portion of the collateral is held in TNGBL tokens, the native token of the Tangible ecosystem. This creates a link between the stablecoin and the protocol’s overall performance.

- Insurance Fund: A smaller, unspecified portion is allocated to an “insurance fund,” presumably to provide an extra layer of security.

Stablecoin Depegs: Not Always a Doomsday Scenario

It’s important to remember that stablecoin depegging events, while concerning, aren’t always catastrophic. Stablecoins are designed to be pegged to $1, but market forces and extreme conditions can sometimes cause temporary deviations.

Examples of Stablecoin Depegs:

| Stablecoin | Event | Date | Lowest Price (Approx.) | Recovery |

|---|---|---|---|---|

| USDR | Liquidity crisis due to redemptions | October 11 | $0.50 | Attempting recovery |

| USD Coin (USDC) | US Bank failures | March 11 | $0.885 | Peg restored by March 14 |

| TerraUSD (UST) | Algorithmic depeg, ecosystem collapse | May | $0.01 (current) | Unrecovered, ecosystem collapsed |

As you can see from the table, stablecoin depegs can have varying outcomes. USDC, a major stablecoin, experienced a significant depeg but quickly recovered. On the other hand, Terra’s UST depeg led to a complete collapse. The key difference often lies in the underlying mechanisms and the strength of the project’s reserves and community support.

Is USDR’s Real Estate Backing a Strength or a Weakness?

The concept of real estate backing for a stablecoin is intriguing. Real estate is generally considered a less volatile asset class compared to cryptocurrencies. Theoretically, this could provide a more stable and secure foundation for a stablecoin. However, real estate is also less liquid than digital assets. Selling real estate to meet sudden redemption demands could be slower and more complex than selling off cryptocurrency reserves.

Potential Benefits of Real Estate Backing:

- Perceived Stability: Real estate is often seen as a safe haven asset, potentially instilling more confidence.

- Diversification: Offers a different type of backing compared to fiat or crypto-backed stablecoins.

- Real-World Asset Exposure: Provides a way for crypto investors to gain exposure to the real estate market.

Potential Challenges of Real Estate Backing:

- Liquidity Concerns: Real estate is less liquid than other reserve assets, potentially leading to liquidity crunches during rapid redemptions.

- Valuation Complexity: Valuing real estate accurately and in real-time can be challenging.

- Regulatory Hurdles: Real estate regulations vary significantly across jurisdictions, adding complexity.

Actionable Insights: What Does This Mean for You?

The USDR depeg serves as a reminder of the inherent risks in the crypto market, even within the seemingly “stable” corner of stablecoins. Here are a few takeaways:

- Diversification is Key: Don’t put all your eggs in one basket, especially in crypto. Diversify your stablecoin holdings and your overall portfolio.

- Understand the Backing: Always research what backs a stablecoin. Is it fiat, crypto, real estate, or an algorithm? Each type of backing comes with its own set of risks and benefits.

- Monitor Developments: Keep an eye on how the Tangible team addresses the USDR depeg. Their actions and solutions will be crucial in determining the long-term viability of USDR.

- Risk Assessment: Assess your own risk tolerance. Stablecoins are generally considered less risky than volatile cryptocurrencies, but they are not risk-free.

Conclusion: The Future of USDR and Real Estate-Backed Stablecoins

The USDR depeg is a significant event for the project and the broader stablecoin market. While the Tangible team insists it’s a temporary liquidity issue, the coming days and weeks will be critical. Will they successfully restore the peg and regain market confidence? Or will this event raise deeper questions about the viability of real estate-backed stablecoins, particularly in times of market stress?

One thing is certain: the USDR situation highlights the importance of robust liquidity management and transparent communication in the stablecoin space. It’s a valuable lesson for both stablecoin projects and crypto investors alike as the market continues to evolve and mature. Stay tuned for further updates on USDR’s journey back to stability!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.