Remember the buzz around Bitcoin’s legal win in the Grayscale lawsuit? It felt like a turning point, right? Well, the party was short-lived. Bitcoin’s price saw a bump, but quickly gave it all back. Now, it’s like BTC is walking a tightrope, hovering just above a critical resistance level. Let’s dive into what’s happening and what it means for Bitcoin’s next move.

Is Bitcoin’s Support Crumbling?

Things are looking a bit shaky for Bitcoin’s price floor. Unlike before, it seems like Bitcoin isn’t bouncing back from price dips as strongly. On-chain data is flashing some warning signs. Basically, BTC is in a danger zone, and if it falls further, we could be looking at a 10-15% drop from where it is now. The concerning part? Solid support below the $25,400 mark seems to be missing in action.

Crypto analyst Ali Charts points out this vulnerability. He suggests that if Bitcoin breaks below $25,400 from its current level around $25,800, we could see a quick slide down to around $23,340.

“Bitcoin’s on-chain data suggests vulnerability below the $25,400 level. A breach below this could trigger a swift correction to $23,340.”

In simpler terms, this $25,400 level is crucial. Think of it as a critical support beam. If it breaks, the structure (Bitcoin’s price) could fall significantly.

Volatility Alert: SEC Decision Looms!

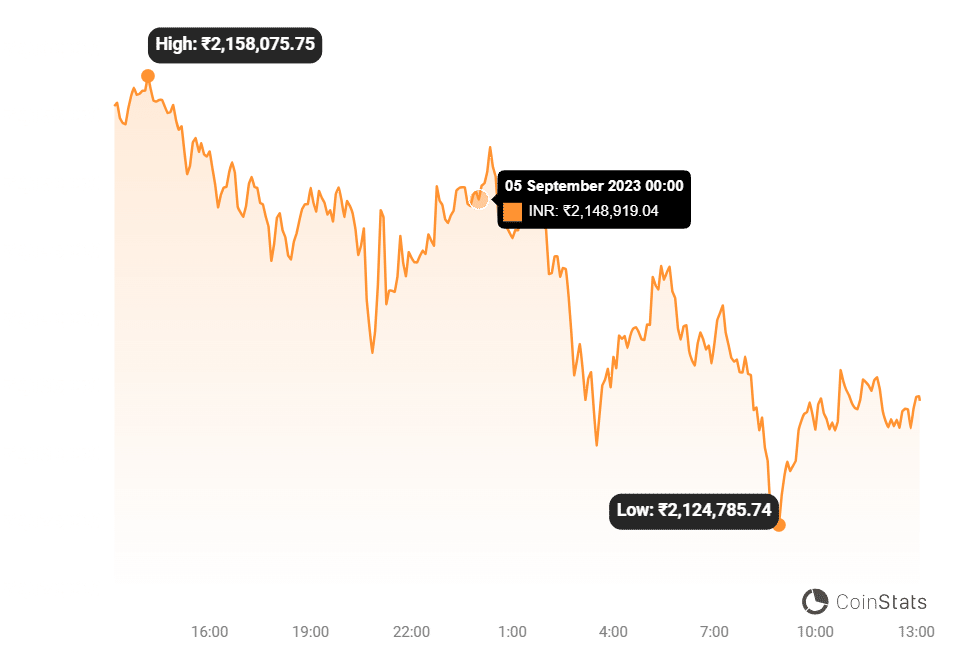

If you’ve been watching the market lately, you know volatility is the name of the game. Just last week, Bitcoin swung from a low of $25,680 to a high of $28,130! And guess what? We might be in for another round of price swings around mid-October 2023.

Why? Because the U.S. Securities and Exchange Commission (SEC) has a deadline coming up to decide on a bunch of spot Bitcoin ETF applications. Big names like BlackRock, Invesco, and WisdomTree are in the mix. Remember back on August 31, 2023, when the SEC postponed their decision? That delay has only built up more anticipation and uncertainty in the crypto world.

Grayscale Ruling: A Regulatory Game Changer?

Let’s rewind to the Grayscale legal victory. The court basically gave a thumbs up to converting Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin ETF. This is a big deal! It’s got everyone wondering: what will the SEC do now? Will they change their stance on spot Bitcoin ETFs in general?

The crypto industry is watching closely because this ruling could reshape the regulatory landscape for Bitcoin and other cryptocurrencies. It raises questions about how regulators will approach crypto going forward. Will they become more open to spot Bitcoin ETFs, or will they find other ways to maintain a cautious approach?

Navigating the Uncertainty

Bitcoin’s journey after the Grayscale win has been anything but smooth sailing. We’ve seen:

- Volatility: Prices jumping up and down.

- Uncertainty: No one is quite sure where the price will go next.

- Regulatory Influence: SEC decisions are clearly a major factor in market moves.

Right now, Bitcoin is in a tricky spot. It’s trading within a range, but facing potential downward pressure. The crypto community is split – some are focused on price charts and trading signals, while others are glued to news about regulatory changes.

What’s the Takeaway?

Bitcoin is at a crossroads. The Grayscale victory was a positive headline, but the market reality is more complex. The $25,400 level is a key point to watch. Keep an eye on the SEC’s upcoming decisions on Bitcoin ETFs – they could trigger the next big wave of volatility. And remember, the Grayscale ruling has opened up a new chapter in the regulatory conversation around crypto. Whether Bitcoin’s trajectory will ultimately lead upwards or downwards depends on how these factors play out in the coming weeks and months. Stay tuned, it’s going to be an interesting ride!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.