Just when the crypto world was buzzing with the launch of Spot Bitcoin ETFs, a major player has thrown a curveball. Vanguard, the second-largest investment management firm in the U.S., is doubling down on its skepticism towards cryptocurrency. Buckle up, crypto enthusiasts, because this is a significant development.

Vanguard Pulls the Plug on Crypto: What Happened?

In a move that has sent ripples through the crypto community, Vanguard has officially terminated support for all cryptocurrency products. This isn’t just about Spot Bitcoin ETFs anymore; it’s a complete exit from the crypto space. Let’s break down what this means:

- No More Crypto Products: Vanguard will no longer allow the purchase of any cryptocurrency products, including Bitcoin Futures ETFs.

- Spot Bitcoin ETF Ban Confirmed: This decision reinforces their earlier stance against offering Spot Bitcoin ETFs on their platform.

- Immediate Effect: The policy change is effective immediately, meaning investors can no longer buy these products through Vanguard.

This news, first reported by Axios, solidifies Vanguard’s position as a staunch crypto skeptic. Their official statement emphasizes a focus on “a core set of products and services consistent with our commitment to serve the needs of long-term investors.” In essence, Vanguard doesn’t see crypto as fitting into their long-term investment philosophy.

See Also: Vanguard Have No Plans To Allow Spot Bitcoin ETF Trading On Its Platform

Why is Vanguard So Anti-Bitcoin?

This latest move isn’t out of the blue. Vanguard’s aversion to crypto has been brewing for some time. Here’s a timeline to understand their stance:

- Pre-Spot Bitcoin ETF Era: Even before the recent Spot Bitcoin ETF frenzy, Vanguard was clear about its reservations.

- Spot ETF Launch Day Rejection: On January 11th, the very day Spot Bitcoin ETFs launched, Vanguard announced they wouldn’t offer them. This was a stark contrast to firms like BlackRock, who actively pushed for and now offer these ETFs.

- “Not Aligned with Our Offer”: In a Wall Street Journal interview, Vanguard stated crypto products “do not align with our offer focused on asset classes.” This suggests a fundamental disagreement with crypto as a legitimate asset class for their investors.

- Long-Term Skepticism: Going back to September 2021, Vanguard published an article expressing their belief that cryptocurrencies have a “weak long-term investment case.”

It’s clear Vanguard’s stance isn’t a knee-jerk reaction to market volatility; it’s a deeply ingrained philosophical difference. They prioritize traditional asset classes and seem unconvinced by crypto’s long-term value proposition for their clients.

Contrast with BlackRock: A Tale of Two Giants

The contrasting approaches of Vanguard and BlackRock, the world’s largest asset manager, highlight the divided opinions on crypto within the financial industry. While Vanguard slams the door on crypto, BlackRock is actively embracing it. BlackRock was among the 11 companies approved by the SEC to launch Spot Bitcoin ETFs, and they are now actively marketing and offering these products to their clients. This divergence raises some interesting questions:

- Different Client Base? Do Vanguard and BlackRock cater to fundamentally different investor profiles?

- Risk Tolerance? Does Vanguard perceive crypto as too risky for its clients, while BlackRock sees managed risk as acceptable?

- Future Outlook? Does Vanguard genuinely believe crypto has no long-term future, or are they simply taking a cautious, wait-and-see approach?

Bitcoin’s Price Reaction: Did Vanguard’s News Matter?

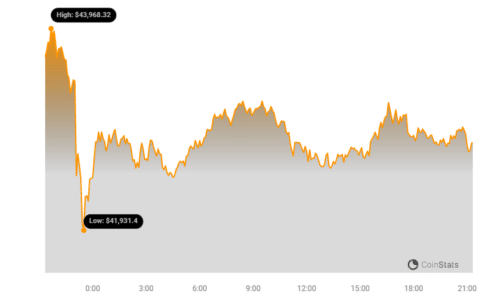

Interestingly, despite the potentially negative news from Vanguard, the immediate price reaction in Bitcoin wasn’t overwhelmingly dramatic. Let’s look at the market snapshot:

According to Coinstats, at the time of writing, Bitcoin (trading symbol BTC) was priced at $42,825.53, with a market capitalization of $839 Billion.

While the chart indicates a price dip – around 7% in the last 24 hours and over 3% in the past week – it’s hard to directly attribute this solely to the Vanguard announcement. The crypto market is notoriously volatile, and various factors can influence price movements. However, Vanguard’s firm stance certainly adds to the narrative of institutional skepticism surrounding crypto, even amidst the ETF launch hype.

The Bottom Line: Vanguard’s Crypto Exit – A Sign of Things to Come?

Vanguard’s decision to completely cut ties with cryptocurrency products is a significant statement. It underscores the ongoing debate within traditional finance about the legitimacy and long-term viability of crypto assets. While some giants like BlackRock are embracing crypto, Vanguard’s firm rejection highlights that mainstream acceptance is far from universal. For crypto investors, this serves as a reminder that the path to widespread adoption may be longer and more complex than initially anticipated. It also raises questions about whether other traditional financial institutions will follow Vanguard’s lead or embrace the crypto wave.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.