Ethereum Price Rockets Above $2,800: Is the Bull Run Back On?

Exciting times in the crypto market! Ethereum (ETH), the second-largest cryptocurrency, has shown impressive momentum, breaking through key resistance levels and sparking optimism among traders. After a period of consolidation, ETH has finally made a significant move, leaving many wondering – is this the beginning of a sustained uptrend? Let’s dive into the details of Ethereum’s recent price action and explore what it means for the near future.

Ethereum Breaks Key Resistance – What Happened?

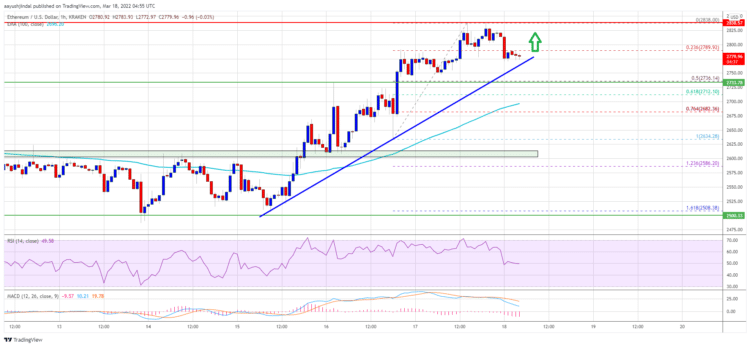

Ethereum’s price has been steadily climbing, and recently, it decisively broke above the crucial $2,700 resistance mark. This wasn’t just a minor fluctuation; ETH powered through the $2,725 and $2,750 resistance levels with noticeable strength, firmly establishing itself in the green zone. This positive momentum is a welcome sign for ETH enthusiasts and the broader crypto market.

The price surge didn’t stop there! Ethereum even briefly surpassed the $2,800 mark, settling comfortably above the 100 hourly simple moving average. This is a significant technical indicator, suggesting bullish momentum is building. A peak was reached near $2,828, and currently, the price is in a phase of consolidation, taking a breather after this impressive climb. A slight retracement saw ETH dip below $2,800, but this is a normal part of market dynamics after such a strong upward move.

Decoding the Technicals: Key Levels to Watch

To understand the significance of this price movement, let’s break down some key technical analysis points:

- Fibonacci Retracement: Analyzing the recent upward swing from the $2,635 low to the $2,838 high, we see a 23.6% Fibonacci retracement level. This helps traders identify potential support and resistance areas.

- Bullish Trend Line: On the hourly ETH/USD chart, a strong bullish trend line has formed, providing support around the $2,775 level. This trend line acts as a crucial indicator of ongoing upward momentum.

- Resistance Levels: The immediate upside resistance is near the $2,800 mark, with $2,830 acting as the next major hurdle. Overcoming these levels is crucial for confirming a new uptrend.

- Support Levels: On the downside, the trend line support and $2,775 offer initial support. Further down, $2,750 and the significant $2,730 levels provide more robust support. The $2,730 level is particularly important as it aligns with the 50% Fibonacci retracement of the recent upward move.

What’s Next for Ethereum? Potential Scenarios

Now that we’ve examined the technicals, let’s consider the potential scenarios for Ethereum’s price action:

Scenario 1: Continuing the Uptrend

For Ethereum to truly kick off a new uptrend, it needs to decisively break through the $2,800 and $2,830 resistance levels. If ETH manages to conquer these hurdles, we could see a rapid move towards the $2,880 mark. Sustained bullish momentum could then pave the way for a test of the primary $3,000 resistance zone, a level that has been a significant psychological and technical barrier in the past.

Key Points for Uptrend Continuation:

- Break and hold above $2,830 resistance.

- Sustained trading volume and positive market sentiment.

- Potential catalysts like positive news around Ethereum 2.0 or increased DeFi activity.

Scenario 2: Potential Downward Correction

Alternatively, if Ethereum fails to break above $2,830 and lacks the momentum to sustain its upward trajectory, we might see a downward correction. This is a natural market movement and doesn’t necessarily negate the overall bullish outlook, but it’s important for traders to be prepared.

Key Support Levels to Watch During a Correction:

- $2,775: Trend line support – a crucial level to hold to maintain bullish structure.

- $2,750: Next significant support level.

- $2,730: Major support zone and 50% Fibonacci retracement level. A break below this could trigger further downside.

- $2,680: Potential lower target if the $2,730 support fails to hold.

A dip to these support levels could present buying opportunities for traders who believe in Ethereum’s long-term potential. However, breaking below the $2,730 support zone could signal a deeper correction and warrant caution.

Ethereum 2.0 and Market Sentiment: Fueling the Fire?

Beyond technical analysis, fundamental factors also play a crucial role in Ethereum’s price movement. The ongoing progress of Ethereum 2.0, with its promise of increased scalability, security, and sustainability, continues to be a major driver of positive sentiment around ETH. Any positive news or milestones achieved in the Ethereum 2.0 development can act as a catalyst for price appreciation.

Furthermore, overall market sentiment in the cryptocurrency space significantly impacts Ethereum. Positive developments in the broader crypto market, increased institutional adoption, and growing interest in decentralized finance (DeFi) all contribute to a favorable environment for Ethereum and other altcoins.

Actionable Insights for Crypto Traders

So, what should crypto traders do with this information? Here are some actionable insights:

- Monitor Key Levels: Keep a close eye on the $2,830 resistance and the $2,775 and $2,730 support levels. These levels will likely dictate short-term price action.

- Manage Risk: Implement appropriate risk management strategies. Use stop-loss orders to protect your capital, especially if you are trading in a volatile market.

- Stay Informed: Keep up-to-date with the latest news and developments in the Ethereum ecosystem and the broader crypto market. Follow reputable crypto news sources and analysis platforms.

- Consider Long-Term Potential: While short-term price fluctuations are inevitable, remember Ethereum’s long-term potential as a leading blockchain platform. Consider your investment horizon and strategy accordingly.

Related Reading: Institutional Interest in Crypto is Surging!

Related Posts – Bank DBS’s Crypto Business Grows Massively Due To Growing Demand From Investors

The linked article about Bank DBS’s crypto business growth further reinforces the positive sentiment surrounding the crypto market. Increased institutional participation, as highlighted in that article, is a significant factor that can drive long-term growth for cryptocurrencies like Ethereum.

In Conclusion: Ethereum’s Bullish Momentum is Building

Ethereum’s recent price surge above $2,800 is a promising sign for bulls. While consolidation and potential corrections are part of the market cycle, the underlying technical and fundamental factors suggest that Ethereum is poised for further growth. By understanding the key support and resistance levels and staying informed about market developments, crypto traders can navigate the Ethereum market effectively and potentially capitalize on future opportunities. Keep watching ETH – it’s certainly a cryptocurrency to keep on your radar!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.