Bitcoin (BTC) is back in the spotlight, breaching the $20,000 mark once again this week! This surge has ignited a flurry of speculation among investors. Is this a deceptive bull trap ready to snap shut, or is it the precursor to a significant rally aiming for $30,000? The market is buzzing with anticipation and uncertainty. Let’s dive into the key events of this week to decipher the prevailing sentiments and understand what might lie ahead for BTC.

Is the Catalyst Run Dry? Decoding Market Sentiments

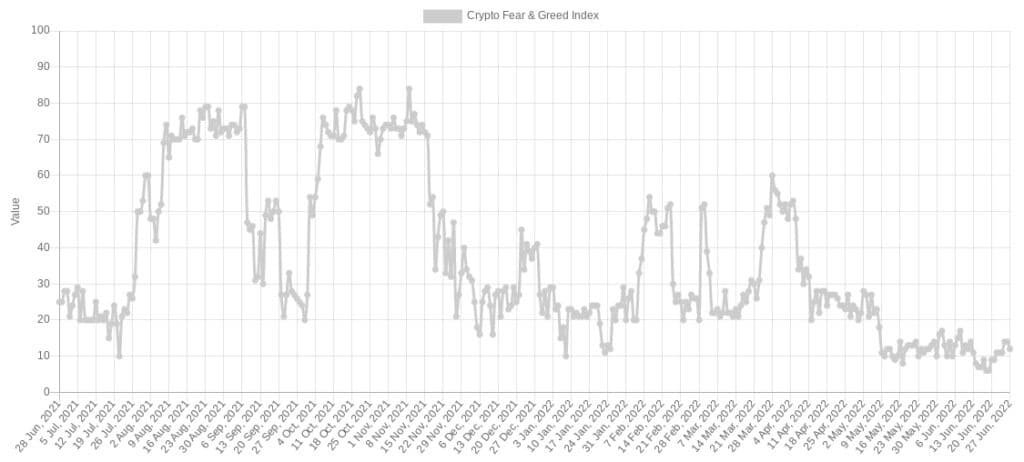

The market’s reaction to the Federal Reserve’s tapering policies appears to be sending mixed signals. Despite expectations that the 75 basis point rate hike would stabilize the market, the Greed and Fear Index continues to hover near all-time lows, suggesting persistent anxiety among investors. This indicates that the anticipated calming effect of the Fed’s actions hasn’t fully materialized, and market jitters remain palpable.

Even with the recent market uptick, cautious analysts predict Bitcoin to largely oscillate between the $12,000 and $20,000 range in the near term. The broader economic landscape suggests that risky assets, including cryptocurrencies, are likely to experience continued volatility as global financial conditions tighten. This cautious outlook underscores the need for investors to remain vigilant and prepared for potential market fluctuations.

Weekly Moving Average Takes a Hit: What Does It Mean?

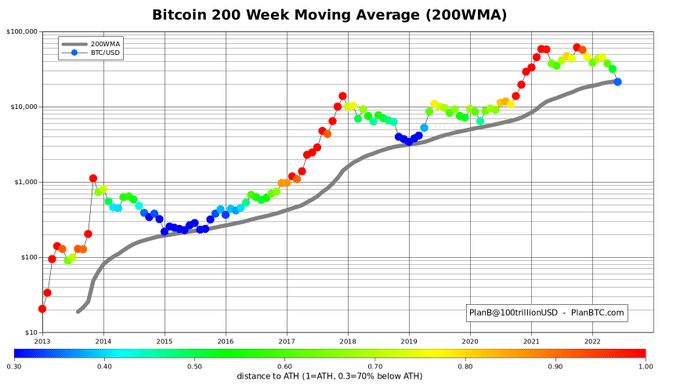

A significant development this week is the 200-week Moving Average (MA) for Bitcoin dipping below its support level for the first time in its history. Historically, the approach of Bitcoin halving events has often triggered increased buying activity, fueled by the anticipation of price breakouts. This long-term trendline breach is a noteworthy event that has market participants on edge.

The critical level to watch remains $20,000. Should Bitcoin fail to maintain its position above this threshold, it could potentially invalidate historical patterns and pave the way for further downward pressure. This scenario would signal a significant shift in market dynamics, suggesting a phase of extended market correction.

Bitcoin’s Dominance: A Shifting Landscape

Bitcoin’s dominance in the cryptocurrency market has seen a notable decrease in 2022, falling from a robust 60% to around 43% at the time of writing. This decline presents a mixed bag of implications for the crypto ecosystem.

The Good: A reduction in Bitcoin’s dominance can indicate a maturing and diversifying crypto market. It suggests that capital is flowing into a wider array of altcoins and projects, potentially fostering innovation and growth across the board. This diversification can reduce the overall market’s reliance on Bitcoin’s performance, leading to a more resilient ecosystem.

The Not-So-Good: Conversely, a sharp drop in Bitcoin dominance during bearish phases can also signal increased risk. Altcoins are generally more volatile than Bitcoin, and a flight from Bitcoin dominance might reflect investors moving out of perceived ‘safer’ crypto assets into fiat or stablecoins. However, in the current context, with overall market stabilization being observed, the former interpretation holds more weight.

The fact that the crypto market is showing signs of stabilization despite reduced Bitcoin dominance could be a positive indicator of underlying strength and broader adoption across different crypto assets.

“Bitcoin is Dead!” – The Rhetoric Resurfaces

As Bitcoin navigates market volatility, the familiar narrative of “Bitcoin is dead!” has once again made its rounds. Interestingly, this resurgence in bearish sentiment often coincides with increased trading volumes. While such pronouncements might be unsettling for some investors, historical data suggests a counterintuitive trend: bearish periods have often been catalysts for maximum Bitcoin adoption.

Looking back at Bitcoin’s journey, periods marked by significant price corrections and negative headlines have paradoxically led to increased user engagement, network growth, and infrastructure development. This phenomenon can be attributed to:

- Entry Points: Price drops offer attractive entry points for new investors who were previously priced out.

- Focus on Fundamentals: Bear markets shift the focus from speculative hype to the underlying technology and use cases of Bitcoin.

- Resilience Testing: Market downturns rigorously test the resilience and robustness of the Bitcoin network and ecosystem.

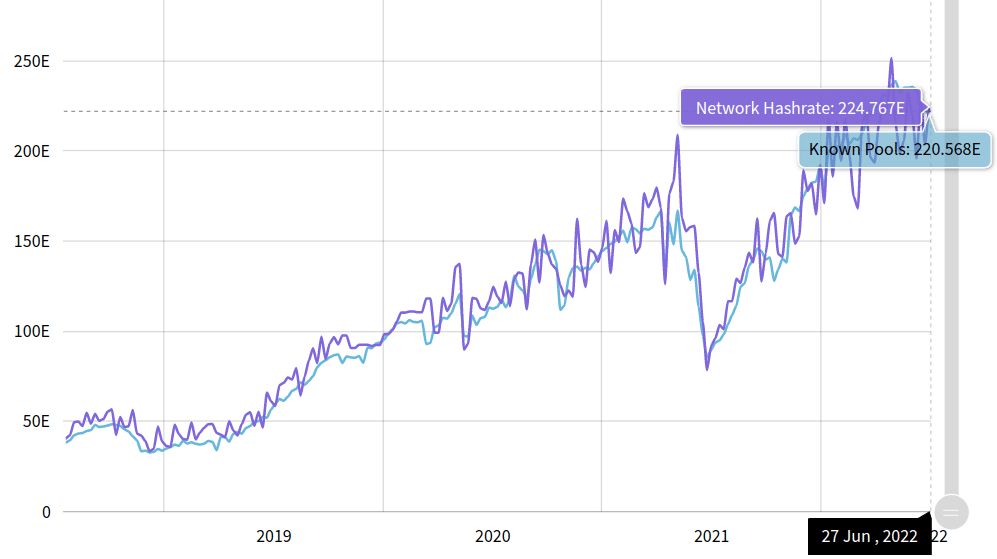

The recent surge in searches for “Bitcoin is dead” might be interpreted humorously as instigated by regulatory bodies like the SEC, but regardless of the intent behind these searches, they highlight a crucial point: even amidst bearish narratives, Bitcoin adoption metrics remain robust. Despite market corrections, we are witnessing significant adoption with consistent new wallet creations and steady mining activities. This suggests a strong underlying belief in Bitcoin’s long-term value proposition, even when market sentiments are shaky.

In Conclusion: Navigating Bitcoin’s Current Crossroads

Bitcoin’s recent push above $20,000 has injected a dose of excitement and uncertainty into the crypto market. While some view it as a potential bull trap, others see it as the beginning of a rally towards $30,000. The truth likely lies in a nuanced interpretation of the various factors at play. The Greed and Fear Index, the breakdown of the 200-week MA, shifting Bitcoin dominance, and the resurgence of bearish narratives all contribute to a complex market picture.

Ultimately, whether this surge is a fleeting moment or the start of a sustained uptrend remains to be seen. Investors should remain informed, exercise caution, and focus on long-term fundamentals amidst the prevailing market noise. The coming weeks will be crucial in determining Bitcoin’s trajectory and the overall direction of the cryptocurrency market.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.