Ever wondered why some cryptocurrencies skyrocket in value while others fade away? It’s not just about fancy technology or celebrity endorsements. A powerful force called the network effect is often at play, and it’s a game-changer in the world of crypto. Let’s dive into how this effect shapes the value and future of cryptocurrencies and NFTs.

What Exactly is the Network Effect?

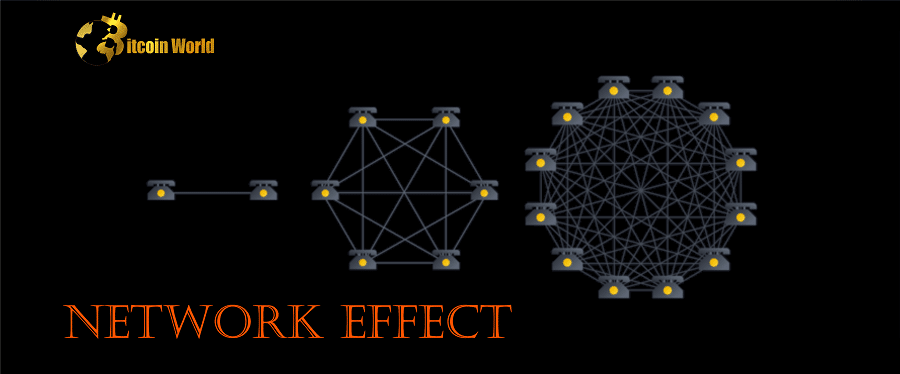

Imagine a phone. Back in the day, if you were the only person with a phone, it wouldn’t be very useful, right? But as more people got phones, its value exploded! That’s the network effect in action.

In simple terms, the network effect means that a product or service becomes more valuable as more people use it. Think about:

- Social Media Platforms: Facebook, Instagram, X (formerly Twitter) – their value isn’t just in their features, but in the massive communities they host. The more friends, followers, and content creators join, the more engaging and valuable these platforms become for everyone.

- Messaging Apps: WhatsApp, Telegram, Signal – you use the messaging app your friends and family use. The larger the network of users, the more convenient and essential these apps are.

- Marketplaces: Amazon, eBay, Etsy – more buyers attract more sellers, and more sellers attract more buyers, creating a vibrant and valuable marketplace for everyone involved.

This positive feedback loop is the essence of the network effect, and it’s incredibly potent in the digital age.

Why is the Network Effect a Big Deal for Cryptocurrencies?

Now, let’s bring this concept into the exciting world of cryptocurrencies. The network effect is arguably even more critical for crypto than for many traditional technologies. Here’s why:

- Increased Value: As more people adopt a cryptocurrency, demand increases. Basic economics tells us that higher demand, with limited supply (like many cryptocurrencies), leads to price appreciation. This price increase, in turn, attracts even more users, creating a powerful cycle of growth.

- Enhanced Liquidity: A larger user base means more trading activity. This translates to higher liquidity, making it easier to buy and sell the cryptocurrency without significant price slippage. High liquidity is crucial for a healthy and stable market.

- Wider Acceptance and Utility: Businesses are more likely to accept a cryptocurrency as payment if a large number of their customers use it. Increased adoption by merchants and services further enhances the real-world utility and value of the cryptocurrency.

- Stronger Security and Decentralization: In many cryptocurrencies, especially proof-of-work systems like Bitcoin, a larger network means more participants securing the network, making it more resistant to attacks and censorship. Decentralization, a core tenet of crypto, is strengthened by a wider distribution of users and nodes.

Essentially, the network effect fuels a virtuous cycle for cryptocurrencies, driving adoption, increasing value, and solidifying their position in the financial landscape.

Bitcoin: The Network Effect Pioneer

Bitcoin is arguably the most prominent example of the network effect in action. Its first-mover advantage and consistently growing user base have created a massive network effect. Consider this:

- Market Dominance: Bitcoin’s large user base and established infrastructure contribute to its dominance as the leading cryptocurrency by market capitalization. This dominance further reinforces its network effect.

- Brand Recognition: Bitcoin enjoys unparalleled brand recognition in the crypto space and beyond. This name recognition attracts new users and investors, strengthening its network.

- Infrastructure Development: A large network encourages the development of more infrastructure around Bitcoin, such as wallets, exchanges, and payment processors. This improved infrastructure makes Bitcoin more accessible and user-friendly, attracting even more users.

The Bitcoin network’s strength isn’t just in its technology, but in the sheer size and activity of its community. This network effect is a significant barrier to entry for competing cryptocurrencies.

NFTs and the Network Effect: Digital Collectibles Thrive on Community

Non-Fungible Tokens (NFTs) also heavily rely on the network effect for their value and adoption. Think about it – what makes a digital artwork or collectible valuable as an NFT?

- Increased Demand and Liquidity: When more people participate in the NFT ecosystem, demand for NFTs increases. This leads to higher trading volumes and better liquidity in NFT marketplaces.

- Community and Social Status: Owning certain NFTs can grant access to exclusive communities and signal social status within those communities. The more vibrant and desirable these communities are, the more valuable the associated NFTs become.

- Creator Empowerment: A thriving NFT market, driven by the network effect, empowers artists, musicians, and creators to directly monetize their digital work and connect with their audience.

NFT marketplaces like OpenSea and Rarible thrive on network effects. The more creators and collectors join these platforms, the wider the selection of NFTs, the higher the trading volume, and the greater the overall value for participants.

DeFi and Web3: Network Effects in Decentralized Applications

Decentralized Finance (DeFi) and Web3 applications are also powered by the network effect. As more users and developers engage with these platforms, the benefits multiply for everyone involved.

Consider Decentralized Exchanges (DEXs) like Uniswap and SushiSwap:

- Improved Trading Conditions: More liquidity providers on DEXs lead to deeper order books and tighter spreads, resulting in better prices and more efficient trading for users.

- Increased Capital Efficiency: Higher participation in DeFi protocols can lead to greater capital efficiency and more innovative financial products and services.

- Network Growth and Innovation: A vibrant DeFi ecosystem, fueled by the network effect, attracts developers and entrepreneurs, fostering innovation and further expanding the possibilities of decentralized finance.

Similarly, Web3 platforms aiming for decentralized social media, data storage, and other applications depend on building strong network effects to achieve critical mass and challenge centralized incumbents.

Is the Network Effect a Guarantee of Crypto Success? Not Quite!

While the network effect is a powerful force, it’s crucial to remember that it’s not a magic bullet. Other factors significantly influence the success of a cryptocurrency or NFT project:

- Technology and Innovation: Strong technology, real-world use cases, and continuous innovation are essential for long-term viability. A strong network effect can amplify the success of a good project, but it can’t save a fundamentally flawed one.

- Community and Governance: A strong, engaged community and sound governance mechanisms are vital for the long-term health and evolution of a crypto project.

- Security and Reliability: Security vulnerabilities and network instability can erode trust and hinder adoption, even with a strong network effect.

- Market Sentiment and External Factors: Broader market trends, regulatory developments, and unforeseen events can all impact the value and adoption of cryptocurrencies, regardless of their network effects.

Key Takeaways: Leveraging the Network Effect in Crypto

So, what does this all mean for you, whether you’re a crypto investor, user, or builder?

- Understand Network Effects: Recognize the power of network effects when evaluating cryptocurrencies and NFT projects. Look for projects with growing user bases and active communities.

- Early Adoption Advantage: Early adoption can be particularly beneficial in networks exhibiting strong network effects. Getting in early can position you to benefit from future growth.

- Beyond the Hype: Don’t solely rely on network effects. Assess the underlying technology, team, community, and real-world utility of a project.

- Long-Term Perspective: Network effects take time to build. Consider the long-term potential of a project’s network and its ability to sustain growth.

In Conclusion: The Network Effect – A Cornerstone of Crypto’s Future

The network effect is a fundamental concept for understanding the dynamics of the cryptocurrency and NFT markets. It’s a powerful engine driving adoption, value, and long-term success. While not the only factor, recognizing and understanding network effects is crucial for navigating the exciting and ever-evolving world of crypto. As the crypto space matures, projects that successfully harness and expand their network effects are likely to be the ones that shape the future of finance and the internet.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.