- Polygon’s volume, revenue, and fees all dropped in the last 30 days causing MATIC’s momentum to become bearish.

- Is another pullback impending?

The 30-day daily transaction volume on the Polygon (MATIC) network dropped by 31.7%, according to a post shared by Artemis.

Here are the daily transaction volumes for the past month. 📊

1. Solana: 22.7 million

2. Tron: 4.8 million

3. Sei Network: 4 million

4. BNB Chain: 3.8 million

5. Polygon POS: 3.3 millionWhile there has been a decrease compared to the previous month, we can see some newcomers. pic.twitter.com/vHYmlIjkek

— Artemis (@artemis__xyz) January 18, 2024

The crypto metrics terminal found that the volume on Polygon, as of the 18th of January, was $3.35 million.

However, Polygon was not the only project which experienced such decline. The likes of Solana [SOL] and BNB Chain also fell into the same group.

The decrease in volume meant that the buy and sell transactions involving MATIC fell. Also, because the volume is in monetary terms, it has an impact on a cryptocurrency’s value.

For example, when Bitcoinworld reported hikes in Polygon’s volume, the price of MATIC jumped consistently.

See Also: Goodnews! Ethereum (ETH) Users Can Now Stake An Entire Validator Directly From MetaMask

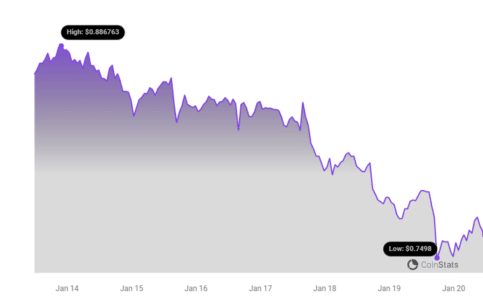

So, the recent drop in volume has also affected MATIC’s direction. At press time, the value of MATIC was $0.79, representing a 13.47% decrease in the last seven days.

Falling volume on falling prices is a testament to a decrease in demand. If buyers do not enter into the market during this phase, the price could continue decreasing.

This was the situation with MATIC as it risked dropping to $0.70. On the other hand, if buying pressure comes in at any time, MATIC’s direction might shift to the upside.

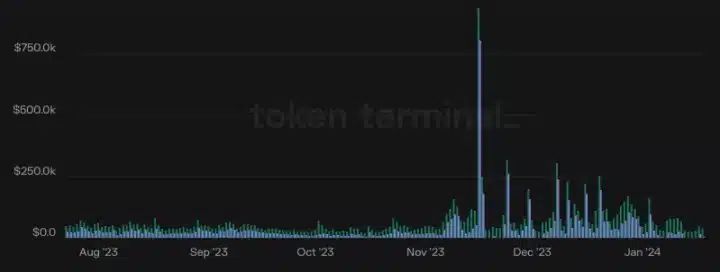

Furthermore, Bitcoinworld’s analysis of Polygon’s fees showed that it followed the same path as the volume and price.

At press time, data from Token Terminal showed that the revenue had decreased by 33.2% in the last 30 days.

An in-depth assessment of the data revealed that the 28th of December was the period Polygon last made fees worth over $100,000.

Less Bridges, Lower Prices

When we considered the Net Value Bridge (NVB) on Polygon, we found that it also dropped. The NVB refers to the value of assets bridged to the Polygon Proof-of-Stake (PoS) network.

However, this metric does not consider the assets bridged back to Ethereum (ETH).

If the NVB increases, it implies that the project’s health is great and utility is impressive. So, the decrease here suggests that validation of Polygon transactions has slowed down.

As per the price action, the 4-hour chart showed that MATIC had continuously become weak. First, it lost its hold on the $0.83 support on the 17th of January.

See Also: Price Analysis: Does Bitcoin Cash (BCH) Price Risk Dropping Below $230

One day later, bulls could not defend the $0.80 area.

Signals from the RSI indicated that buyers were making attempts to revive the price. However, if RSI does not at least, hit 44.40. MATIC might slide to $0.75.

In addition, the On Balance Volume (OBV) showed that crowd sentiment does not predict a bullish outcome as the volume had failed to close higher.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.