Navigating the crypto markets can feel like riding a rollercoaster, right? Just when you think you’ve got a handle on things, the landscape shifts. Lately, Polygon (MATIC), a popular Ethereum scaling solution, has been experiencing a bit of a downturn. Let’s dive into what’s been happening and what it could mean for MATIC holders.

MATIC Momentum Shifts: What’s Behind the Volume Drop?

Recent data points to a noticeable decrease in activity on the Polygon network. Specifically, over the past 30 days, key indicators have taken a hit:

- Transaction Volume Decline: Polygon’s daily transaction volume has shrunk by a significant 31.7%.

- Revenue and Fees Down: Following the volume trend, Polygon’s revenue and the fees generated on the network have also decreased.

- Bearish Momentum for MATIC: This overall decrease in network activity has contributed to a bearish turn in MATIC’s price momentum.

According to Artemis, a crypto metrics platform, Polygon’s daily transaction volume on January 18th was around $3.35 million. This figure underscores the considerable drop from previous levels. You can see the data point in their tweet:

Top chains by Daily Transaction Volume (30D) 🧵

1/ @ethereum $2.6B (-1%)

2/ @solana $707M (-36.5%)

3/ @BNBCHAIN $311M (-36.8%)

4/ @0xPolygonLabs $3.35M (-31.7%)

5/ @arbitrum $2.6M (-22.7%)

6/ @avalancheavax $2.2M (-26.5%)7/ @optimismFND $1.5M (-33.3%) pic.twitter.com/fW76q3sZ7O

— Artemis 📊 (@artemis__xyz) January 18, 2024

It’s worth noting that Polygon isn’t alone in this trend. Other prominent blockchains like Solana [SOL] and BNB Chain have also experienced similar dips in transaction volume. This suggests a broader market trend might be at play, rather than issues isolated to Polygon alone.

Volume, Price, and MATIC: How Are They Connected?

Why is transaction volume such a big deal? Well, it’s a key indicator of network activity and demand. Lower volume signifies fewer buy and sell transactions for MATIC. Since volume is expressed in monetary terms, it directly influences a cryptocurrency’s perceived value and price.

Think of it like this: when there’s high demand (high volume), prices tend to go up. Conversely, when demand cools off (lower volume), prices can face downward pressure. We’ve seen this play out before with Polygon. For instance, previous reports of volume surges on Polygon were accompanied by consistent price jumps for MATIC, as Bitcoinworld reported.

See Also: Goodnews! Ethereum (ETH) Users Can Now Stake An Entire Validator Directly From MetaMask

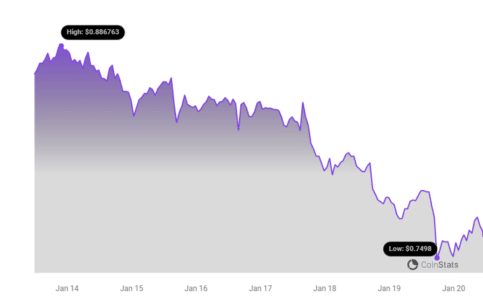

Currently, this recent volume decline is impacting MATIC’s price trajectory. As of now, MATIC is trading around $0.79, reflecting a 13.47% decrease over the past week. This price movement is visualized in the chart below:

Declining volume alongside falling prices often signals a decrease in demand. If buyers remain on the sidelines, the price could potentially continue its downward trend. For MATIC, this meant a potential slide towards the $0.70 mark. However, the crypto market is dynamic, and increased buying pressure could reverse this direction and push MATIC upwards.

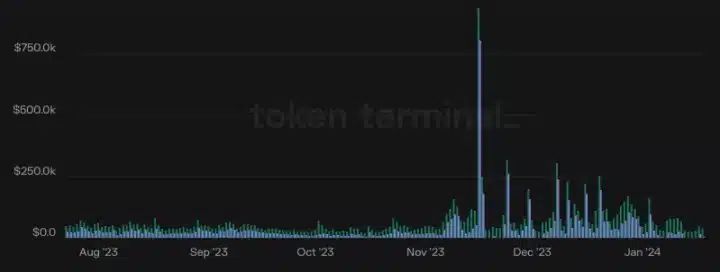

Revenue and Fees Mirror the Downtrend

It’s not just volume and price; Polygon’s network fees and revenue are also experiencing a similar downward trajectory. Data from Token Terminal reveals a 33.2% decrease in revenue over the last 30 days.

Looking closer at the data, it appears Polygon last generated over $100,000 in fees on December 28th. This highlights a significant drop in network earnings since the end of the year.

Net Value Bridge (NVB): Another Indicator of Slowdown

Another metric worth considering is Polygon’s Net Value Bridge (NVB). The NVB tracks the value of assets being bridged onto the Polygon Proof-of-Stake (PoS) network. It’s important to note that NVB doesn’t account for assets bridged back to Ethereum.

A rising NVB generally indicates a healthy project with strong utility as it suggests more assets are being moved onto the network for use in various applications. Conversely, a decrease in NVB, like what Polygon is currently experiencing, can suggest a slowdown in network activity and potentially reduced transaction validation.

Technical Analysis: MATIC Price Levels to Watch

Analyzing MATIC’s price action on the 4-hour chart reveals a weakening trend. MATIC initially lost support at $0.83 around January 17th. The following day, buyers struggled to defend the $0.80 level, indicating further bearish pressure.

See Also: Price Analysis: Does Bitcoin Cash (BCH) Price Risk Dropping Below $230

The Relative Strength Index (RSI) suggests buyers are attempting to stage a recovery. However, for a significant price rebound, the RSI would ideally need to climb above 44.40. Failing to do so could pave the way for MATIC to potentially slide further down to $0.75.

Furthermore, the On Balance Volume (OBV) indicator isn’t currently signaling a bullish reversal. The OBV, which measures buying and selling pressure, hasn’t shown signs of closing higher, indicating that overall crowd sentiment isn’t yet predicting an upward price movement.

Looking Ahead: Will MATIC Find its Footing?

Polygon (MATIC) is currently navigating a period of reduced network activity, reflected in lower transaction volumes, revenue, and fees. This has contributed to bearish momentum for MATIC’s price, and further pullbacks are possible if buying pressure doesn’t return. However, the crypto market is known for its volatility and rapid shifts. Keep an eye on key indicators like transaction volume, RSI, and OBV to gauge potential shifts in MATIC’s price direction. Will MATIC find a bottom and rebound, or will the pullback continue? Only time will tell.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.