The cryptocurrency market is always buzzing with action, and lately, VeChain (VET) has been stealing the spotlight! In a remarkable turn of events, VeChain has not only witnessed a significant price surge but has also climbed the ranks to surpass Cronos (CRO) in terms of market capitalization. This altcoin is making waves, and its price is currently the highest it has been all year. Let’s dive into what’s fueling this exciting momentum for VET.

VeChain’s Meteoric Rise: Surpassing Cronos

- VeChain (VET) has experienced a dramatic price increase over the past month, firmly establishing its position above Cronos in market capitalization.

- Currently, VET’s price is at its peak for the year, signaling strong investor interest and market confidence.

VET, the native cryptocurrency powering the VeChainThor blockchain – a platform renowned for its enterprise-grade blockchain solutions and smart contracts – has shown impressive growth recently. This surge has propelled its price to a new yearly high of $0.38. But what exactly has triggered this upward trajectory?

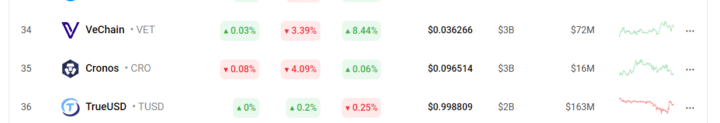

According to data from Coinstats, VeChain’s price rallied by an impressive 12% in just the last week. Simultaneously, its market capitalization expanded from $2.41 billion to approximately $3 billion. This significant increase allowed VET to overtake Cronos (CRO), making VeChain the 35th largest cryptocurrency by market cap. This is a notable achievement, reflecting growing investor confidence in VeChain’s potential and underlying technology.

What’s Fueling the VET Rally? Open Interest Spikes

Beyond just price action, a deeper look into VeChain’s futures market reveals even more compelling bullish indicators. Open interest, which represents the total number of outstanding derivative contracts, has been on a steady climb since the beginning of December.

Data from Coinglass reveals that VET’s futures open interest has reached $46.05 million, a level not seen since April 2022. To put this into perspective, at the start of December, the open interest was below $20 million. This remarkable surge signifies a 142% growth in just 25 days!

A significant increase in open interest like this generally points to a growing number of participants entering the market and establishing new trading positions. In VET’s case, this surge suggests a strong influx of capital and increasing market activity surrounding the altcoin.

Furthermore, VET’s funding rates across various exchanges have remained consistently positive during this period. Positive funding rates indicate that traders are predominantly bullish, willing to pay a premium to maintain their long positions, betting on continued price appreciation.

See Also: This Trader Made $5.7 Million After Investing 30 Solana Tokens (SOL)

Bullish Signals on the Charts: Is VeChain Gearing Up for More Gains?

Analyzing VeChain’s price movements on the 24-hour chart further reinforces the presence of a strong bullish sentiment, suggesting that the price growth could indeed be sustainable. Several technical indicators are pointing towards continued positive momentum.

Firstly, a golden cross occurred in November, with the 50-day moving average moving above the 200-day moving average. This is a classic bullish pattern in technical analysis, signaling a potential long-term uptrend. A golden cross typically indicates increasing buying pressure and a shift in market momentum to the positive side.

Moreover, key momentum indicators have been trending upwards since December 11th, confirming a surge in coin accumulation. At the time of writing, VeChain’s Relative Strength Index (RSI) stood at 70.81, and its Money Flow Index (MFI) was at a high 88.04.

These elevated RSI and MFI values indicate that buying pressure significantly outweighs selling pressure. In simpler terms, more people are buying VET than selling, further driving the price upwards.

However, a Word of Caution: It’s important to note that while these indicators are bullish, RSI and MFI values in overbought territory (typically above 70 for RSI and 80 for MFI) can also suggest a potential price correction. Buyer exhaustion is common at these high levels, meaning the upward momentum might temporarily slow down or even reverse. Therefore, while the outlook for VeChain appears positive, traders should exercise caution and be aware of potential short-term pullbacks.

In Conclusion: VeChain’s Strong Momentum and Future Outlook

VeChain’s recent surge, outperforming Cronos in market capitalization and reaching new yearly price highs, is a significant development in the crypto market. Fueled by increased open interest, positive funding rates, and strong bullish technical indicators, VeChain is demonstrating robust momentum. While the market can be unpredictable and caution is always advised, especially when indicators suggest overbought conditions, VeChain’s current performance highlights its growing strength and investor interest. Keep an eye on VET as it continues to navigate the dynamic crypto landscape!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.