Feeling that Monday motivation in the crypto world? After a typically sluggish weekend, the crypto market is flashing green, and Bitcoin is leading the charge, comfortably sitting above $37,000! Let’s dive into what’s fueling this positive momentum and what it means for you.

Why is the Crypto Market Bouncing Back Today?

- Weekend Effect Wanes: Crypto markets often experience a dip over the weekend. It’s a recurring pattern – weekly gains sometimes get erased as the weekend rolls around. Bitcoin and altcoins are no strangers to this trend. But as Monday arrives, it often marks a turnaround.

- Argentina Election Boost: The victory of Javier Milei in Argentina’s presidential elections is adding to the positive sentiment. Milei is known to be a strong advocate for Bitcoin, and this win is seen as a potentially bullish signal for crypto adoption in the region.

So, it’s a combination of factors at play. The usual post-weekend recovery is in effect, and the excitement around Argentina’s pro-Bitcoin president-elect is adding extra fuel to the fire. Let’s break down what this means for Bitcoin and the broader crypto landscape.

Crypto Markets Show Resilience After Weekend Dip

Monday, November 20th, is witnessing a wave of optimism in the crypto sphere. Investors seem to be regaining confidence, pushing prices upwards. This positive trend isn’t entirely new; the market has been riding a wave of anticipation, largely due to the buzz around a potential Bitcoin Spot ETF (Exchange Traded Fund).

Remember last week’s slight pullback? While the overall sentiment was positive, traders exercised caution, leading to a temporary market correction and some profit-taking. Adding to the market jitters was BlackRock’s filing for a Spot Ethereum ETF. Interestingly, the SEC (Securities and Exchange Commission) appears to be taking its time in making decisions on all pending ETF applications in the US, creating a bit of uncertainty in the market.

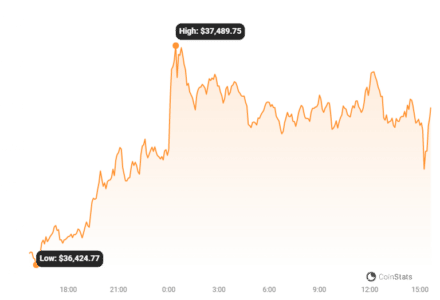

Looking at the numbers, the crypto market has collectively jumped by 2.3% in the last 12 hours. This surge has propelled the total crypto market capitalization to a solid $1.45 trillion during Monday morning trading in Asia. Bitcoin itself mirrored this growth, climbing by a similar percentage to reach $37,135 at the time of this report. Throughout the weekend, BTC had largely hovered around the $36,500 mark.

Ethereum also joined the party, rising by 1.96% to $2,003.62. However, it’s worth noting that Ethereum’s trading volume saw a decrease of 5.46%, settling at $7.73 billion in the last 24 hours. XRP, on the other hand, experienced a 1.29% price increase, reaching $0.6179, accompanied by a healthy 21.75% surge in one-day trading volume, hitting $1 billion.

Other notable movers include Solana, which jumped by 3% to $59.45, and Cardano, up by 1.98% to $0.3846. Solana’s one-day trading volume increased by 11.47% to $2.04 billion, while Cardano’s volume decreased by 21.86% to $282.61 million.

Even meme coins are catching some of the upward momentum. Dogecoin’s price increased by 2.1% to $0.08078, although its trading volume decreased significantly by 55.99% to $541.48 million. Shiba Inu also saw a 2.13% price increase to $0.000008515, but its volume also dropped by 28.54% to $107.61 million.

The Javier Milei Effect: Argentina’s Pro-Bitcoin Stance

As Michael Saylor pointed out, Bitcoin’s recent surge is partly linked to the outcome of Argentina’s elections. Argentina has been grappling with a severe inflation crisis, with the Argentine peso experiencing a staggering annual inflation rate exceeding 140% in the past year. This economic turmoil has made alternative financial solutions increasingly attractive.

Congratulations to President-Elect @JMilei. Argentinians are ready for sound money and economic freedom. #Bitcoin

— Michael Saylor⚡️ (@saylor) November 20, 2023

Many crypto enthusiasts have been advocating for Argentina to explore Bitcoin as a hedge against this runaway inflation. With Javier Milei, a known Bitcoin supporter, now at the helm, prominent figures in the Bitcoin community are celebrating this victory, hoping it will pave the way for greater crypto adoption in Argentina.

What Economic Events Should Crypto Investors Watch This Week?

Looking ahead, this week is packed with potentially market-moving economic announcements. The macroeconomics publication, The Kobeissi Letter, highlighted key events in the US economy for this week. Keep an eye on these:

Important Economic Events This Week:

1. US Leading Indicators (Monday)

2. FOMC Minutes (Tuesday)

3. Nvidia Earnings (Tuesday)

4. Initial Jobless Claims (Wednesday)

5. Durable Goods Orders (Wednesday)

6. Thanksgiving (Thursday)

7. Black Friday PMI's (Friday)Analysis below.

— The Kobeissi Letter (@KobeissiLetter) November 19, 2023

FOMC Minutes (Tuesday, November 21): This is a big one! The release of the FOMC (Federal Open Market Committee) minutes on Tuesday will be closely scrutinized by investors. These minutes will provide valuable insights into the current economic outlook and the Federal Reserve’s likely future moves regarding interest rate hikes. Essentially, it will give us a peek into the Fed’s thinking and policy direction for the remainder of the year.

Read Also: Is Michael Saylor The Ultimate Bitcoin Spokesperson?

US Leading Economic Indicators (Monday): The report on US leading economic indicators is also due on Monday. Current expectations are for it to remain unchanged from the previous month.

Remember Jerome Powell’s dovish tone at the last Fed policy meeting? That dovishness was a key takeaway. Markets are hoping for more of the same this week. However, there’s a possibility the Fed might walk back some of that dovish stance.

Recent data suggests the economy showed steady growth in the third quarter, and the latest inflation report was encouraging. Despite this, the Fed remains prepared to tighten policy further if needed, meaning another rate hike isn’t completely off the table.

While the FOMC minutes release could cause some short-term market fluctuations, a major impact is not expected. Keep an eye on it, but don’t anticipate dramatic swings.

Nvidia Earnings (Tuesday): Also on Tuesday, tech enthusiasts and market watchers will be keenly awaiting Nvidia’s earnings report. Nvidia is a major player in the tech world, and its performance can often reflect broader market trends.

Initial Unemployment Claims and Durable Goods Orders (Wednesday): Wednesday brings data on initial unemployment claims, which are projected to fall, and durable goods orders, which are expected to decline by 3.5% in October.

Thanksgiving and PMI Data (Thursday & Friday): US markets will be closed on Thursday for Thanksgiving, reopening for a half-day on Friday. Friday will see the release of S&P Flash US services and manufacturing PMI (Purchasing Managers’ Index) statistics. These have been hovering around the 50 level for the past few months, indicating neither significant expansion nor contraction in these sectors.

Key Takeaways and What to Expect

The crypto market is showing signs of renewed strength, shaking off the weekend blues and fueled by factors like Argentina’s pro-Bitcoin political shift and continued anticipation around Bitcoin ETFs. While economic events this week, particularly the FOMC minutes, could introduce some volatility, the overall sentiment appears to be leaning positive. Keep a close watch on market movements, stay informed about these key economic releases, and as always, do your own thorough research before making any investment decisions.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.