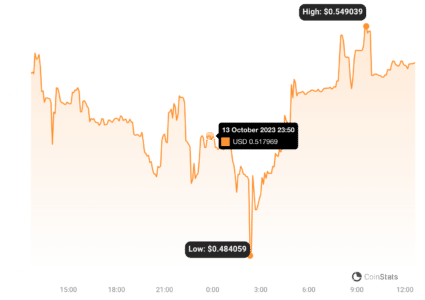

On October 11, the real estate-backed stablecoin known as USDR saw a significant drop, plummeting to a value of $0.53 per coin. However, the project team swiftly reassured the public that this was merely a temporary liquidity hiccup and they intended to rely on their real estate assets and digital holdings to support the coin’s value.

This real estate-backed stablecoin, USDR, experienced a detachment from its peg to the United States dollar due to an unexpected wave of redemptions that drained its liquid assets, including Dai, from its treasury. The team behind this project clarified the situation.

USDR, a stablecoin backed by a combination of cryptocurrencies and tangible real estate holdings, is issued through the Tangible protocol, a decentralized finance initiative that focuses on tokenizing real-world assets, particularly housing.

USDR primarily trades on the Polygon-based decentralized exchange, Pearl DEX.

In a tweet dated October 11, the Tangible team detailed that a sudden and substantial redemption of all the liquid Dai from the USDR treasury triggered a swift decline in its market capitalization, further leading to an abrupt depegging.

USDR faced a surge of selling around 11:30 am UTC, causing its price to plummet to as low as $0.5040 per coin. It did manage to recover somewhat, hovering around $0.53 shortly thereafter.

https://coinstats.app/coins/real-usd/

Despite the nearly 50% depreciation in its value, the project’s developers pledged to devise “solutions” for the situation, reiterating that it was indeed a momentary liquidity challenge rather than a fundamental issue. Their statement emphasized that the real estate assets and digital resources backing USDR were still intact and would be utilized to support redemptions.

Even in the wake of this setback to the treasury, the project’s official website, as of 9:57 pm UTC on October 11, asserted that their assets retained a higher value than the entire market capitalization of the coin.

It’s noteworthy that approximately 14.74% of USDR’s collateral comprises Tangible (TNGBL) tokens, which are integral to the coin’s native ecosystem. The remaining 85.26% is underpinned by real-world housing and an “insurance fund.”

Stablecoins are conventionally designed to maintain a $1 value on the open market; however, they can experience temporary detachment from this peg during extreme market conditions.

For instance, on March 11, Circle’s USD Coin, which ranks as the sixth-largest cryptocurrency by market capitalization as of October 11, fell to $0.885 per coin when several U.S. banks faced bankruptcy. Nevertheless, it managed to restore its peg by March 14. On the other hand, Terra’s UST lost its peg in May and never fully recovered, currently valued at $0.01 per coin as of October 11, according to data sourced from CoinMarketCap.